GREENSBORO, N.C. — Stimulus payments are already being sent to your bank accounts. Some of you may have already got your payments. If you got your payment, or not, you may still have questions.

Figuring out your stimulus payment can be confusing. We talked to Mark Hensley, the Associate State Director for AARP NC Triad Region, and got information straight from the IRS website to break it down for you.

How you get the payment:

According to Hensley, how you get your tax return or benefits like social security, is how you will get your stimulus payment. If you used direct deposit, expect to get the stimulus payment through direct deposit. If you get a paper check, you'll also get a paper check for your stimulus payment. Good news for those waiting for a check, the first checks began printing Thursday, so you should expect them in the mail within the next few weeks.

If you have direct deposit, the payment will be listed as IRS Treas 310. Now, it might be listed as pending at first. If that's the case, give it another day, your bank could be trying to get it into your account. If you notice it's still pending the next day, call your bank directly to figure out the problem.

If you still owe taxes:

If you still owe taxes don't worry, you'll still get your stimulus payment. The IRS isn't waiting to issue those payments because you haven't filed your 2019 taxes. If you still need more time to file them, you're in luck. The new tax deadline this year is July 15.

The only reason you won't get your stimulus payment is if you owe back child support. The money you owe will be taken out of your stimulus payment.

How to check your payment:

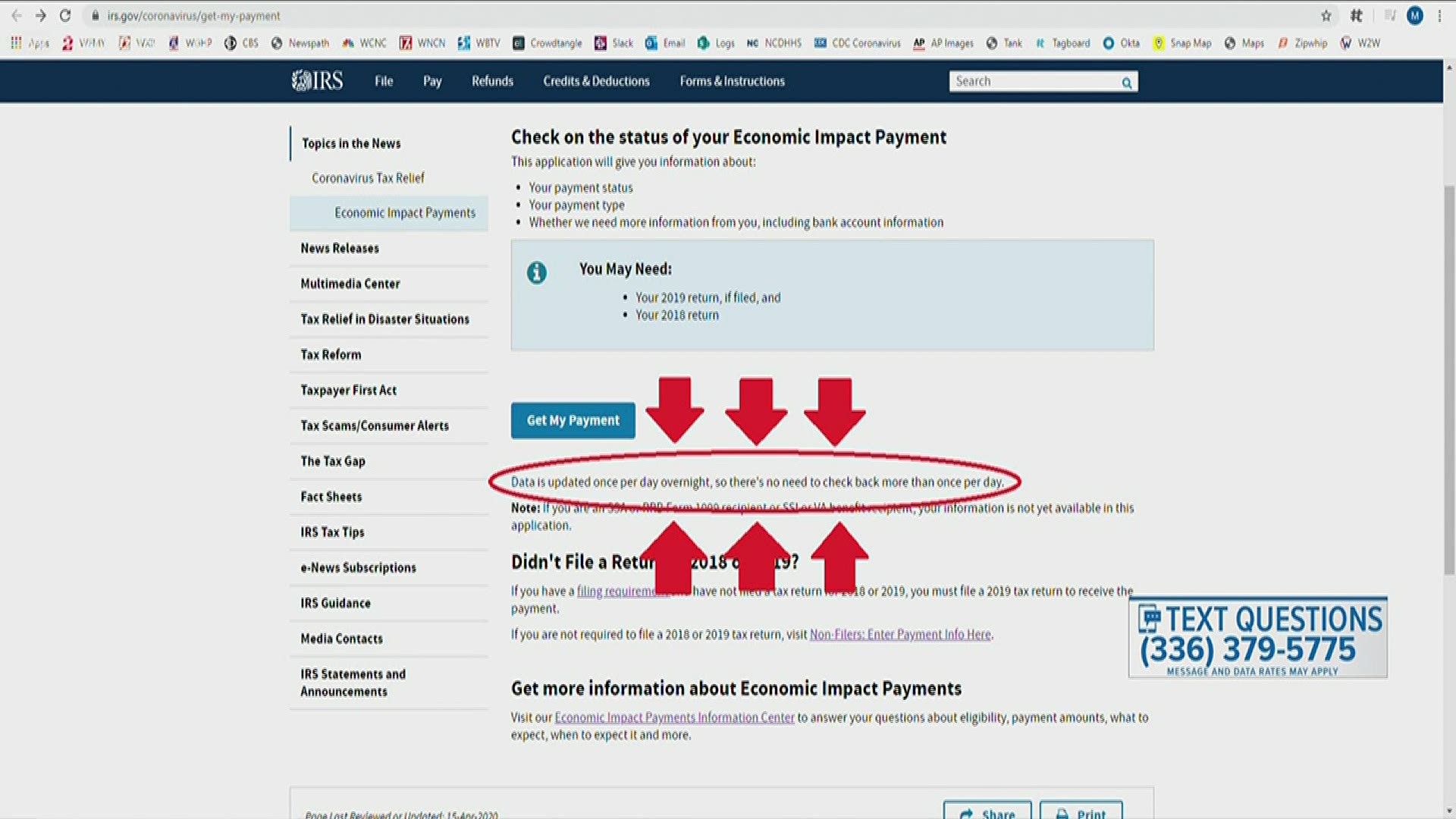

You can check the status of your payment on the IRS website. Once you’re there, you’ll need to get a few forms together before going any further

- Your 2019 return, if filed.

- Your 2018 return.

Once you have those, click on “get my payment” and fill out the form on the next page.

If the site is having trouble loading just be patient. Tons of people are using the site now to check on their stimulus payments as well. If it doesn’t let you in the first time you try it, just go back to it later.

When you do check for your payment and it says it still hasn't been handed out, don't check it a few hours later. That’s because the IRS only updates their data once a day, usually overnight. So, if the page says at 3 pm your payment hasn’t been given out, you’ll get the same message if you were to check again at 9 pm.

Also, the IRS says if you are an SSA or RRB Form 1099 recipient, or SSI or VA benefit recipient, your information is not available on the site yet.

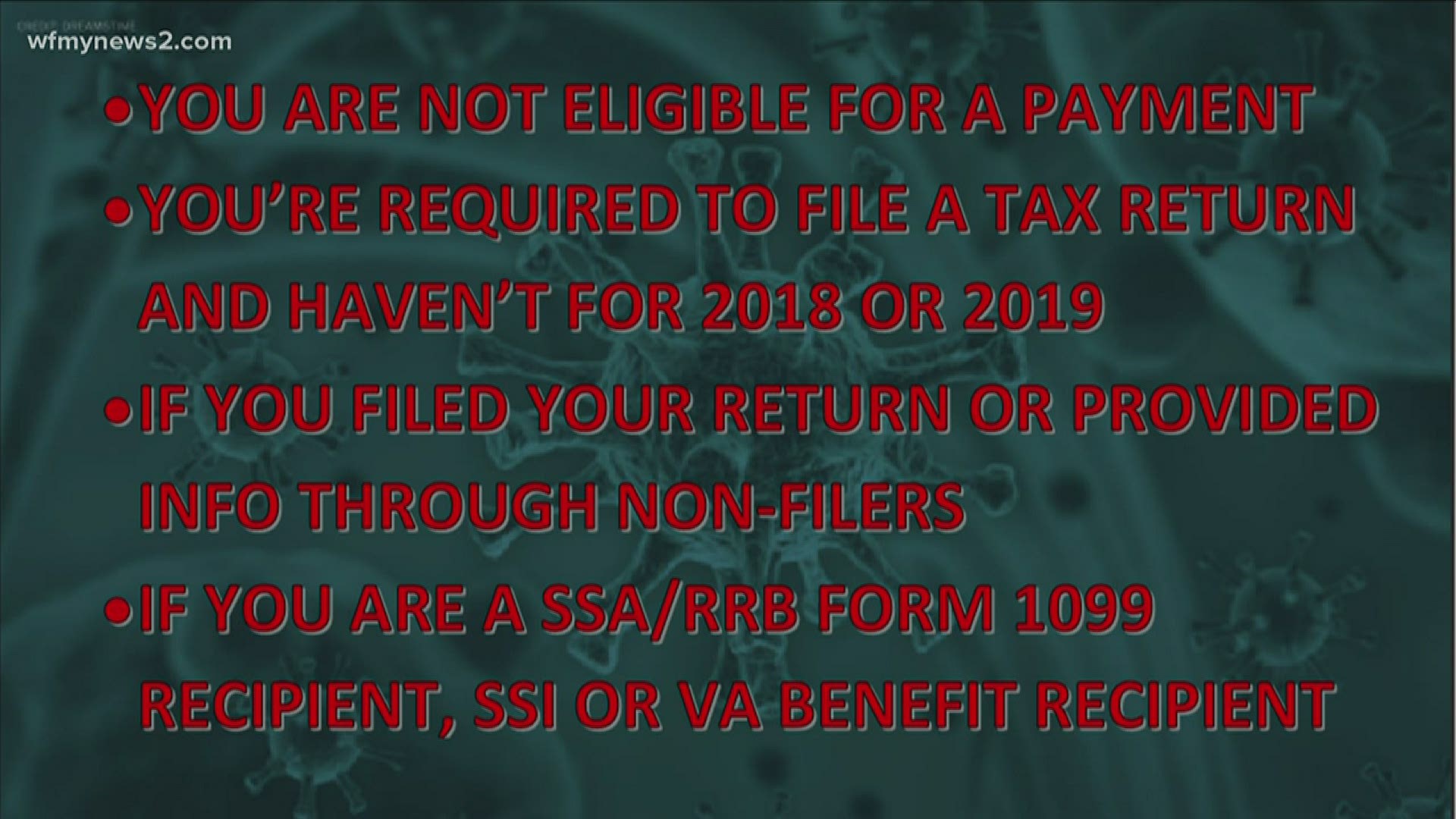

I got a “Status Not Available” message:

First things first, don’t freak out if you see this message. You most likely got this message for one of the following reasons according to the IRS

- You’re not eligible for a payment.

- You haven’t filed a tax return for 2018 or 2019.

- Maybe you recently filed your return or provided information through Non-Filers.

- If this is the case you’ll need to visit the IRS page for non-filers here.

- You’re an SSA or RRB Form 1099 recipient, SSI or VA benefit recipient

- If this is the case, the IRS is working with your agency to get your payment; your information is not available in this app yet.

People who aren’t eligible for payments:

Of course, not everyone is eligible for the stimulus payment. The IRS says these people will not qualify:

- Your adjusted gross income is greater than

- $99,000 if your filing status was single or married filing separately

- $136,500 for head of household

- $198,000 if your filing status was married filing jointly

- You can be claimed as a dependent on someone else’s return. For example, this would include a child, student or older dependent who can be claimed on a parent’s return.

- You do not have a valid Social Security number.

- You are a nonresident alien.

- You filed Form 1040-NR or Form 1040NR-EZ, Form 1040-PR or Form 1040-SS for 2019.

Extra step needed for people with dependents:

If you filed your taxes and claimed your kids as dependents, there is an extra step you need to take to claim an extra $500.

First, the only kids who qualify under this rule must be under the age of 17. And again, you had to file taxes in 2018 and 2019.

Anyone who gets Social Security retirement or disability benefits (SSDI), Railroad Retirement benefits or SSI and has child under 17, they can quickly register by visiting the special tool available only on IRS.gov and provide their information in the Non-Filers section.

For those with dependents who use Direct Express debit cards, the IRS is still working on how to get the extra $500 to you.

If you need any more information on the stimulus payments you can visit the IRS and AARP of North Carolina online.

RELATED: VERIFY: Is the IRS site safe? Will I have to pay back my check? And other common stimulus questions.

FACTS NOT FEAR

Remember facts, not fear when talking about the coronavirus. You should take the same measures recommended by health leaders to prevent the spread of the flu and other viruses. That means washing your hands, avoiding touching your face, and covering coughs and sneezes.

WHERE YOU GET INFORMATION ABOUT THE CORONAVIRUS IS IMPORTANT

It is important to make sure the information you are getting about the coronavirus is coming directly from reliable sources like the CDC and NCDHHS. Be careful not to spread misinformation about coronavirus on social media.

NC CORONAVIRUS HOTLINE

The state also has a special hotline set up where you can call 866-462-3821 for more information on the coronavirus. You can also submit questions online at ncpoisoncontrol.org or select chat to talk with someone about the virus.

You can also text keyword VIRUS to WFMY News 2 at 336-379-5775 to find out more information.