GREENSBORO, N.C. — Where is my money for my kids? It’s a common question. While you can claim your child as a dependent on your tax return, that doesn’t mean your child is part of stimulus money.

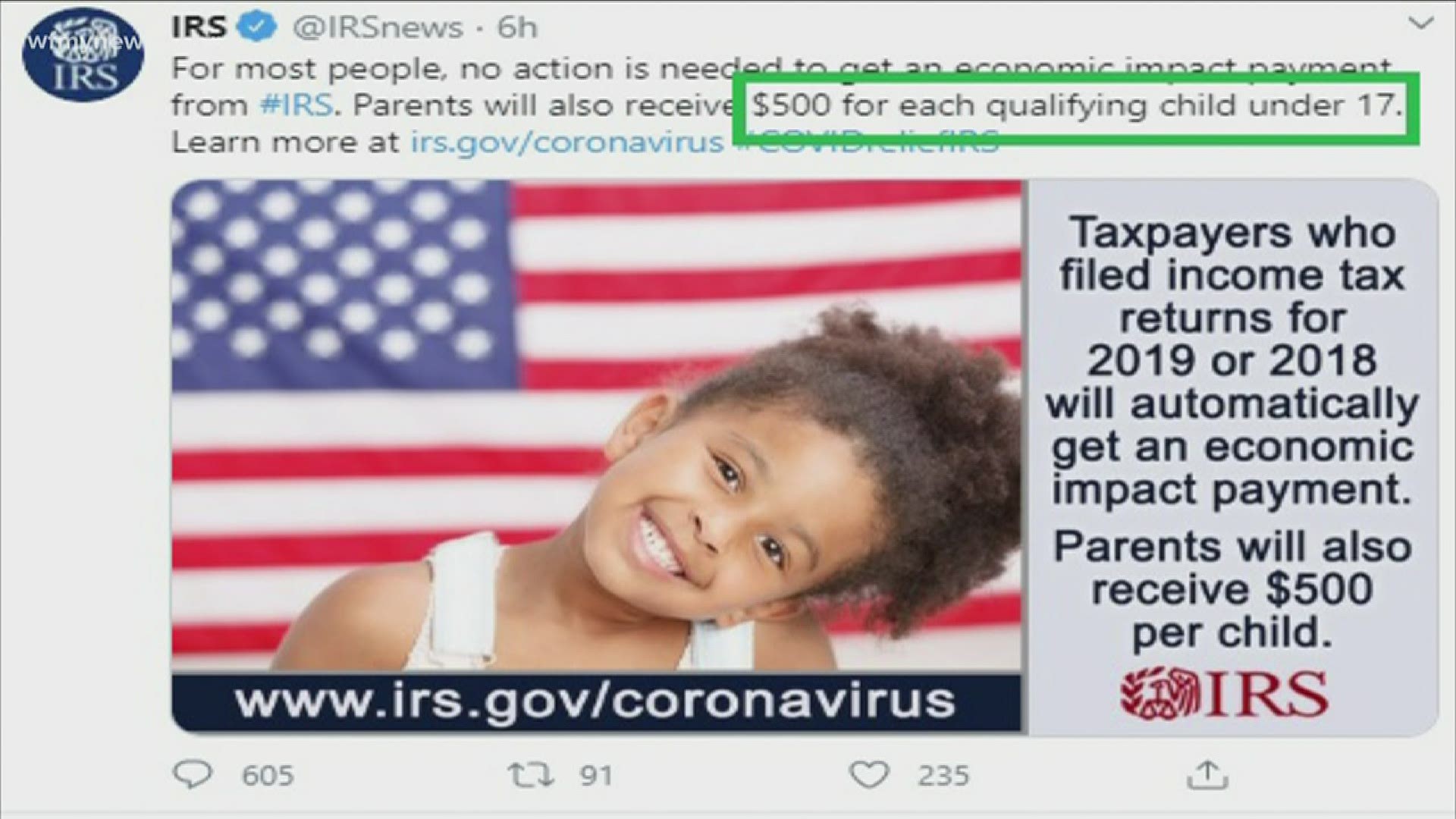

Congress wrote the rules for the stimulus payments, not the IRS. And in the rules, there are certain kids who qualify. The sticking point is age. The stimulus money and the $500 for each child, is for kids under the age of 17 years old.

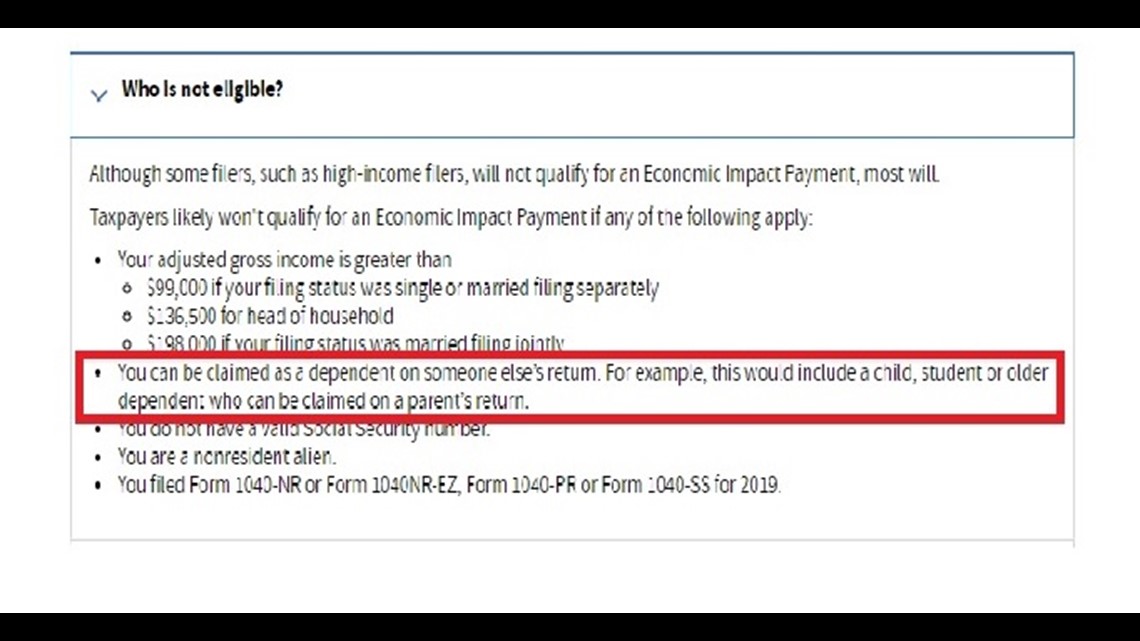

And that means the parents miss out on getting the $500 for each kid, and the college-aged student can’t get the stimulus money themselves because they are considered a dependent.

Here is the IRS FAQ about who is eligible.

Also, while Social Security Disability beneficiaries do get stimulus money, if your child gets Disability, they are not qualified as they are claimed by you as a dependent.