GREENSBORO, N.C. — The coronavirus pandemic has impacted every aspect of life, including the economy and the tax deadline.

The Federal Reserve delayed this year's tax filing deadline to July 15th as a way to help individuals and companies deal with the financial impact of the pandemic.

The new date comes with some pros and cons, according to financial expert Scott Braddock.

On the positive side, filers and companies will have an additional 90 days to file their federal tax returns and make payments without interest or penalties.

One thing to keep in mind, this only applies to your federal taxes. Here in North Carolina, the tax deadline has been extended, but if you have to file in other states, make sure you check to see if those deadlines were also pushed back.

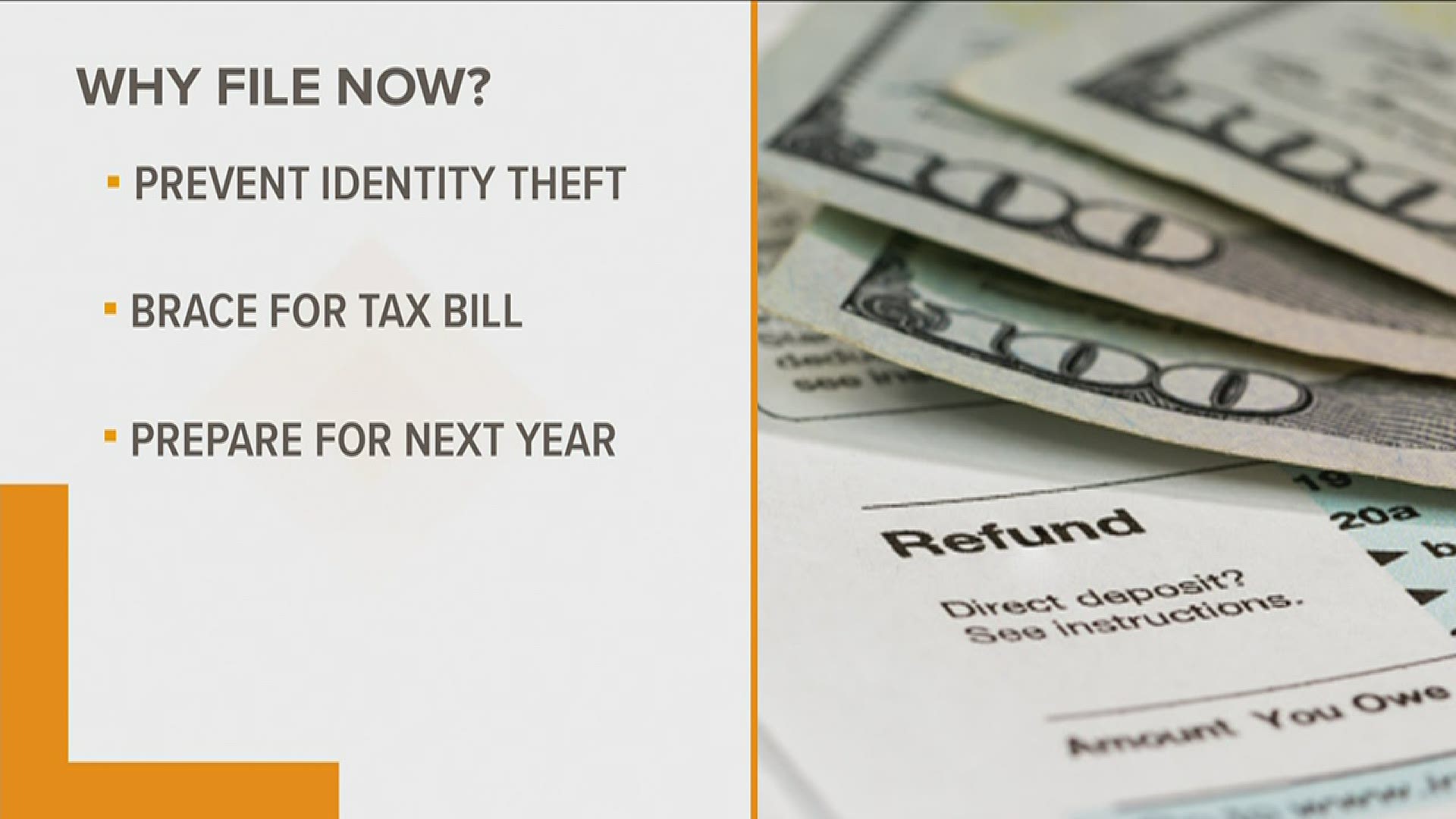

Despite the new deadline, you should file taxes sooner, rather than later.

Prevent Identity Theft

- Filing your taxes early is one simple way to protect your identity.

- Although tax identity theft has decreased in recent years, the IRS still considers it one of the top tax scams everyone should be aware of.

- All identity thieves need to file a claim electronically is your name and tax ID number. By getting your tax return early, the IRS is more likely to recognize a fake return being filed in your name.

- If you think you’ve been a victim of tax fraud, click here for some resources on how to report a claim.

Brace for Your Tax Bill

- The sooner you calculate your tax liability, the more time you have to plan and budget for your tax bill due July 15th.

- Especially in this uncertain time when people have experienced the loss of income and turbulent investments, you’ll want a clear picture of what you owe.

- Even if you wait until the last minute to run the numbers and file for an extension, you still have to pay what you owe.

- What we don’t want to see people do is put their tax bill on a high-interest credit card that they aren’t able to pay off right away.

This tax season will be different because of the new deadline but it could help in the long run.

"This year is definitely unique, and hopefully it will kickstart people into being proactive in their tax planning. If you’re nearing or in retirement, now is the time to take a strategic look at your taxes. Decisions you make now could help your tax situation next year, or even ten years from now," said Braddock.