GREENSBORO, N.C. — It sounds too good to be true -- free money from the federal government at a time of need.

VERIFY QUESTION

By now, millions of Americans in eligible income brackets have received (or will be receiving soon) stimulus checks through the $2.2 trillion CARES act passed by Congress and signed by President Donald Trump during the COVID-19 pandemic.

Misinformation about the stimulus checks continues to circulate, especially because social media can't believe there's no 'catch' to this much-needed financial aid.

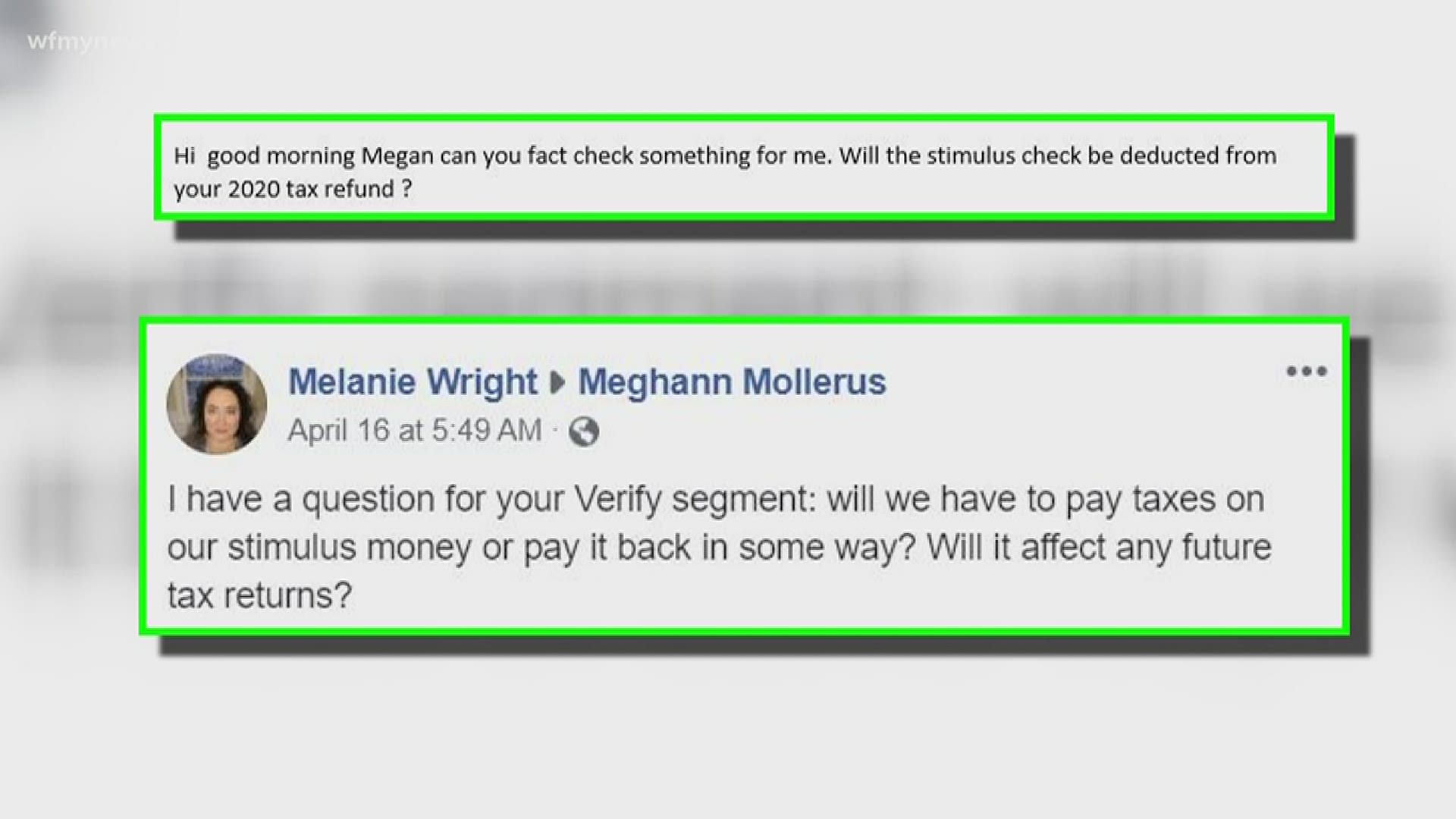

Two viewers e-mailed WFMY News 2's Meghann Mollerus asking whether the stimulus checks will be deducted from the 2020 tax refunds, or if taxpayers will have to pay back the checks in some other way.

VERIFY SOURCE

VERIFY PROCESS

On the IRS page, under the 'Economic Impact Payment Information Center' tab, there is a section for commonly-asked questions and answers.

Question 19 is: is the payment [included] in my gross income?

The answer is no. The IRS explains the payment is not income, and a stimulus check recipient won't owe tax on it. It won't decrease the refund amount or increase the amount owed on the 2020 tax return.

It also cannot bump someone to the next tax bracket and cannot cancel eligibility for federal government assistance or benefit programs, like SNAP or EBT.

It also will not affect taxes currently owed to the IRS. There is one exception -- if someone is past due on child support.

VERIFY CONCLUSION

There is no 'catch' to the stimulus check payment you received as part of the IRS Economic Impact Payment payout. Spend it or save it, as you wish.

Do you have a VERIFY inquiry? Submit a post, screen shot or selfie video to Meghann Mollerus via:

Facebook: Meghann Mollerus News

E-mail: Mmollerus@wfmy.com

Twitter: @MeghannMollerus