GREENSBORO, N.C. — Buy now; pay later? It's an enticing concept for the families struggling to pay bills amid the ongoing COVID-19 pandemic.

From March 15 to now, more than 1.2 million North Carolinians have filed for unemployment benefits. Many families are living paycheck to paycheck and dealing with bad credit.

So, what if there were a way to make purchases and pay them back in manageable, interest-free installments...all while being held accountable?

VERIFY QUESTION

Good Morning Show viewer Joanne Mendoza reached out to VERIFY's Meghann Mollerus. Mendoza inquired about a website she had heard about called After Pay and wondered whether it is legitimate and safe.

VERIFY SOURCES

- Afterpay

- Lechelle Yates - communications director with Better Business Bureau (BBB) of Central and Northwest NC

VERIFY PROCESS

The Afterpay website explains a customer signs up for free, browses and shops the stores that have partnered with Afterpay, selects items and awaits Afterpay's approval for purchase. If Afterpay grants that approval, Afterpay buys the item for the consumer, and the consumer must re-pay Afterpay in four installments every two weeks. There are no interests or fees, if the customer pays on time.

The process sounds pretty simple, but is the company legitimate?

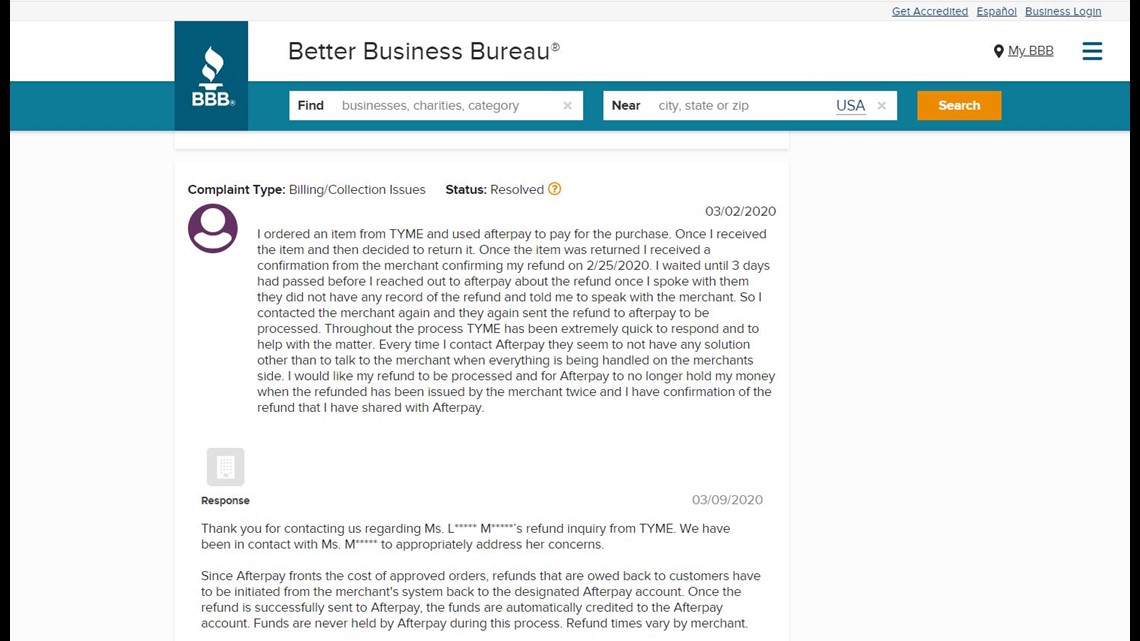

The BBB's Lechelle Yates explained, "According to our records, Afterpay started in 2017, so it has been around for a little while. But, they do have 89 complaints filed against them, which has lowered their rate to a B- with the BBB. On the plus side, though, they have responded to all of their complaints."

The company's BBB profile shows the majority of complaints are about returns, when customers returned an item to the store and then had to wait for Afterpay to reimburse the payment.

Also impressive is the company's tendency to respond to BBB complaints in specific detail and within about a day.

Yates said the manner in which a company like this responds can say a lot about its reputation. Consumers just need to do their research.

"Go to BBB.org and look at the profile and read the complaints. See what issues consumers are having with the business. Is this something that you think could be an issue for you? Also, read the business's responses, because that'll tell you how they'll respond to you, if you do end up having a problem," Yates explained.

Yates also reminded consumers to use installment websites wisely and understand what could happen if they are late on payments and how that lateness could affect their credit. Unpaid debts can go to collections agencies, and after a delinquent period of 90 days can get reported to credit bureaus.

Also, stick to a budget and read the fine print about the company financing the purchase.

Check out the BBB's full advisory on safe shopping practices when buying in installments.

VERIFY CONCLUSION

The installment payment service Afterpay appears to be legitimate, but heed caution in researching a company's legitimacy and making a plan to re-pay the installments on time to avoid late fees and harm to credit.

WFMY News 2 reached out to Afterpay's marketing team for more information about its location, employees and operations and as of the this article's publishing, Afterpay had not responded. Visit the site's "How It Works" page for general information.

Do you have a VERIFY inquiry? Submit a post, screen shot of the article in question or selfie video to Meghann Mollerus via:

Facebook: Meghann Mollerus News

Twitter: @MeghannMollerus

E-mail: Mmollerus@wfmy.com