GREENSBORO, N.C. — Protecting your home is priceless...unless it starts falling apart. A home warranty plan might sound enticing.

VERIFY QUESTION

Good Morning Show viewer Debra Hatchett wrote via e-mail, "Can you VERIFY if we, as homeowners, are being scammed locally and nationally with these so-called home warranty plans? We now have Choice Home Warranty...we had to call them out on some things that were, it seems, intentionally left off...even after we reviewed our plan with them on the phone. Are we just wasting our money with these so-called home warranty plans? Should we just save it for our own repairs with our local repairman?"

VERIFY SOURCES

- Consumer Reports

- Better Business Bureau

- Tom Garcia - Home Improvement Expert - Southern Evergreen

VERIFY PROCESS

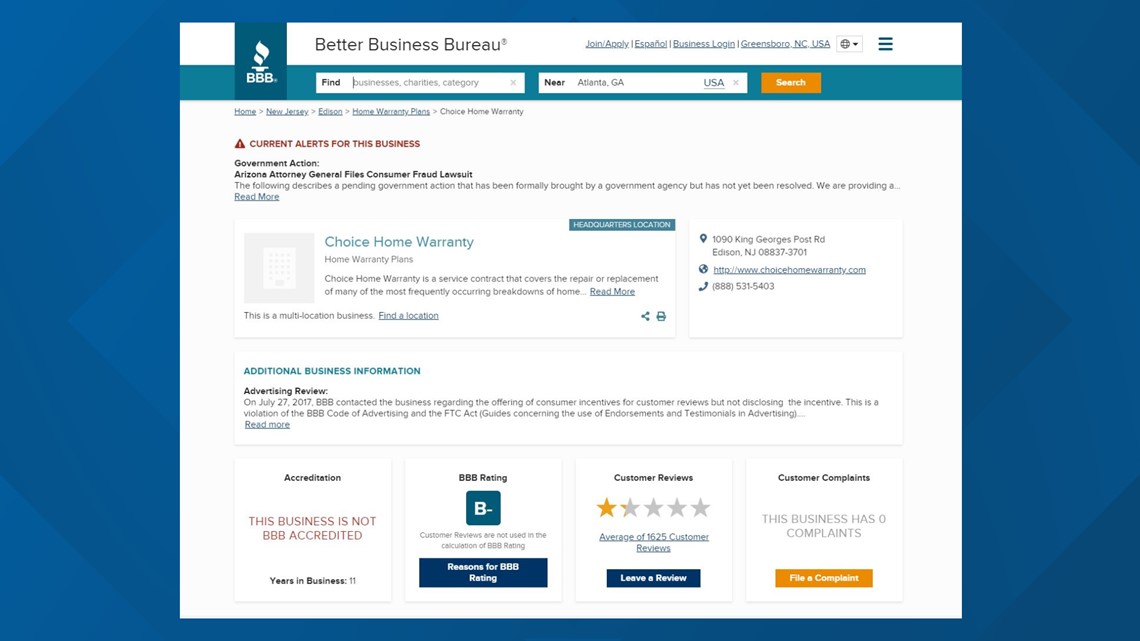

Viewer Debra Hatchett said she tried the home warranty company Choice Home Warranty. A quick search on the BBB shows Choice Home Warranty is not BBB-accredited. It has a B- rating with more than 5,100 complaints, mostly for advertising. Additionally, the Arizona Attorney General has an active lawsuit filed against the company for consumer fraud.

Consumer Reports says most consumers see the TV and online ads pitching home warranties, which claim to protect against issues not covered by traditional homeowners insurance policies. They are usually service contracts, covering the cost of repair or replacement of certain items, like appliances, plumbing, heating and AC. Prices usually vary based on the company and where you live and can range from $400 to $1,000 a year.

The pros -- Consumer Reports says home warranty plans can give homeowners peace of mind. They can, indeed, cover certain items not under warranty. But, you need to do thorough research.

The cons -- many of your new home appliances might already be covered or still under warranty with your credit card. And, there could be unforeseen costs, like a co-payment to a contractor. If a repair is too expensive, the policy could replace the broken item but cover only the depreciated value. That means you might pay the difference out of pocket to get the same model.

Home guru Tom Garcia said generally, sellers offer home warranties to promote a sale. But, he has heard only complaints from home buyers who have them.

VERIFY CONCLUSION

Should you consider a home warranty policy or just hire a local contractor to fix the problem? It depends on your policy and what an independent contractor charges for the service. Do your research, read the fine print and have your agreements and correspondences in writing.

Do you have a VERIFY inquiry? Submit a post, screen shot or selfie video to Meghann Mollerus via:

Facebook: Meghann Mollerus News

E-mail: Mmollerus@wfmy.com

Twitter: @MeghannMollerus