GUILFORD COUNTY, N.C. — Guilford County voters decided on two school funding issues on the ballot.

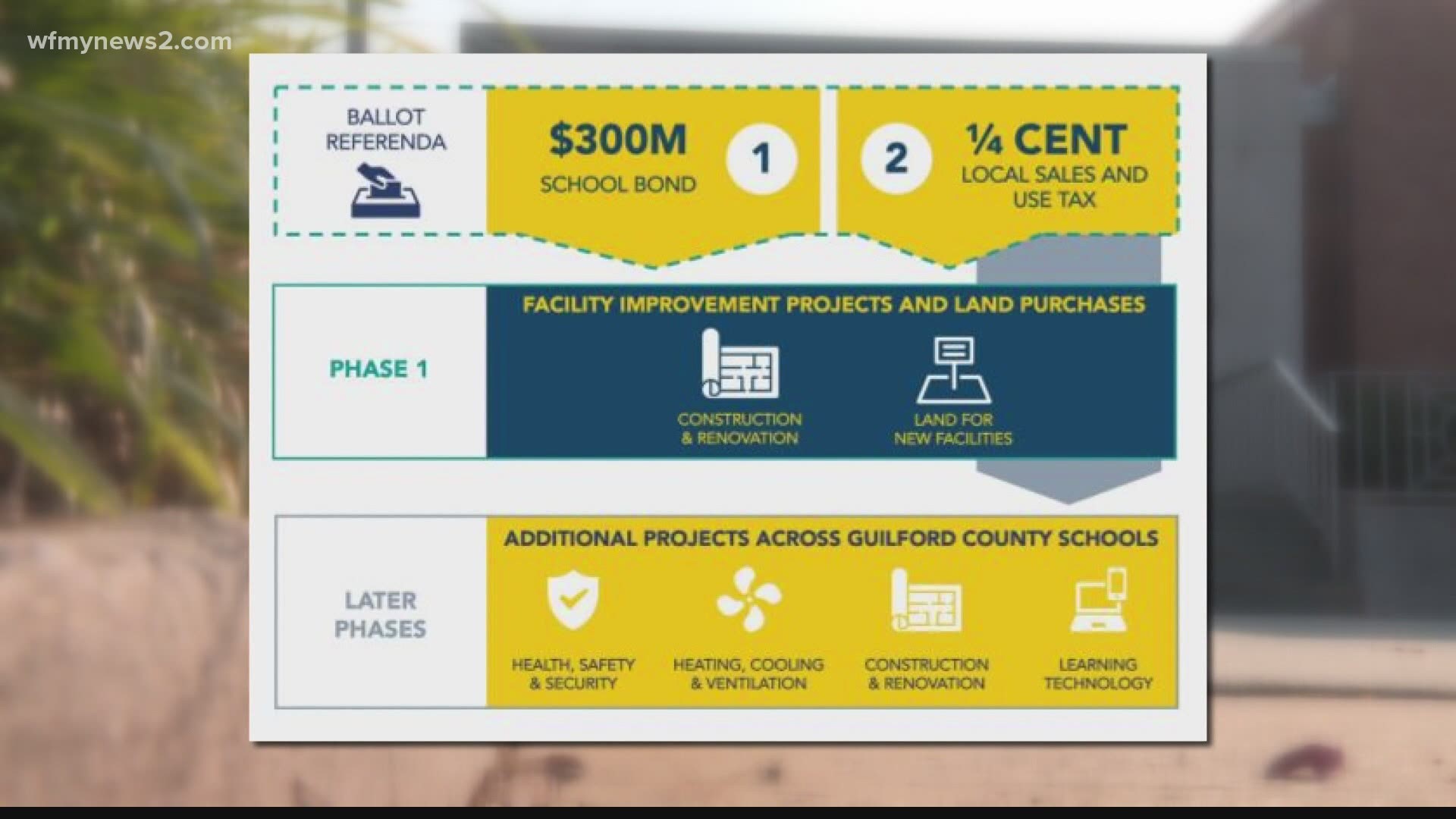

A $300 million school bond passed with more than 72% of votes, while a 1/4 cent sales tax increase failed with only 33% in favor of the measure.

The school bond money will be used to jumpstart a $2 billion master plan to renovate and repair dilapidated schools across the county.

The sales tax increase would have also gone toward school repairs, but because it did not pass, it's likely that property taxes could go up to cover the bond.

Two items at the bottom of the ballot:

$300 million bonds for Guilford County Schools: This is for new school facilities, improving existing ones as well as furnishings and equipment.

1/4% local sales tax raise: This would help pay for the repair and renovation of Guilford County School buildings. The County Manager estimates around $19 million. The tax doesn't apply to prepared food, the food you buy at the grocery store, prescriptions, gas, or vehicles.

Why are these things on the ballot?

Going back to November 2019, the district released a $2 billion master plan to overhaul the district's aging schools. No school would be left untouched, but the plan needs funding in order to begin.

What about lottery money?

In Guilford County, lottery money totaled $31 million last year. Of that, $5 million was used on school construction.

The school system doesn't get to decide how the lottery money is spent -- state lawmakers decide.

What if one passes but the other doesn't?

Guilford County Manager Marty Lawing said if the $300 million school bond passes but the sales tax fails, it's likely property taxes could go up to cover the bond.