GREENSBORO, N.C. — Don't miss this:

The IRS does not call you out of the blue and demand you pay up right now.

The IRS does not text you about an issue with your taxes.

The IRS doesn't email you asking you for your social security number and other personal information.

But, the IRS could send you a letter in the mail and alert you to possible tax identity theft.

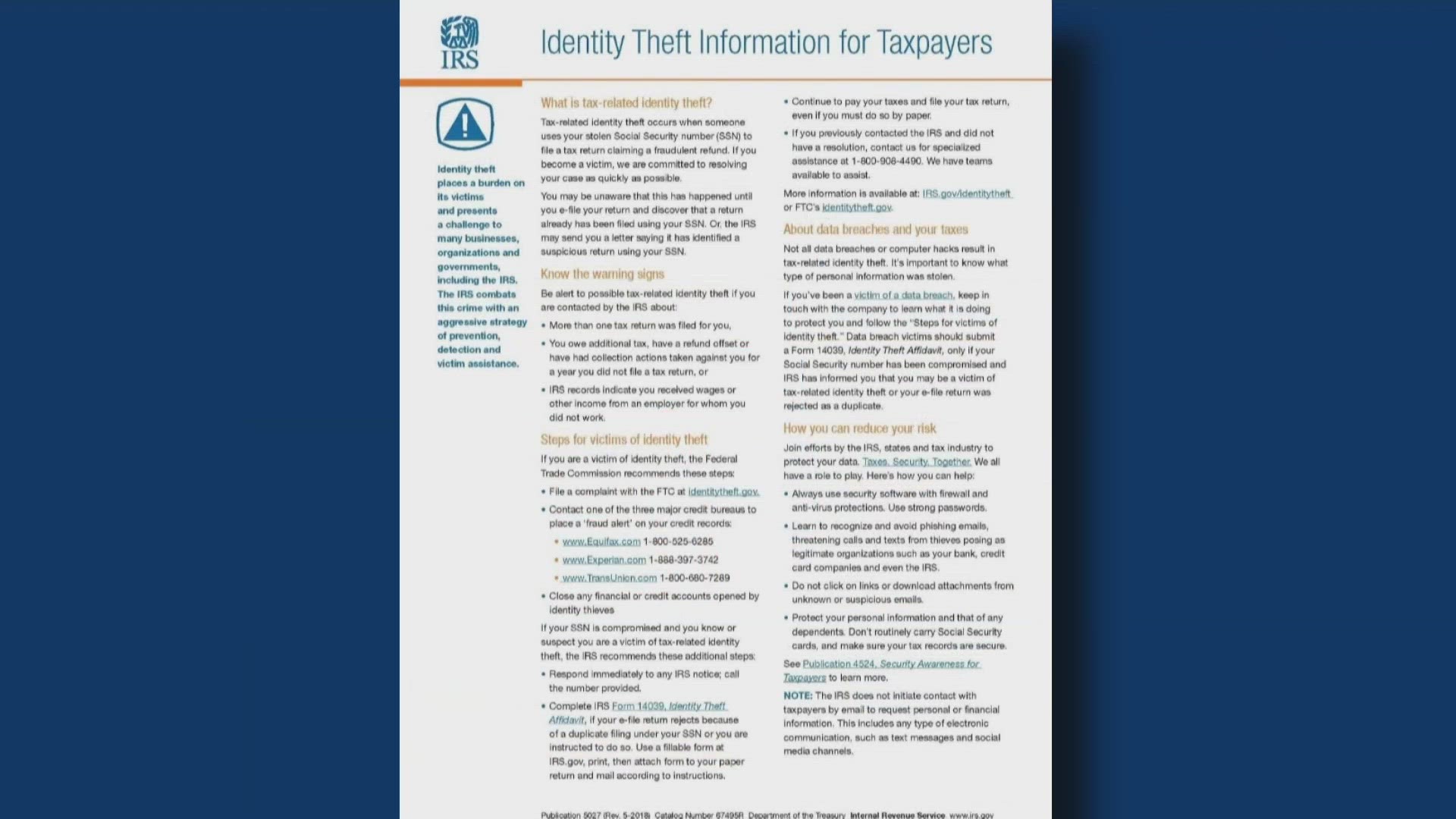

The Surry County Sheriff's office put a post on Facebook yesterday saying "There has been an increase in people getting letters from the IRS about their social security number being used to file taxes." Attached to the post is a fact sheet from the IRS about what to do if you have been a victim of identity theft.

The IRS sends letters to taxpayers, they're numbered 4883c or 6330c, and they are focused on verifying your identity.

Again, letters through the mail are the official form of communication the IRS uses. Of course, if you have any questions about whether a letter from the IRS is real, you can always go to IRS.gov or call them directly.

This is a good time for 2 Wants To Know to remind you that scammers can pretend to be calling, texting, or emailing from your credit card company, your power company, the IRS, or even a member of your local police department.

When you get a call, text or email:

Take down the info of what they say is wrong, just so you have it.

Don't give out any personal info, don't click any links.

Don't put in any password or log-in info.

If it's a call hang up. Don't use the numbers they give you to call back.

Go to your app, or online account, look up the number on your card or the number to the agency and go from there to see if there's really anything wrong.