GREENSBORO, N.C. — Car break-ins are on the rise. Oftentimes, the thieves simply open up an unlocked door and steal whatever is inside. If that happens to you, will insurance cover what you're missing?

It depends. Your car insurance doesn't cover items inside your vehicle, it's your homeowners or renters insurance that does that. (That's your cue to make sure you have renter's insurance!)

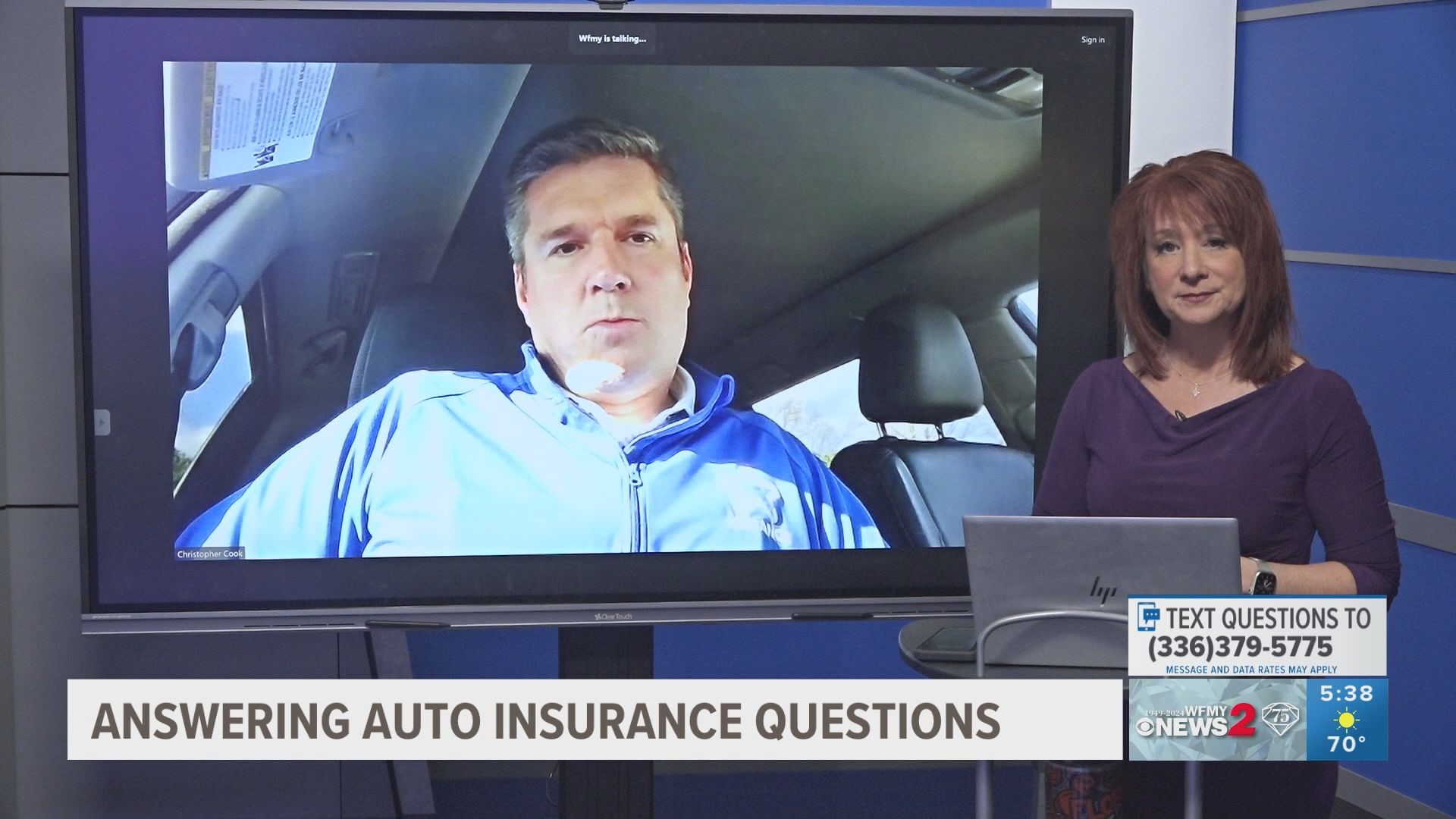

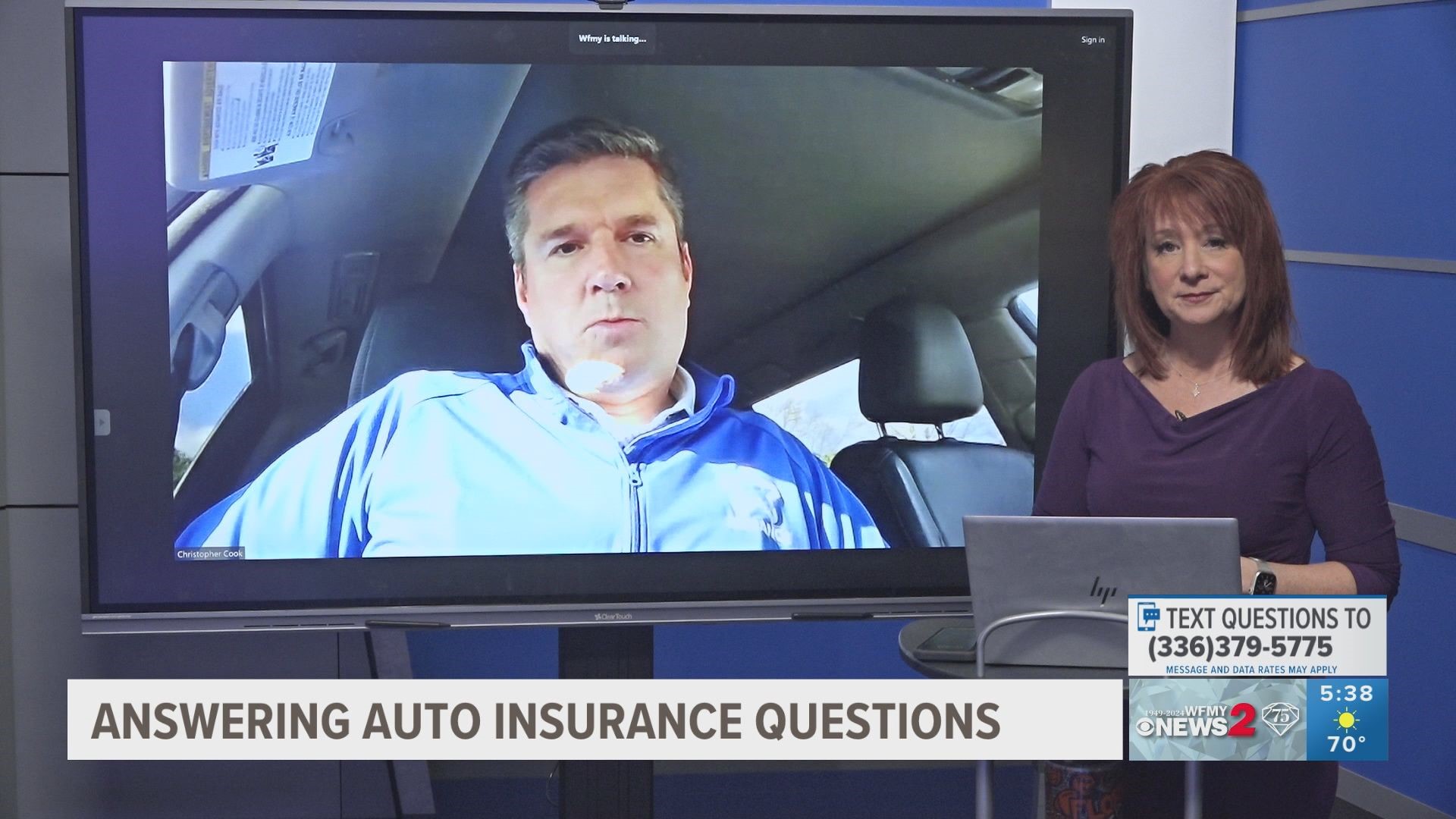

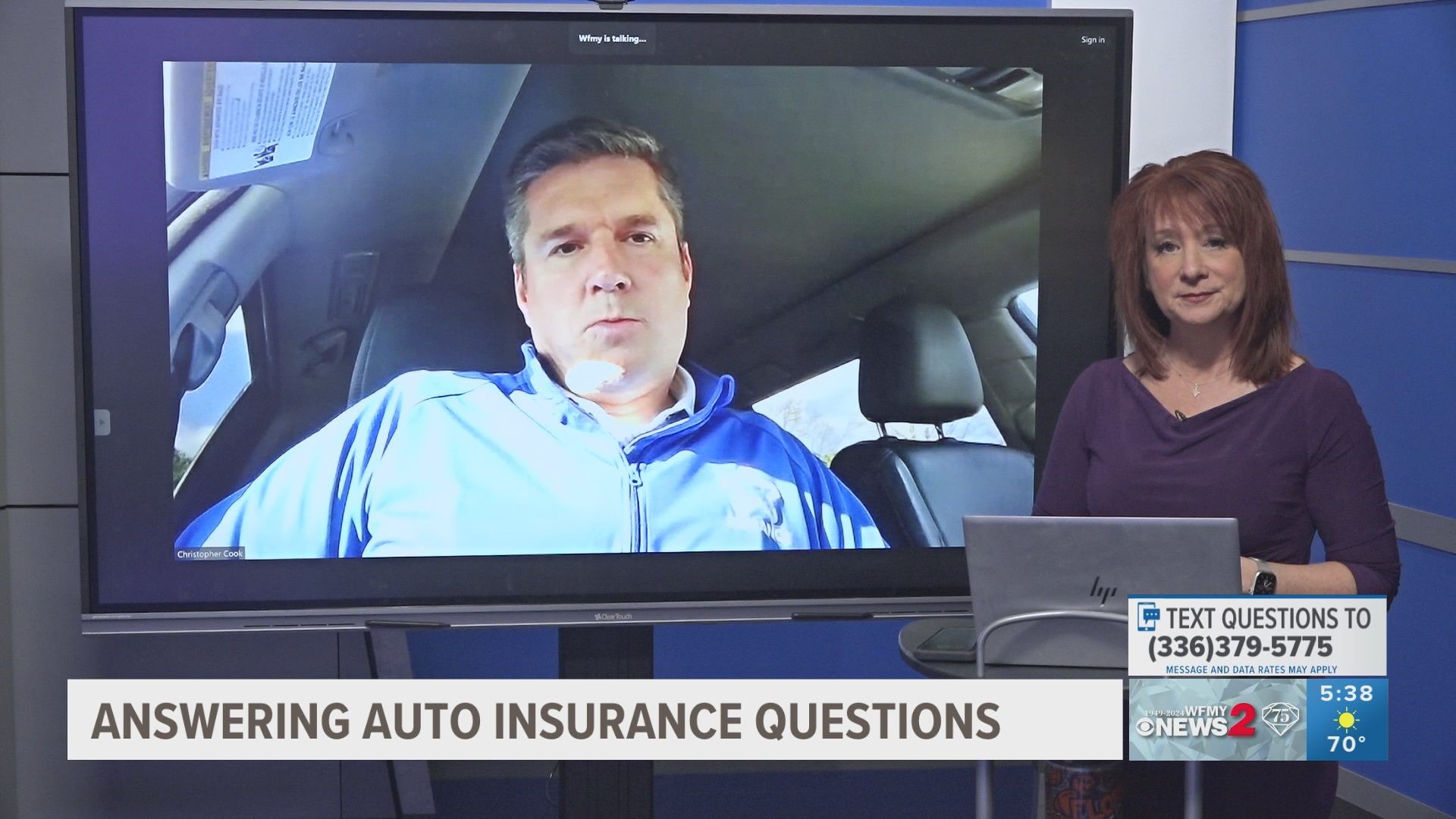

Christopher Cook from Alliance Insurance Services joins us on 2 Wants To Know to talk about all things insurance.

Why you should say YES to rental car insurance

When you're renting a car, if you have physical damage, your car insurance can extend to that rental car what your car insurance does not cover is their loss of income, the car company's loss of income if you wreck their vehicle,” said Christopher Cook, Alliance Insurance Services.

When a rental car is damaged, the car rental agency loses $100 to $150 a day by not renting that car. Your personal auto insurance does not cover that cost. You would need to depend on the Collision Damage Waiver.

“That's the insurance the car company offers you at the counter a Collision Damage Waiver,” said Cook.

When you buy it, the company won't come after you financially if the car is damaged or stolen. The other option you have to buy the rental car insurance is checking out your credit card perks.

Nerd Wallet has written about it many times. You need to call your credit card company and ask these four questions.

Is the rental car coverage primary or secondary? Most are secondary which means your regular insurance deductible will have to be paid first.

How do I make sure the coverage applies to my rental? Usually, the answer is, that you have to use that card to pay for the rental car.

What coverage is included? There may be more than just the Collision Waiver.

What isn't covered? Usually what isn't is covered by your regular auto insurance policy.