GREENSBORO, N.C. — Most major purchases—cars, appliances, even many houses—come with warranties. They’re great for peace of mind if they cover the right things.

"A good warranty is one that’s long. It covers the most important parts and has a simple process for resolving problems. That’s important because it tells you that a manufacturer has confidence that its product is going to last a long time," said Diane Umansky, Consumer Reports.

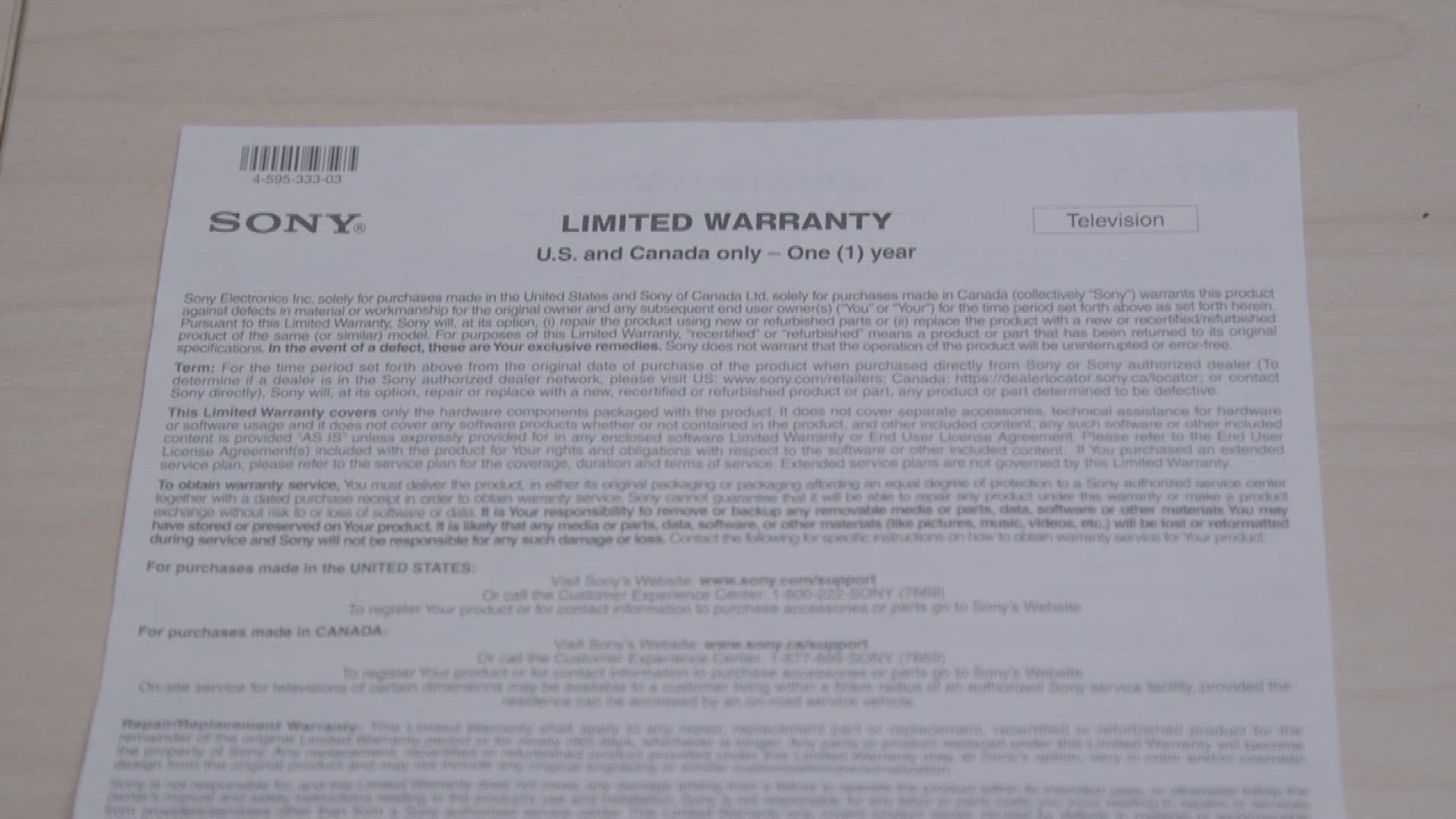

Consumer Reports says reading the fine print—all of it—is important. Coverage periods in warranties vary, and there are almost always exclusions.

"Regular wear and tear aren’t covered in a warranty, and neither are user mistakes, like spilling coffee on your keyboard. You want to use the product as it’s recommended to be used. That’s really important to make sure your warranty stays in effect," said Umansky.

Extended warranties that claim to provide additional coverage on top of the manufacturer’s warranty or coverage after it expires often sound appealing. But Consumer Reports says that most times they’re not worth the additional cost. CR found that consumers are usually better off just putting away a little cash for emergency repairs.

The bottom line: Know what your warranty covers and what it doesn’t before you need it. Always take the time to read the terms and conditions so that you avoid potential frustration in the future.

Even if a product is recently out of warranty, Consumer Reports says it never hurts to contact the manufacturer if you need help. And if you paid for an item with a credit card, you might have additional warranty protection. It's worth calling your credit card company now and asking about what protections they provide for items purchased and even for rental car insurance.