LEXINGTON, N.C. — Gowrie Kunjbehari was in the market to buy a home big enough for her kids and parents to live in.

“We were living in an apartment, and she decided she must own a house,” said her father, Edward Cummings.

The family found a nice home in Lexington that was plenty big enough for the entire family to live in. The home had a finished bottom floor for her parents that had a separate small kitchen and bathroom.

The backyard was large and had a built-in pool for the kids to enjoy.

“She looked at a few places, and this was the best option,” Cummings said.

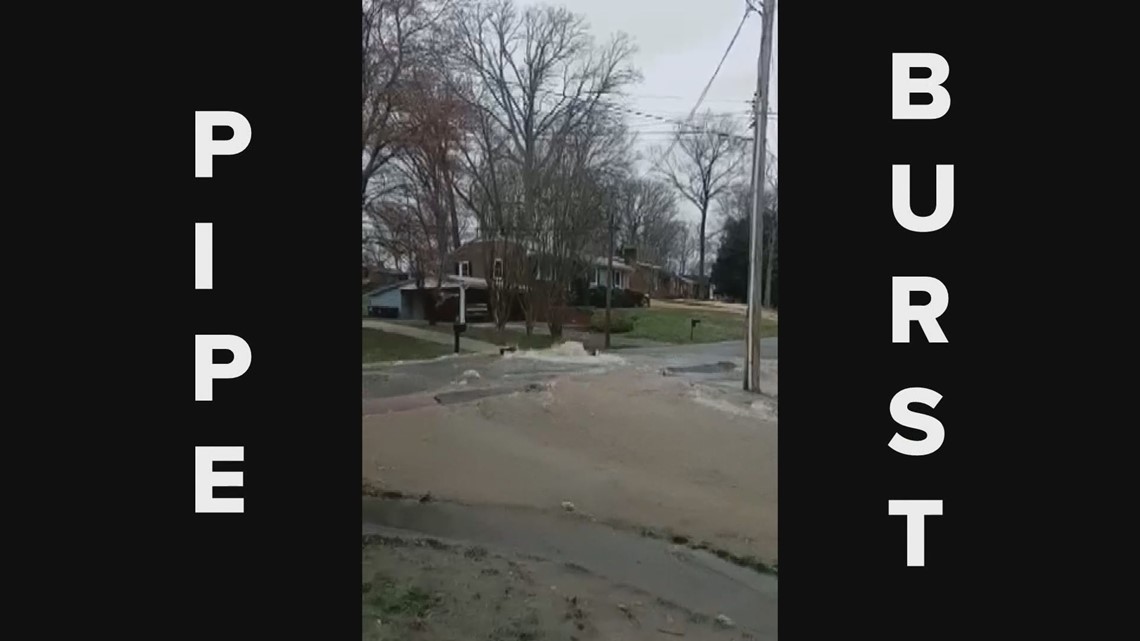

The family was only living in the home for about a year when something horrible happened. A city water pipe under the road in front of their house busted. Water poured up from the street like a fountain and eventually flowed down to the home.

“I was in the house and suddenly I felt water at my feet, and I said, 'Where is the water coming from,'” Cummings said.

This was not a small leak; it was massive. More than 3,500 gallons a minute gushed out of the pipe and onto the street. Kunjbehari’s house is on a downslope from the road so most of the water was pouring right down to the house.

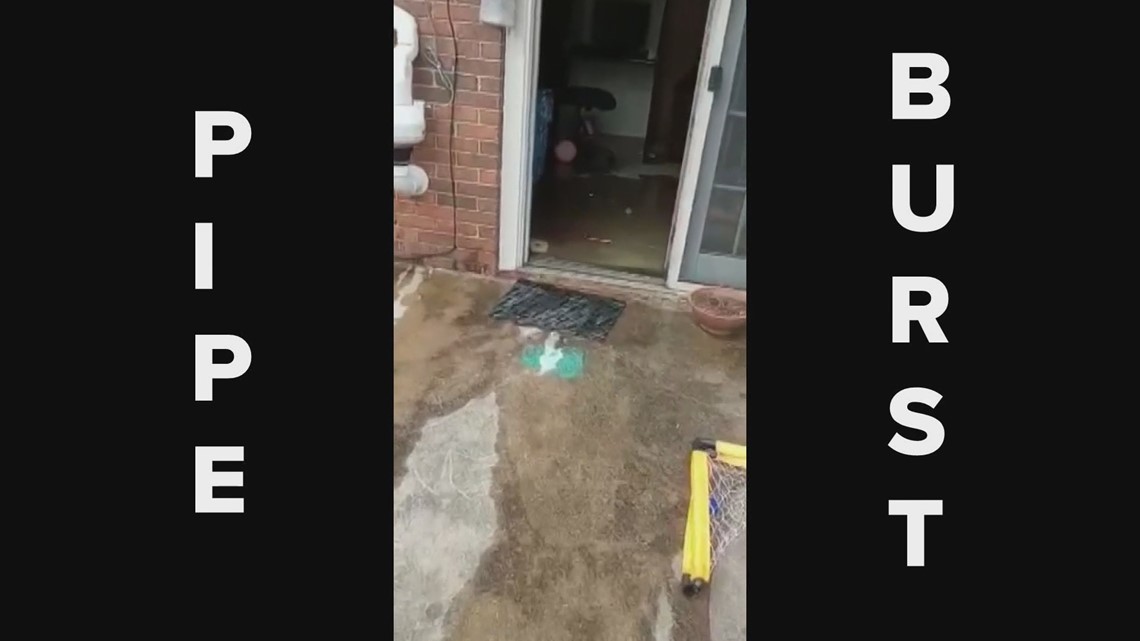

Within 30 minutes, about 2 to 4 inches of water covered the bottom floor. The family was helpless to do almost anything. Water continued to gush out from the pipe and rush down around the house for almost an hour before city crews could shut it off.

“I thought the house was going to be washed away off the foundation,” Cummings said.

The family took video of the water pouring up from the street and into the home. It looked like a fast-moving river next to the home. By the time the water was turned off, dozens of items inside the home were damaged or soaked with water.

“It was an enormous disaster; it really was - everyone was devastated,” Cummings said.

In the next couple of days after the pipe burst, Kunjbehari reached out to her insurance agent and city leaders to see what could be done. It took a few days before she was given the bad news.

Her insurance policy did not cover the damage. The city got in touch with her a short time later to alert her that it was also not liable and would not pay for any damage.

“They (insurance company) just said they're not covering this, and the city said the same thing, that they're not responsible for this,” Cummings said.

Kunjbehari had an insurance policy but did not have flood insurance. Even though this was a city pipe burst and not water from a river, lake, or ocean, it is considered a flood and only covered by a flood insurance policy.

The city is not responsible because it was an accident and not a foreseeable circumstance.

“The claim was denied because there was no known negligence on the city’s part,” City Manager Terra Greene said.

The pipe is rated to last between 70 and 100 years and was installed back in 1960. City officials did not have an exact date for the most recent inspection but did not have any reports of issues related to that pipe.

“It's certainly an unfortunate situation for the family,” Greene said.

Kunjbehari told WFMY News 2 that the initial estimate to repair the damage would be around $80,000.

“I don’t know what we're going to do,” Cummings said.

About a month after the flood, the family was still trying to remediate the water damage. A good portion of the home was still wet from all the water and mold was starting to become a major concern.

The family was doing most of the work on their own, but it was becoming a major problem. The smell was getting worse by the day and there was a real concern about mold growing inside the walls and behind the drywall.

After several calls to the city and out of an abundance of concern and caution, city officials reached back out to its insurance company to see if anything could be done.

The city eventually decided it was in the best interest of the community and the safety and well-being of others to assist in the cost of remediation, so the home did not become a health risk.

“We became very concerned, and I immediately called a meeting with the homeowners,” Greene said.

The city paid about $30,000 to help remediate the home and ensure it was safe. The family has still not been able to afford to do much if any repair work since the flood, but the home is livable.

The downstairs is still without carpet or flooring and most of the drywall has either been pulled out or about a foot by the floors cut out.

“It’s horrible, it’s just horrible,” said Cummings.

While this is certainly an extremely rare occurrence, Kunjbehari was surprised when she was told her insurance policy did not cover this. WFMY News 2 reached out to a licensed insurance agent to better understand why this wasn’t covered.

“Unfortunately, most people don’t have a flood policy, when you live on the inland side of the state away from the coast, a flood is sort of an afterthought,” Conrad Caldwell with the North State Insurance said.

It simply comes down to the fact that this pipe burst and subsequent water intrusion is deemed a flood event, and if the homeowner does not have a flood policy, they're not covered.

Flood policies will cost anywhere from a couple of hundred dollars to well into the thousands depending on your location and what you’re insuring. It’s best to check with your agent to see what’s best for you.

Kunjbehari has been trying to save money to finally start making some of the necessary repairs. If you'd like to help, the family does have a GoFund account where donations can be sent.