RALEIGH, NC (WNCN) - As the calendar turns to November, the upcoming holidays are on everyone's mind.

This includes shopping — and consumers are heading online. In 2017, 1.6 billion people bought goods online.

Your online checkout experience may cost you a bit more beginning Thursday.

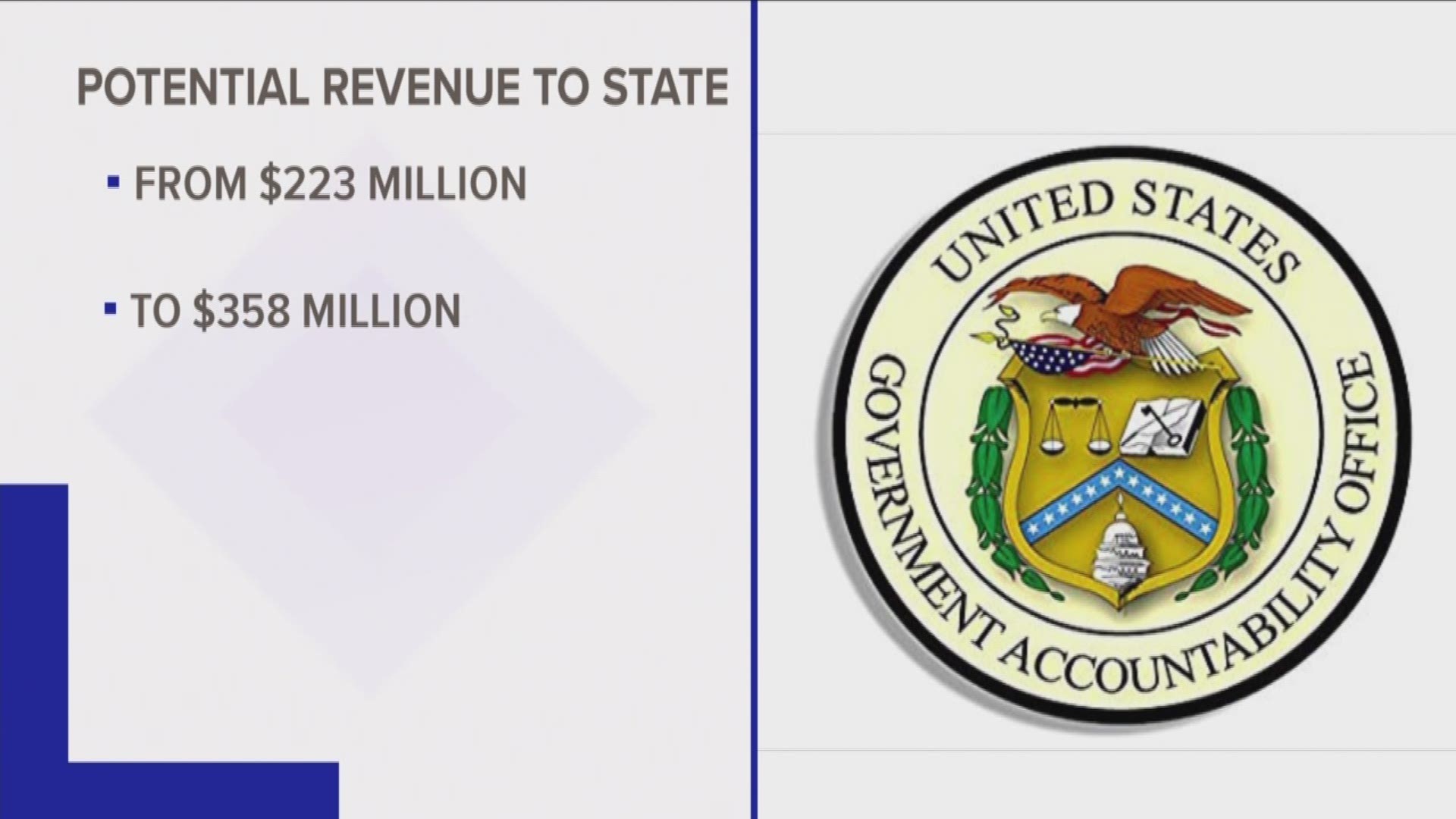

A new law on the books says that whenever you shop online you will now have to pay sales tax. A sales tax of at least 6.75 percent will be in effect for most of the region.

Lawmakers have been able to do this because of a recent Supreme Court ruling in the summer that says states can charge online sales tax.

For years, retailers have been able to find ways around that, but not anymore.

If a business has more than $100,000 in sales or they have 200 transactions online, they're going to have to charge you sales tax.

The N.C. Department of Revenue said it "will enforce an existing law regarding remote sales and require remote sellers to collect and remit the applicable sales and use taxes."

As a result, online shoppers in North Carolina could end up paying two sales taxes: the state tax, plus any county sales taxes. The local taxes vary. Here is a resource for individual counties.