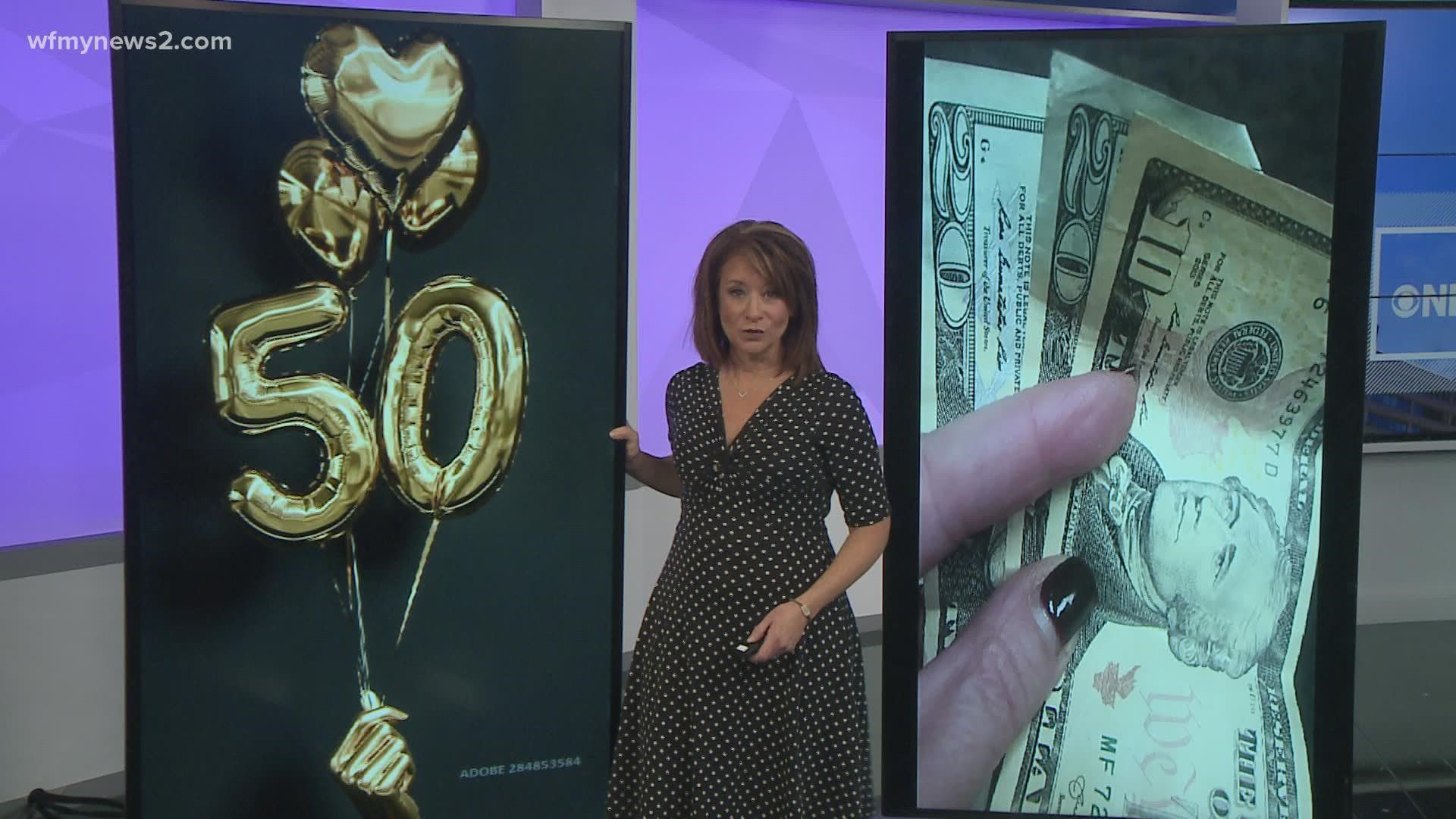

GREENSBORO, N.C. — Fifty dollars is a really nice amount when you're talking gift cards, as a present for Christmas or a birthday. When you turn 50 years old, you might want to think about adding that much or more to your retirement.

In fact, the IRS gives you the gift of allowing you to contribute more to your retirement.

“Once you become 50 or older you can contribute an additional $6,500 to your 401K, it's a great way to catch up, I mean think about it, you're at a minimum of 12 years away from social security,” Ryan Dodson of Liberty Tax Services said.

To be very clear, you don't have to contribute an additional $6,500, but you can contribute that much more if you wanted to. Folks under 50 can contribute $19,500 a year to retirement. Folks 50 and over can contribute a total of $26,000.

Not only does it help you save more money for when you retire-- it saves you on taxes now.

“Once you make the contribution, you're going to save state and income taxes on those. That's saving like 22% to 32% depending on what tax bracket they’re in. It's a great way to save taxes in those later years and lot of workers, that's their prime working and earning years,” said Dodson.

The “catch up” Dodson says, is because a lot of folks forgo giving to their retirement when they have kids and are putting them through school.

You probably only have two more paychecks this year, but you can change your contribution for those two and help your taxes for next year. At the very least, you can up your contributions now so you start next year with more being saved for retirement.