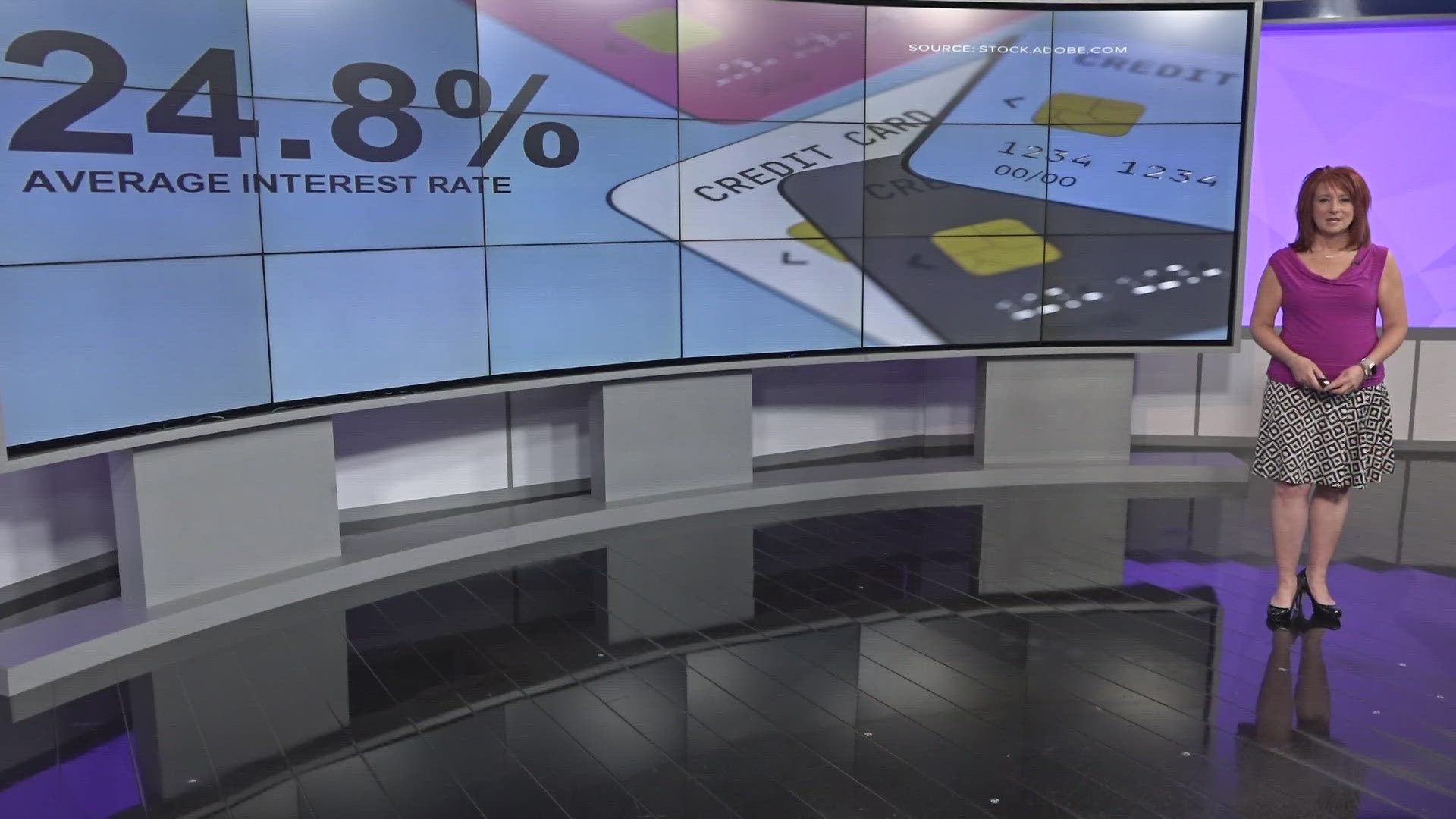

GREENSBORO, N.C. — The average credit card interest rate is 24.8%. LendingTree.com says you usually get a lower rate if your credit score is good. But if you aren't getting a break, you should ask for a lower rate, even if it's a point or two.

When you do the math it adds up. LendingTree.com gives this example:

You owe $5,000 on a credit card. You pay $250 a month.

If your interest rate is 28.19% you'll pay $1,833 in interest alone and it takes you two and a half years to pay it off.

But if the interest rate is 21.4% you pay $600 less in interest and you pay it off three months earlier.

If you have good credit, you should always ask for a few points off, the worst they say is no. A 2023 LendingTree survey found that 76% of cardholders who asked to lower their credit card interest rate were successful with an average reduction of 6% points.

But if there's no way to change the high rate, experts say the way to beat it, is to pay more.

"With high interest rates, you have to do the strategy of beating the interest rate basically, you're going to have to pay extra to the principal each and every month. It's still about paying extra money to the principal and bringing that balance down," said Ja'Net Adams of Debt Sucks University.

MORE WAYS TO GET WFMY NEWS 2

Subscribe to our daily newsletter Let’s Get 2 It!

Download the WFMY News 2 APP from your Apple or Google Play store.

ADD THE WFMY+ APP TO YOUR STREAMING DEVICE

ROKU: Add the channel from the ROKU store or by searching for WFMY.

Amazon Fire TV: Search for WFMY to find the free app to add to your account. You can also add the app directly to your Fire TV through your Amazon account.