GREENSBORO, N.C. — You're not buying a house. You're not buying a car.

So what do you care if the Federal Reserve raised interest rates again? (The November raise is +75bps)

Chances are, it impacts your wallet every single month.

“If you're someone who has credit card debt, it is going to affect you. You're going to pay more money each and every month, every time they raise that interest rate,” said Ja’Net Adams, founder of Debt Sucks University.

SEE HOW THE INTEREST RATE HIKES ADD UP

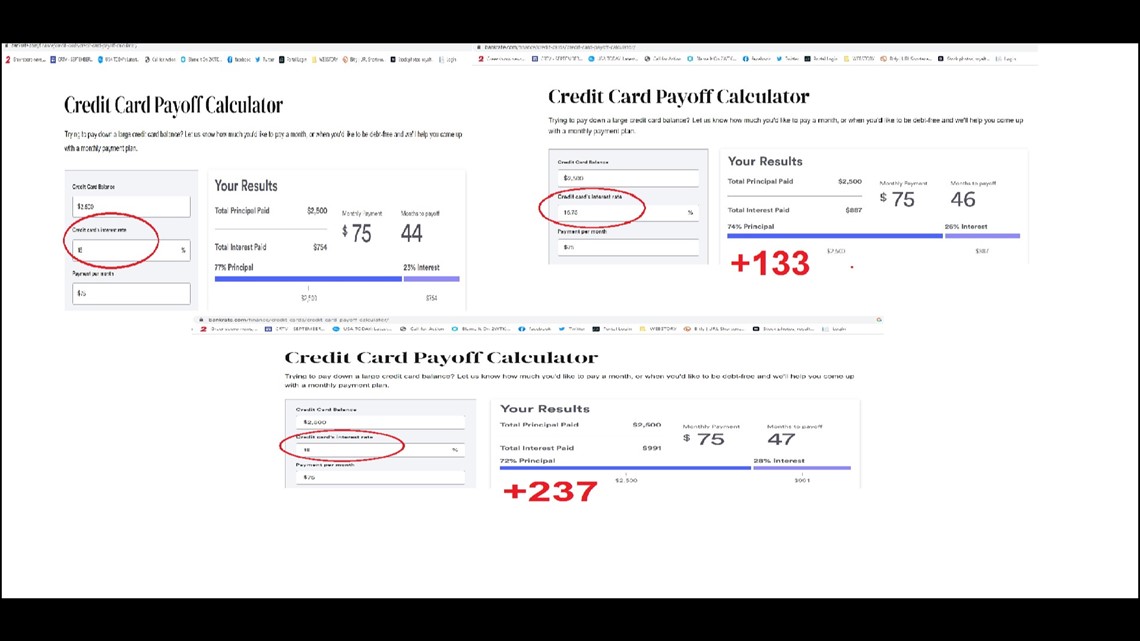

To show you how every little bit adds up, let's say you have a constant $2,500 credit card balance. It always seems to hover there due to purchases and such.

You're paying $75 a month. at the start of this year, you were paying a 15% interest rate on your credit card balance. It would take you 44 months to pay off the balance.

But when the interest rates went up, your APR went up to 16.75%. That same balance will now take you 46 months to pay off and it will add an extra $133 to the amount you pay in the long run.

Interest rates go up again and that same debt now costs you $237 more than the initial balance.

Those itty-bitty rate increases can really add up. Adams says while you pay your debt down, it wouldn't hurt to ask the credit card company for a little help.

“I would think you could still call your credit card company and see if they would lower your interest rate or APR. It never hurts to ask the worst they can say is no and if they do say no, it's more important for you to get that debt down because you're going to be paying more money,” said Adams.