GREENSBORO, N.C. — When you go through the drive-through, you're most concerned that everything is in the bag. There's nothing worse than not getting everything you paid for. Unless of course, you get charged too much.

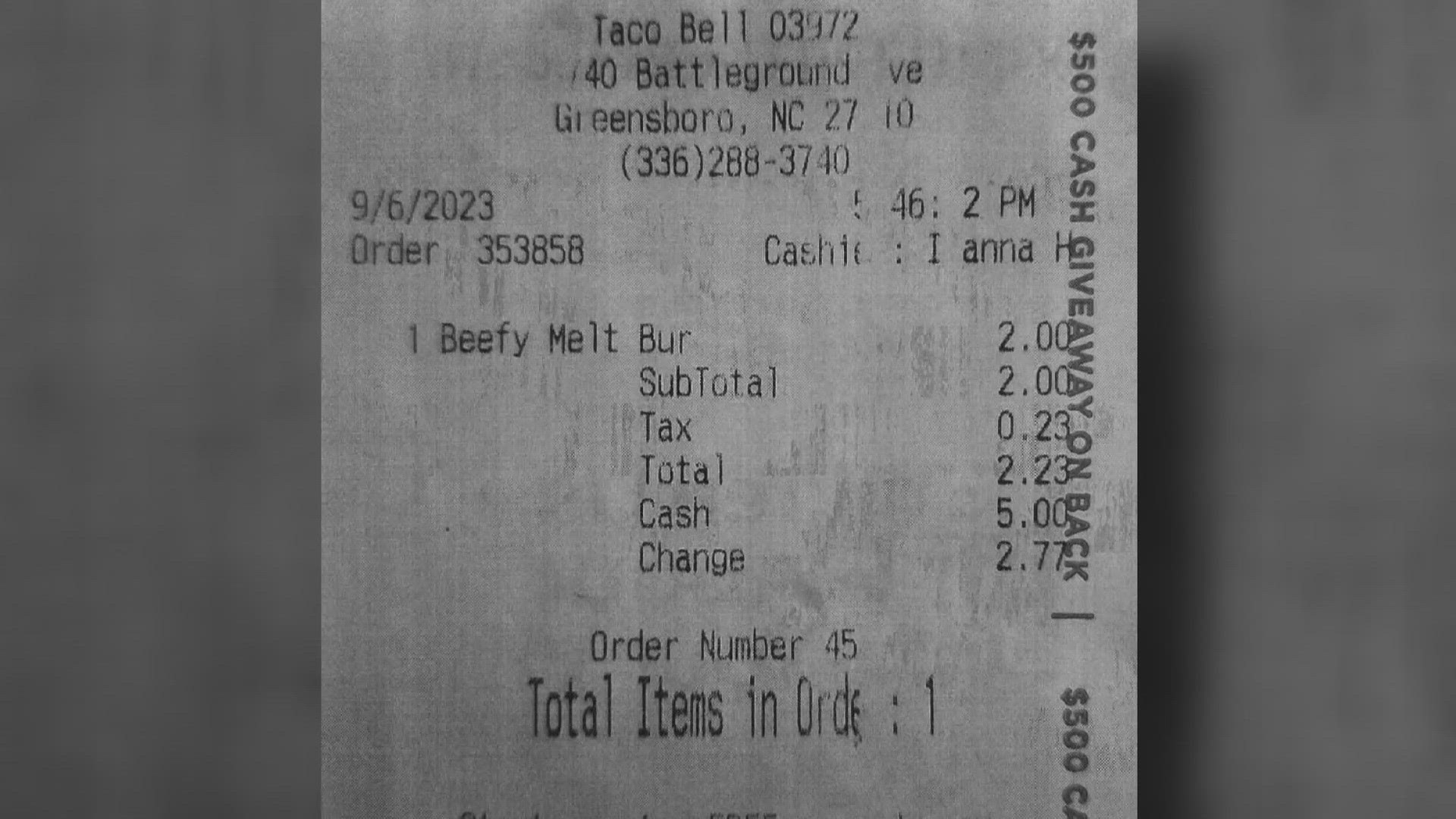

It happened recently at a fast-food restaurant in Greensboro. Check out the receipt from a Taco Bell at 3740 Battleground Avenue. A WFMY News 2 viewer ordered just one thing. The subtotal for that one item was $2.00 but the total came to $2.23.

The tax rate in Greensboro is 6.75%. The tax charge should have been 14 cents.

"We can't give them the refund, they have to go back to the business for that, but we look into it and contact the business," said Andrew Furuseth, Director of Sales & Use Tax Division, NCDOR.

Nine cents. It's not a lot. You may not even go back to the business for it. And if you did, the Department of Revenue says you should actually put your request for that refund in writing. You're probably not going to do that. However, you should report it because what happens to one customer one day could happen to every customer, every day for days, weeks, or months.

You can report it online at the North Carolina Department of Revenue. You'll go to the Contact Us tab and look for the Taxpayer Advocate. You can fill out a web form or call 1-919-715-2080.

"Generally when we see someone collecting the wrong sales tax, it's human error. They may have several locations and be in different counties or states and they put in the same sales tax. When they go in and program their systems they charge the wrong rate," said Furuseth.

Furuseth said North Carolina has an audit program that examines sales and use tax compliance. Some teams go in and audit the right rates.

2 Wants To Know called the Taco Bell location several times and emailed and called the Taco Bell corporate headquarters. Neither responded. This week, 2WTK went to the same Taco Bell and ordered the same item and the tax was correct.