GREENSBORO, N.C. — Greensboro homeowners, don't miss the opportunity to get a partial refund on your property taxes. If your 2023 property taxes were higher than your 2021 property taxes, you could get a check for the difference, but you must apply before the money runs out.

"These funds are limited, they're on a first come first serve basis. So we do recognize that it's possible not all applicants will receive the assistance amount just because those funds are limited," said Caitlin Bowers, City of Greensboro Neighborhood Investment Manager.

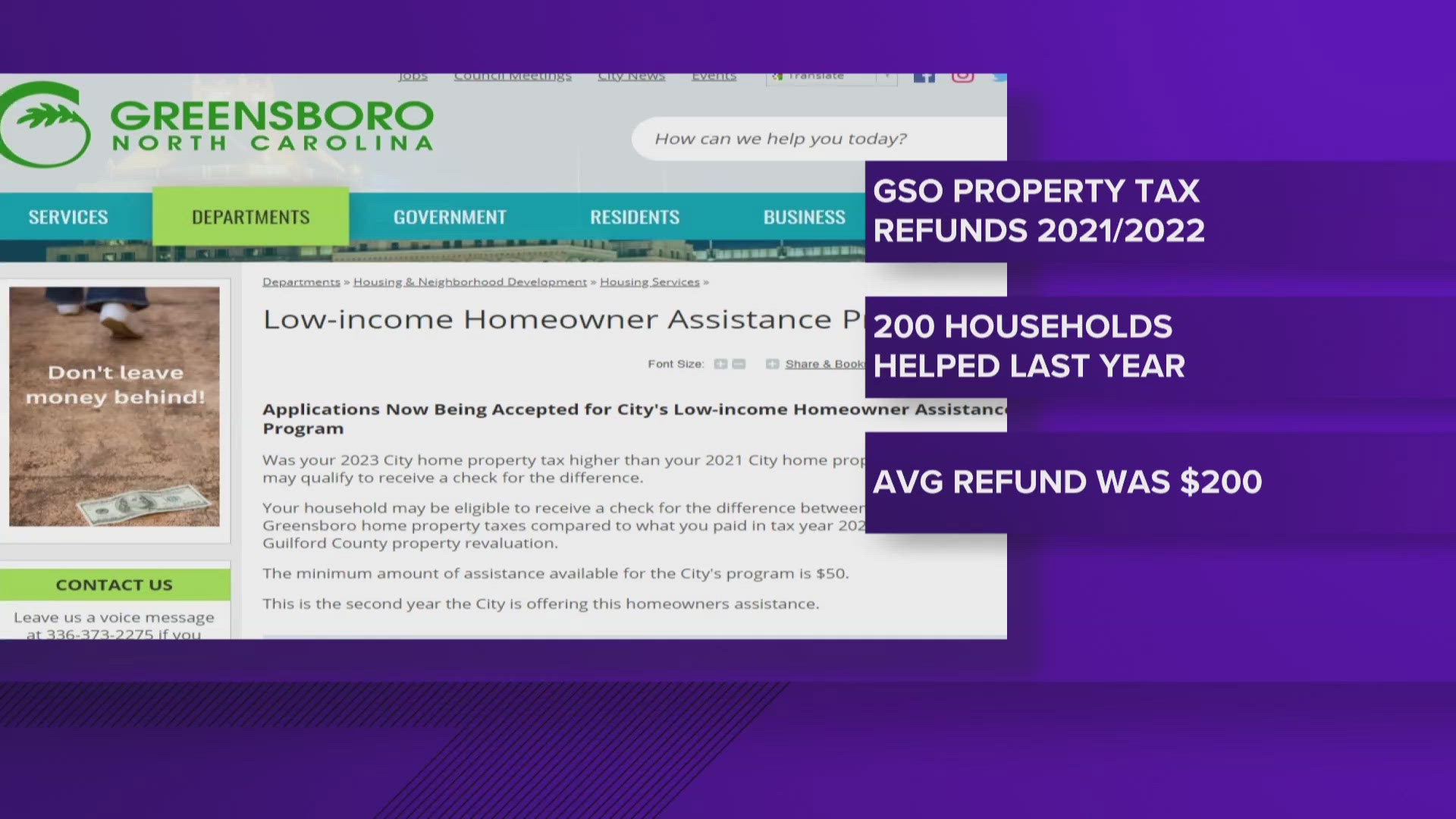

The refunds are part of the city's Low-Income Homeowner Assistance Program. This is the second time the city has offered to refund the property tax difference.

Last year, during the pilot program, about 200 households were helped by this refund which matched up the 2021 and 2022 property taxes. The average refund last year was about $200.

"But we saw some as high as almost $600 which could go a long way and make a huge difference in these households," said Bowers.

There is a list of eligibility requirements to get this refund:

- Applicant cannot have also received assistance from Guilford County tax assistance programs

- Home must be the applicant’s primary residence

- Home must be located within Greensboro's city limits

- Applicant must be the person who paid the taxes

- Applicant must have owned the home for five continuous years

- Home's total property tax value must be less than $250,000

- For one-person households, the total household annual gross income for 2023 must be less than or equal to $43,500 to apply. For two or more people in a household, the total annual gross income for 2023 must be less than or equal to $49,500.

- There can be no outstanding liens, assessments or delinquent taxes on the home owed to the City of Greensboro

What if you don't know what you paid in 2021 versus 2023?

Finding your bills is easy to do, you can search the Guilford County website. You can look it up by owner name or street name.