GREENSBORO, N.C. — College is back in session and for the most part, students are back on campus. There is no question the school year is different, which means financially preparing for it is going to be different too.

Money expert Ja'Net Adams said every student returning to campus has important things to consider.

"There are thousands of college students back on campus preparing for a semester that looks like nothing they have seen before. I want to share what college students and their families should be considering when it comes to their money this school year."

Adams offered three main tips to help students navigate the uncertain semester; one which we are seeing play out now at UNC-Chapel Hill. This week undergraduate students started heading home just days into the fall semester due to several COVID-19 clusters on campus.

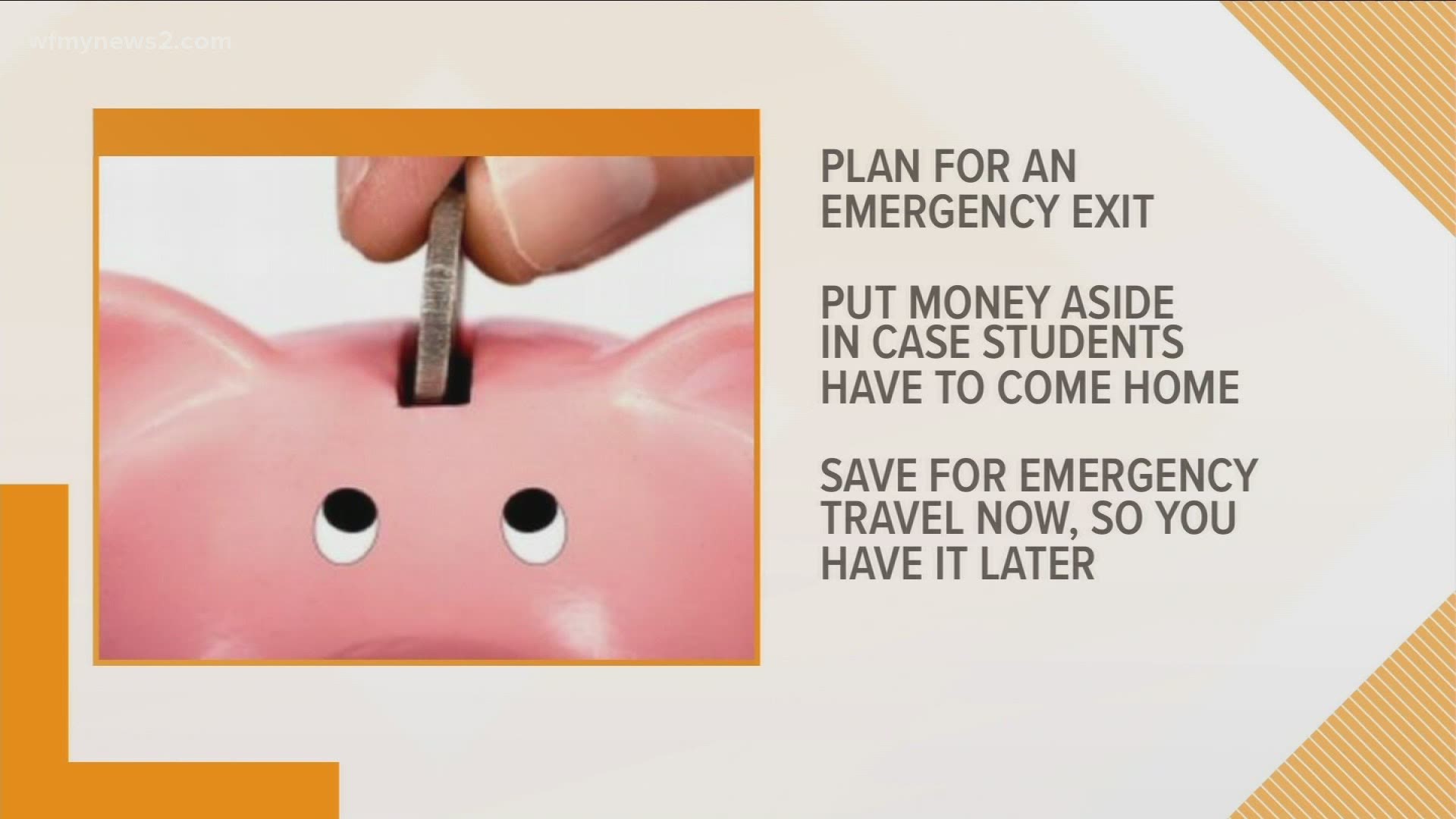

1. Save For An Emergency Exit:

"We always hope for the best, but stay prepared," said Adams, who wrote the book, The Money Attractor.

"Students and their parents/guardians should be putting money aside just in case students have to come home. If there is a health emergency you don't want to have to find money for a flight, bus, or train ticket so the student can get home. Save up the emergency travel money now so if you need it, it will be there," said Adams.

2. Find A Different Money Source:

"For safety reasons colleges want students to minimize their time off campus. For students who need to work in order to have money for their education this request is tough. I suggest that the student look for work from home (dorm room) jobs that are part time and can be done when they are not in class. The most popular site to find these jobs is the website Rat Race Rebellion."

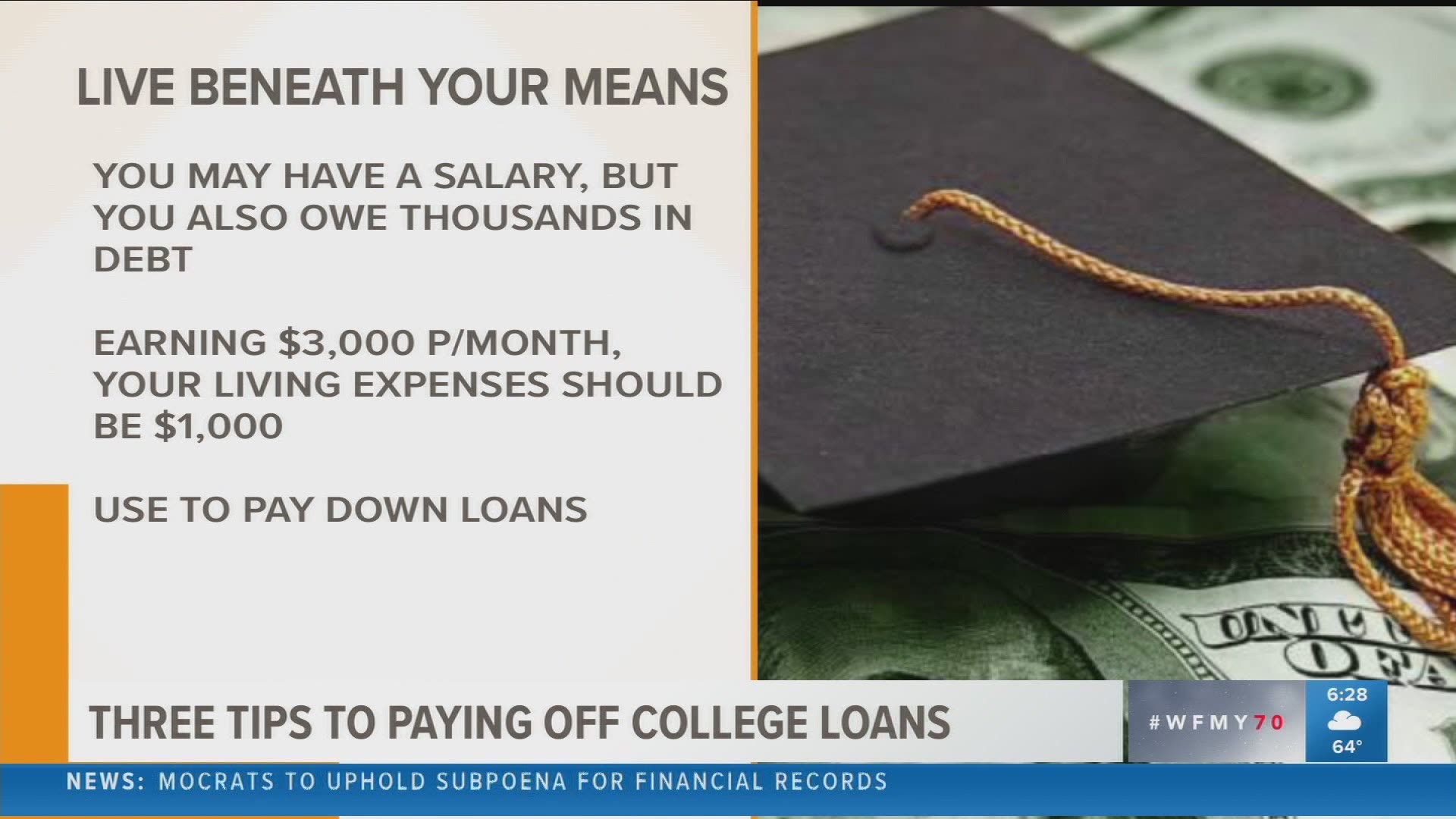

3. Focus your savings:

"There are college students who will be completely virtual for one or both semesters. What that means is there is money being saved in reduced tuition or money from not staying on campus and having a meal plan. This money could be saved for a future semester on campus when the student is safe to go back. Another option is for parents/guardians to add the saved money to their retirement or start an investment account for the student. It is never too early to start building wealth!"

The takeaway here is that your education is important but so are your health and finances.

"The college experience looks really different right now, but that doesn't mean that you have to lose focus when it comes to your money," said Adams.

You can find more great money tips and connect with Ja'Net Adams through her website.