GREENSBORO, N.C. — The theory is that when a child turns 18, they go out into the world and fend for themselves, but more and more young adults are ending up back home with their parents.

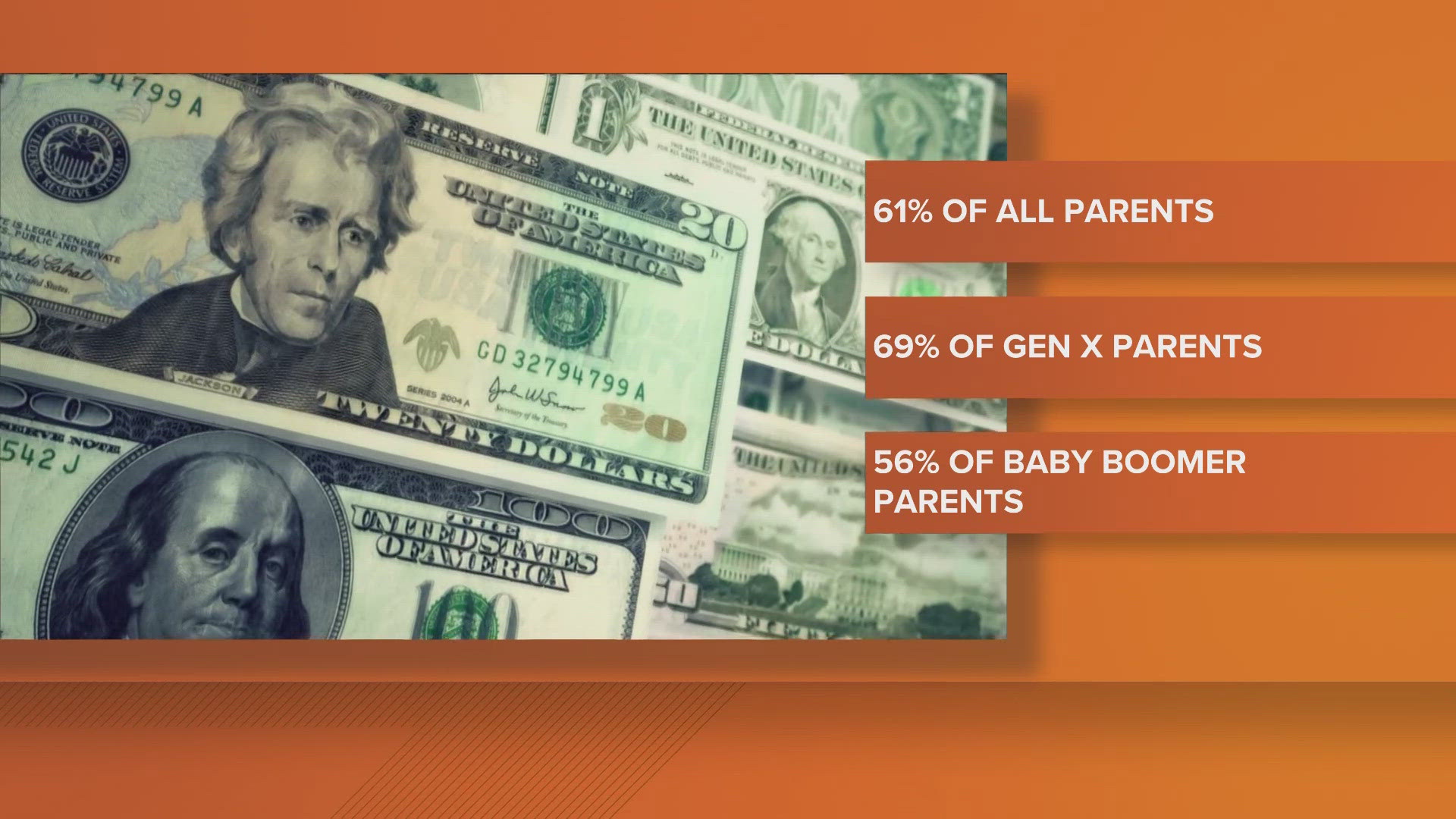

A new study by Bankrate found 61 percent of parents and guardians of children age 19 or older are currently sacrificing or have sacrificed to provide financial assistance to their kids. A trend that’s getting more common. 69 percent of Gen X parents say they have done that compared to just 56 percent of baby boomer parents.

“We see that really breaking down one or two ways, either help with shelter in some respect, whether that's rent, living at home rent free or with reduced rent, or help in buying that first home, as well as everyday expenses,” Bankrate’s Greg McBride said.

Bankrate says parents who support their adult children should keep in mind their own financial goals. It's kinda like on an airplane where you have to put on your own oxygen mask first before helping the kids.

“Retirements come in one way or the other, and stats have shown that in about half of cases, it tends to come sooner than was planned and was involuntary” McBride said. “So when you retire isn't as simple as saying picking a date on the future calendar. A lot of times that may be out of your hands due to downsizing or health concerns. And so as a result, parents can't compromise their own retirement security in order to help out their adult children financially.”

To help transition kids to financial independence, Bankrate recommends taking three steps:

Sit down as a family and make budgets together. Help your kids figure out how to stretch the money they are making. Also look for ways to cut your own extra spending instead of taping into emergency savings and retirement funds.

And think of other ways to help besides money. Maybe you could add your kids to a family cell phone plan. Or help them land a job at one of your friend’s companies.

Finally talk openly about money with them. Let them know how much you can give and how long you can give it and them explain that you have to meet your own financial burdens like planning for retirement.