GREENSBORO, N.C. — First, it was student loan repayments starting up after the COVID state of emergency ended. Now the IRS is planning to start going after people who owe back taxes again.

The agency says its main focus will be to aggressively pursue wealthier taxpayers first. They plan to go after 1,600 millionaires and 75 large companies that owe hundreds of millions of dollars in back taxes.

The IRS commissioner said, "If you pay your taxes on time, it should be particularly frustrating when you see that wealthy filers are not."

While the agency is focused on rich people right now, they have indicated a plan to start sending out debt collection letters to all taxpayers with outstanding balances again by the end of the year. Remember the longer you wait to pay, the more you're going to owe.

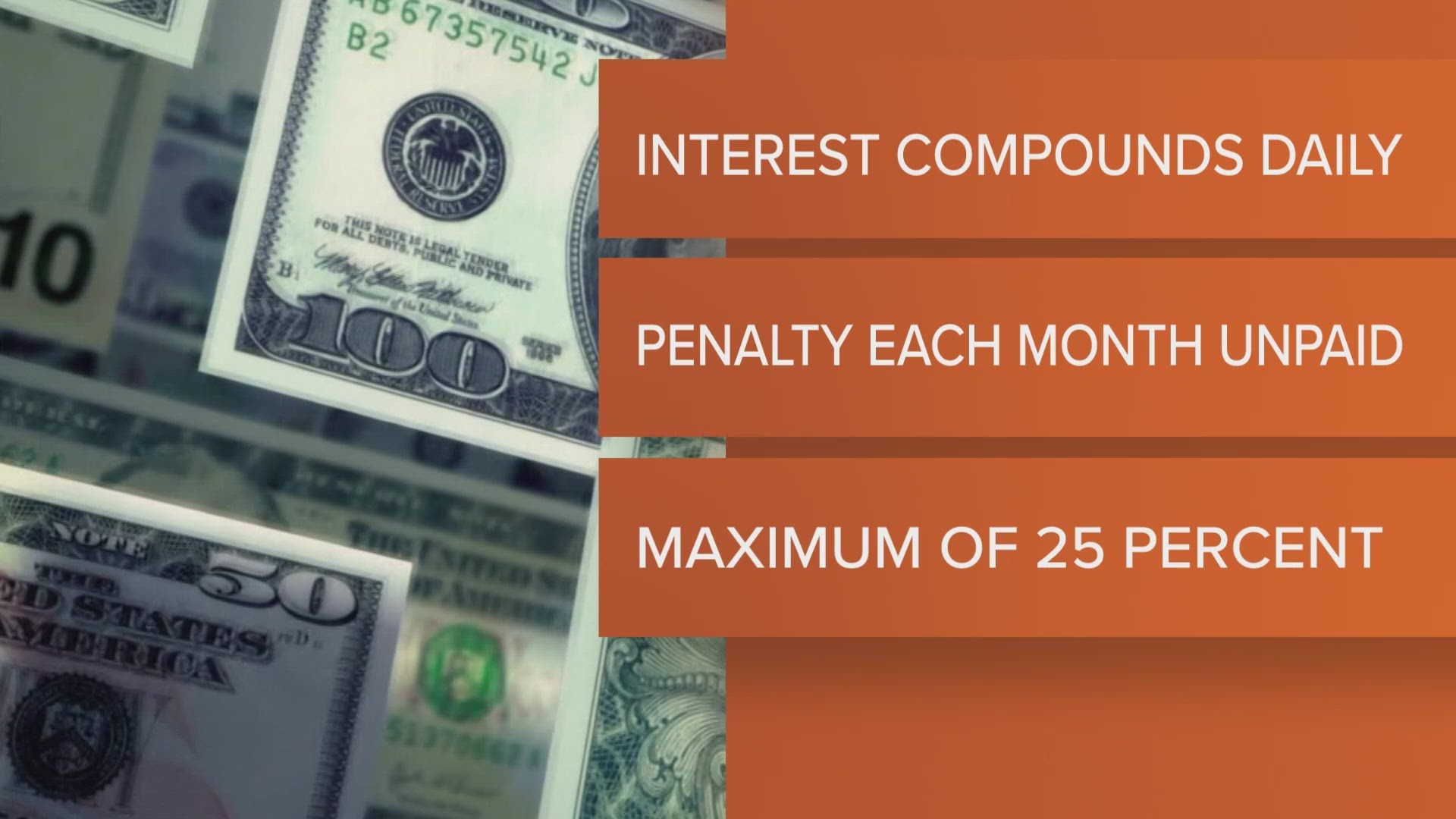

Interest on back taxes compounds daily. Plus, there's a half percent penalty for each month it remains unpaid up to a maximum of 25 percent.

If you can't afford to pay, accountants recommend you respond to the IRS's collection letter explaining why it's hard for you to pay. Maybe you lost your job or had a lot of medical expenses. The IRS has been known to cut a deal reducing interest and penalties. But the worst thing you can do is ignore it. They could end up seizing your property or garnishing your wages.

MORE WAYS TO GET WFMY NEWS 2

Subscribe to our daily newsletter Let’s Get 2 It!

Download the WFMY News 2 APP from your Apple or Google Play store.

ADD THE WFMY+ APP TO YOUR STREAMING DEVICE

ROKU: Add the channel from the ROKU store or by searching for WFMY.

Amazon Fire TV: Search for WFMY to find the free app to add to your account. You can also add the app directly to your Fire TV through your Amazon account.