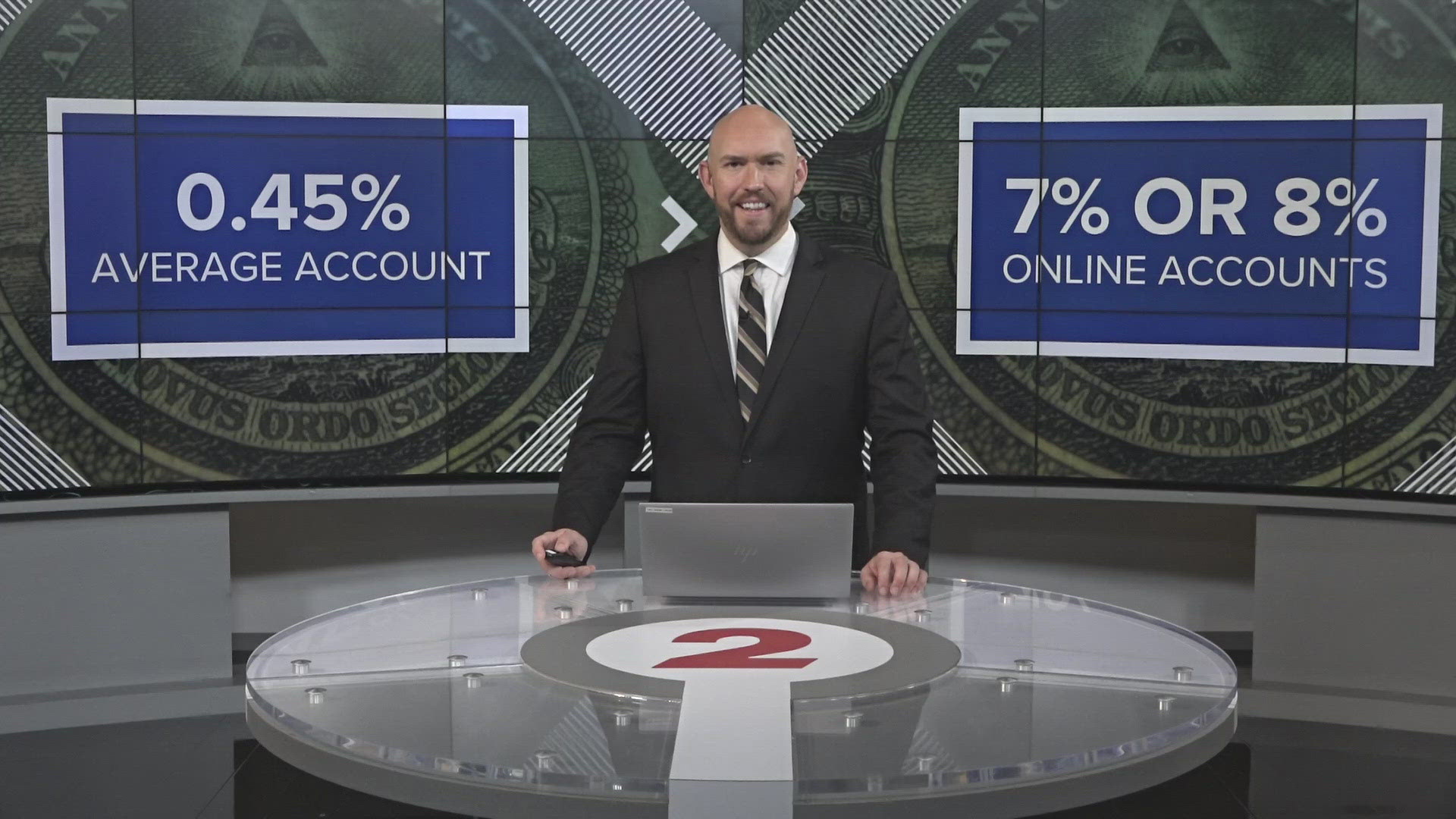

GREENSBORO, N.C. — The average savings account in the United States provides a return of just point four five percent interest. But some online bank accounts are claiming up to 7 or 8 percent returns. And for most of these accounts, CNET found pretty much anyone can sign up.

“Usually, there aren't many requirements. There's usually, based on CNET's research, we don't see too many banks, online banks specifically, that have minimum deposit requirements, minimum balance requirements," said CNET's Dashia Milden.

But a lot of people are worried about putting their hard-earned money in an account online. CNET says there’s one safeguard you always want to see before depositing anything.

"Online banks generally are safe if they are FDIC or NCUA insured to protect you in case of bank failure. That being said, if you're going to use a banking app, you're going to want to make sure that you are using that bank's security features if it's multi -factor authentication, biometric authentication, strong passwords, being careful of those links that you actually click," Milden said.

One catch – many of these accounts require you to keep your money in them for so long before the interest rates kick in – or they only let you withdraw money once or twice every 30 days. Make sure you understand the terms before signing up.

CBS News recently found these high-yeild saving options for the month of June 2024:

- Brio Direct - 5.35% APY: You must deposit at least $5,000 to open your account. Once your account is open, you'll need to maintain a $25 minimum balance to earn the stated APY.

- Forbright Bank - 5.30% APY: You don't need to meet a minimum deposit requirement to open this account and there is no minimum balance requirement to earn the stated APY.

- Tab Bank - 5.27% APY: There is no minimum deposit to open this account. Once your account is open, you'll need to maintain a $0.01 minimum balance to earn the stated APY.

- UBF Direct - 5.25% APY: You don't need to meet a minimum deposit requirement to open this account and there is no minimum balance requirement to earn the stated APY.

- Bread Savings - 5.15% APY: You must deposit at least $100 to open your account. Once your account is open, there is no minimum balance requirement to earn the stated APY.

- Popular Direct - 5.15% APY: You must deposit at least $100 to open your account. Once your account is open, you'll need to maintain a $0.01 minimum balance to earn the stated APY.

- BMO Alto - 5.10% APY: You don't need to meet a minimum deposit requirement to open this account and there is no minimum balance requirement to earn the stated APY.

- Bask Bank - 5.10% APY: You don't need to meet a minimum deposit requirement to open this account and there is no minimum balance requirement to earn the stated APY.

- EverBank - 5.05% APY: You don't need to meet a minimum deposit requirement to open this account and there is no minimum balance requirement to earn the stated APY.

- Salem Five Direct - 5.01% APY: You must deposit at least $10 to open your account. Once your account is open, there is no minimum balance required to earn the stated APY.

- CIBC Bank - 5.01% APY: You must deposit at least $1,000 to open your account. Once your account is open, you'll need to maintain a $0.01 minimum balance to earn the stated APY.

- LendingClub - 5.00% APY: You must deposit at least $100 to open your account. Once your account is open, there is no minimum balance required to earn the stated APY.