GREENSBORO, N.C. — The USGS reports a 2.0 earthquake hit near McLeansville just northeast of Greensboro at 2:19 a.m. Tuesday. Just three minutes later at 2:22 a.m., another earthquake hit just a few miles west between Wendover and Huffine Mill Rd.

This appears to be a secondary quake of just about the same strength, a 2.1. At this time, no damages have been reported. But if there was damage, would your insurance cover it?

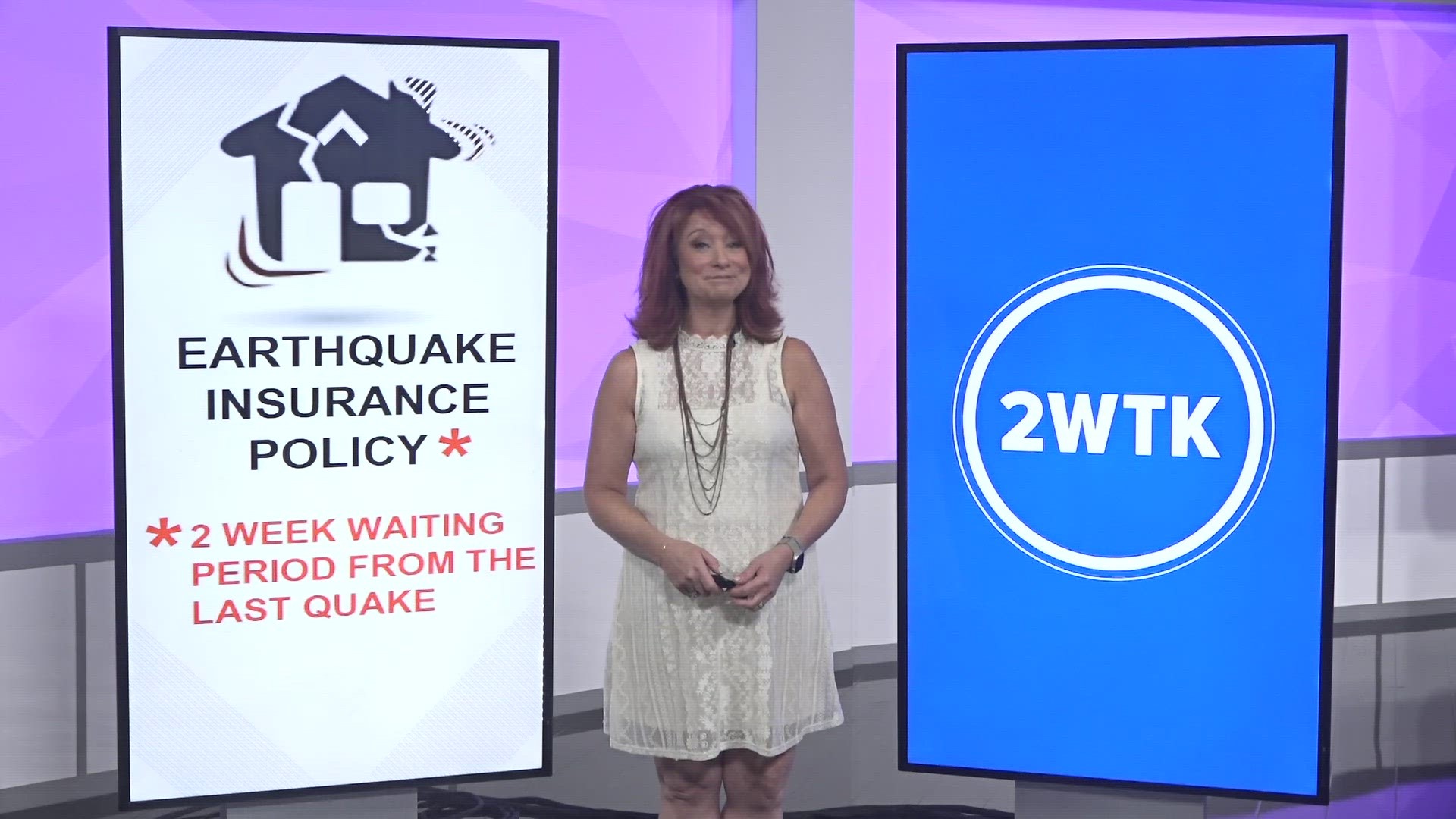

The typical homeowner's insurance does not cover damage from an earthquake. If you want to be covered, you'll need to buy an earthquake insurance policy.

EARTHQUAKE INSURANCE POLICIES

In NC, it's about $200 a year for a $200,000 house. When it comes to the deductible, it's not a flat fee like most of your other insurance coverage.

"In earthquake coverage, it's a percentage. And wind insurance policies are the same. If you have a 2% deductible and you have a $200,000 house, you would have the first 2% on that house to pay as the deductible, which equates to a $4,000 deductible," said Christopher Cook of Alliance Insurance Services.

If you're thinking about earthquake insurance, don't be surprised if your agent says you can't get it right now. Insurance companies don't write policies while the ground is still shaking, there's usually a two-week waiting period from the last quake, and that includes aftershocks.

WHAT HAPPENS WHEN YOUR A/C GOES OUT OR YOUR HOT WATER HEATER STOPS WORKING?

Chances are, your insurance doesn't cover replacing it. Why? Insurance isn't a home warranty, it is to pay for emergencies that happen out of the blue, not maintenance issues. So, if your roof is 15 years old and needs to be replaced, it's on your dime. But if your roof is older but a hail storm damages it, you could get a whole new roof for the price of the deductible.