GREENSBORO, N.C. — Online sports betting is one thing, but the March Madness office pool doesn't really count as gambling, does it? It does if you win and the IRS finds out about it.

"If you win the office pool for March Madness, be sure you get competent help, and don't listen to that guy on TikTok saying this isn't reportable, don't worry about it. Why? Because the jealous co-worker who didn't win, might turn you in," said Mark Steber of Jackson Hewitt Tax Prep Services.

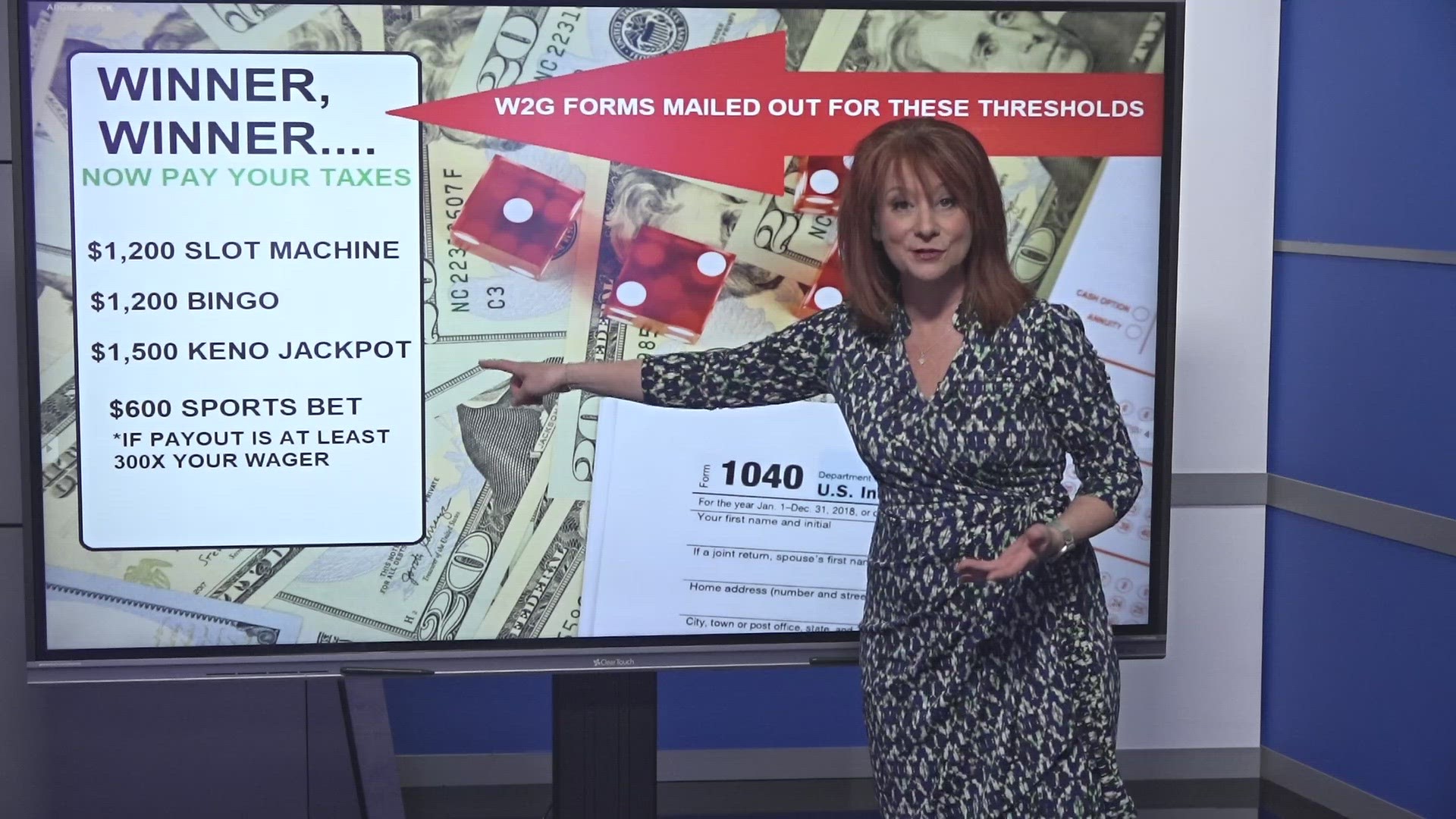

It's true, the big casinos and sports betting sites mail out IRS W2-G forms if you win a certain amount of money. For example, the threshold is $1,200 for a slot machine win, $1,200 for a Bingo win, $1,500 if you win the Keno jackpot, and winnings over $600 for certain sports bets.

Those kinds of numbers make the office pool winnings sound pretty small, and your office pool isn't going to give you one of these so it may not feel like gambling winnings.

"That's where the myth gets started, people think if I didn't get a document then it's not taxable. If it's not an official casino I don't have to report it. That's not the rule, the rule is if you won a dollar with a coin flip with your buddy, it's technically taxable," said Steber.

The IRS tax forms show gambling wins as additional income, it is 8b on this year's forms just in case you won last year.