GREENSBORO, N.C. — Oops! Everyone makes mistakes, I mean, we're human. But when you make a mistake on your taxes, it can be a real headache, and costly too.

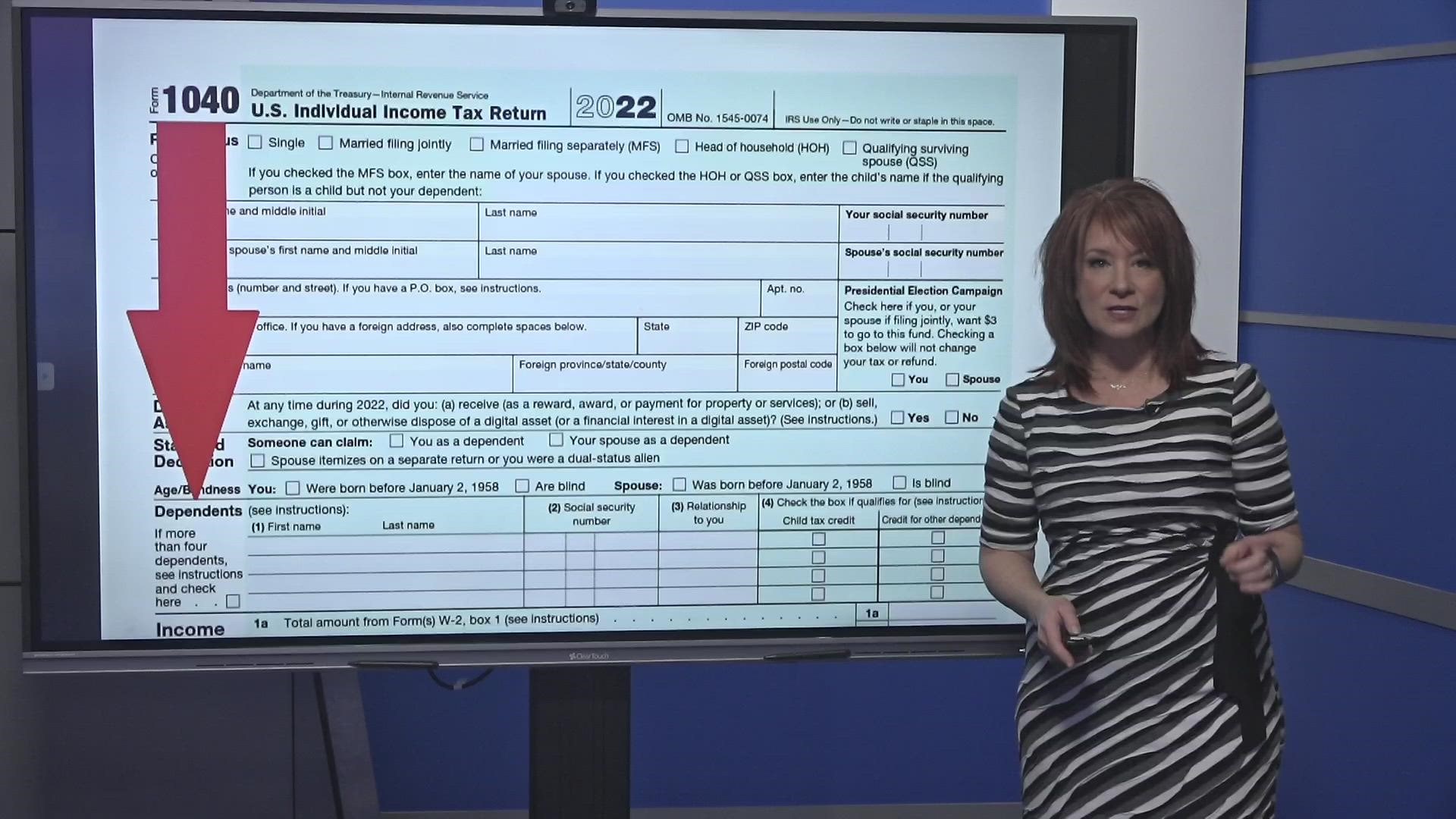

The three most common tax return mistakes according to the Internal Revenue Service:

Filing before you have all the necessary documents

Missing or inaccurate social security numbers

Misspelled names

If you're divorced with kids, you can easily make one of the top three mistakes if you don't have good communication with the adults.

“About 30% to 40% of all rejected returns we get sent back is because another parent has claimed that child,” said Ryan Dodson of Liberty Tax Service.

Both divorced parents can't claim the same child as a dependent. If one parent claims the child and the second parent hasn't yet, but it's their year, they can possibly work it out between them.

But if the second parent actually files, the second tax return is rejected. When that happens, there's no more talk about working it out between the two.

“The only way to work around that is to do it the old-fashioned way which is on paper. Then we send it in, the IRS sends a letter back, then we send it back, it becomes a very long and drawn-out process,” said Dodson.

Long story short, have the conversation and confirm which parent is claiming which kids before you file that return.

The Child Tax Credit can reduce your taxes by up to $2,000 per child.

Taxes are due Tuesday, April 18, 2023.