GREENSBORO, N.C. — You can book an entire vacation on your phone, sign up for healthcare benefits online, and even buy a car without ever stepping onto a dealership lot. So why not look around for the best rates for a personal loan online?

"We would recommend you go to the names online that you know and are recognized and accredited with the BBB because there are a lot of people out there offering loans and you could get yourself in trouble when you're out there Googling loans," said Lechelle Yates of the Better Business Bureau.

The Triad woman who called the Better Business Bureau for help says she was almost approved for a loan, but because she had a low credit score, "the loan company" wanted to do something to boost her credit score. The plan was for the "loan company"y to send the triad woman a few checks. She would deposit them to make it appear she had more money in her account. She would be approved for the loan and then send the money back via Cash App.

"The checks did end up being fake and she ended up losing the money. This is a heartbreaking story, someone who needed money and she involved with this scammer who manipulated her, where she is now paying back money to the bank," said Yates.

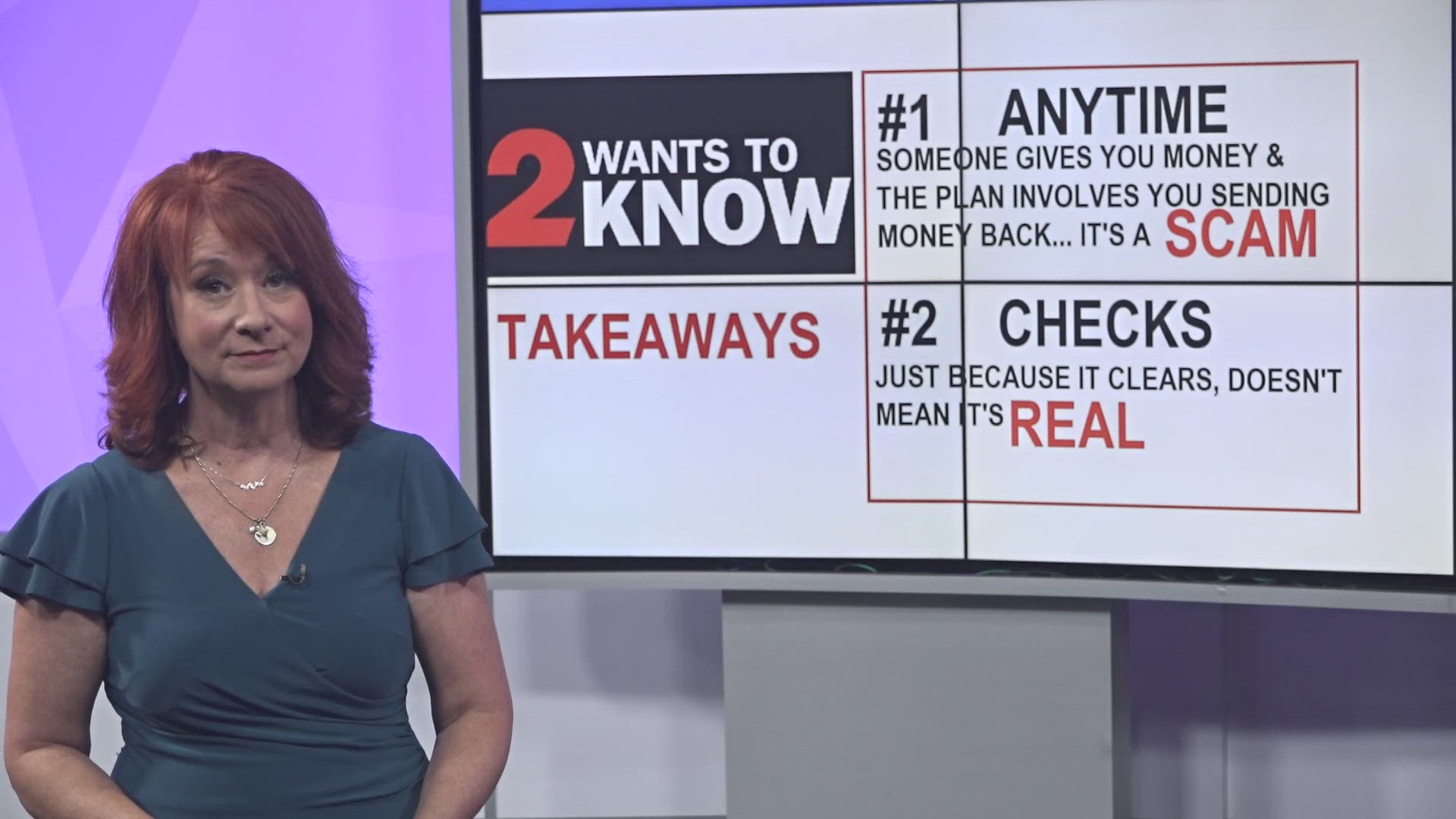

There are several takeaways here, but these are the top two:

#1 Anytime someone gives you money, and the plan involves you sending money back, whether it's to pay for fees, to buy equipment, or because they overpaid you, it's always a scam.

#2 It takes up to two weeks for a check to wind its way through the banking system. Just because a bank cashes a check, doesn't mean it's real.