GREENSBORO, N.C. — Credit cards offer purchase protection, a great way to pay for a trip, a product, or a service. But there are three things experts say you should never pay for with a credit card. The Motley Fool Ascent recently had an article on this.

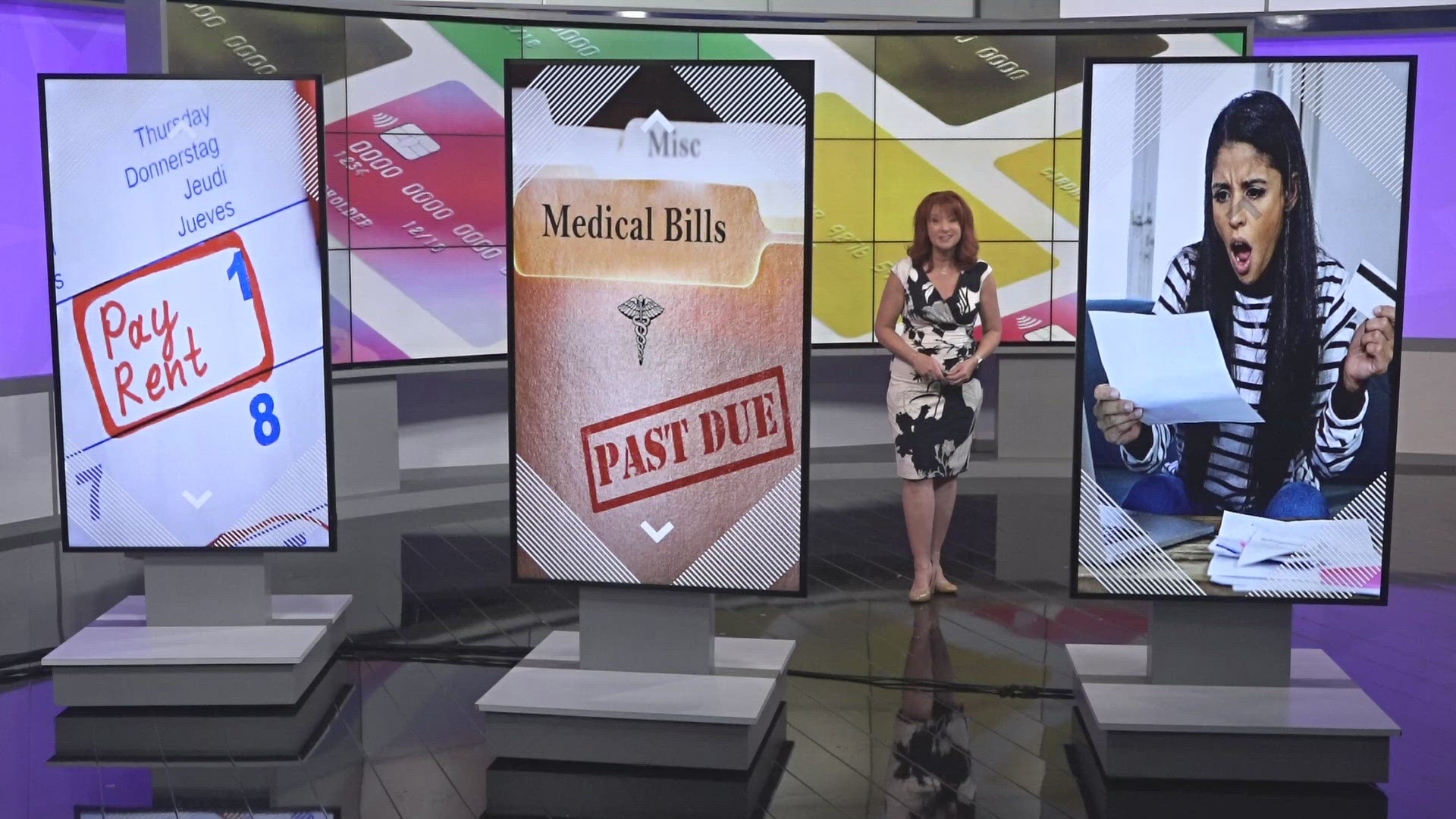

The three purchases on the no list: are your mortgage/rent, a medical expense, or an impulse purchase, which includes sports betting and lottery tickets.

"Your mortgage or rent payments, those are extremely large payments, and it could be difficult to pay off the amount in a single billing cycle, and that could create interest and exponentially increase the amount owed. Oftentimes times you'll also get hit with a servicing fee as well," said Jack Caporal, Analyst at The Motley Fool Ascent.

When it comes to medical expenses, you may have heard that medical debt is not factored into your credit report and score. While that's true, if you use a credit card to pay your medical expenses, that protection is thrown out.

"Once something goes on your credit card, the type of debt it is, the purchase type is irrelevant to credit bureaus. The credit bureaus will not look and say, 'Oh it's a medical expense so we'll just ignore it or forgive it'. If it's on a credit card, that's not going to happen," said Caporal.

He said a medical emergency can become a financial emergency if you use your credit card for a medical expense. The best bet for medical expenses is to set up a payment plan with the doctor's office or hospital.

When it comes to sports betting, lottery tickets, or impulse buys, credit cards make it easy to spend money, but experts say credit cards are not a get-out-of-jail-free card to buy things you want but can't afford.