About three out of four working Americans are saving for retirement. But, a new study finds not everyone is saving enough.

Thirty-five-year-old Taryn Ciulla only recently started thinking about her retirement plans. "I was saving for a while, and then I felt like I couldnt afford it, so I stopped," she says, "And then, when I got a more permanent job as a teacher, then I started saving again."

She puts about $250 per paycheck into her retirement account. But, it's a struggle. "If you dont make that much, how are you going to do it?" Ciulla says.

A new survey from Bankrate.com finds 29 percent of working Americans are increasing their retirement savings compared to last year. But half are contributing the same and 16 percent are saving less. Steve Grimes has a 401k, but admits he hasn't given it enough attention. "It just wasn't something I was thinking about, easily until I want to say about five years ago," he says, "and that's relatively late, right? You know, in my mid-thirties before I started thinking about retirement."

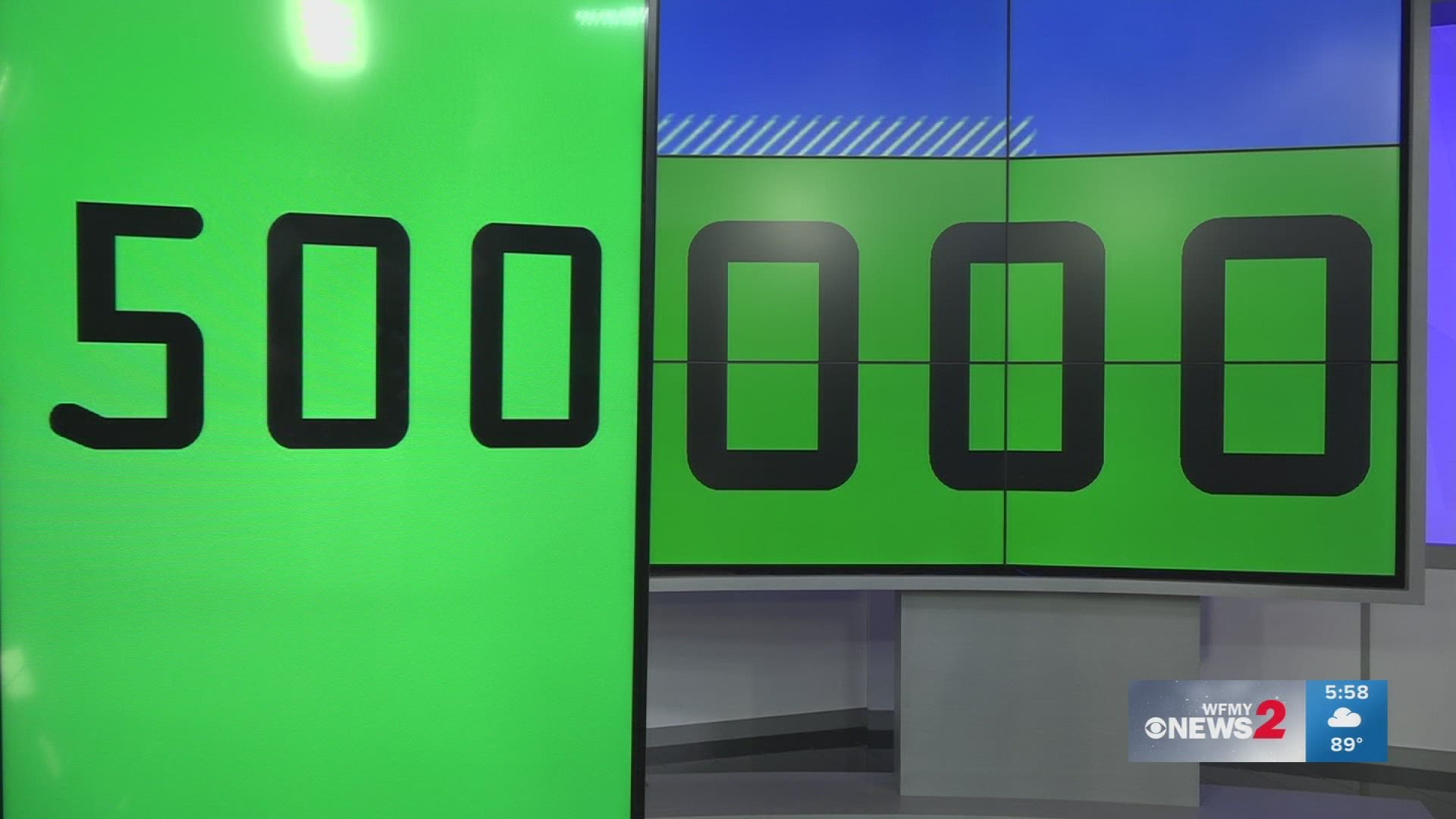

A 35-year-old who puts $5,000 in a traditional IRA every year could have around $500,000 at age 65. But if that same person started contributing when they were 25, that retirement account could be $1 million.

Greg McBride is chief financial anaylst at Bankrate.com. He says, "If you are not saving at least 10 percent of your income for retirement, you need to get there pronto and once you do, look to bump that up." McBride says the goal is putting away a full 15 percent of your income to ensure you have enough to retire.