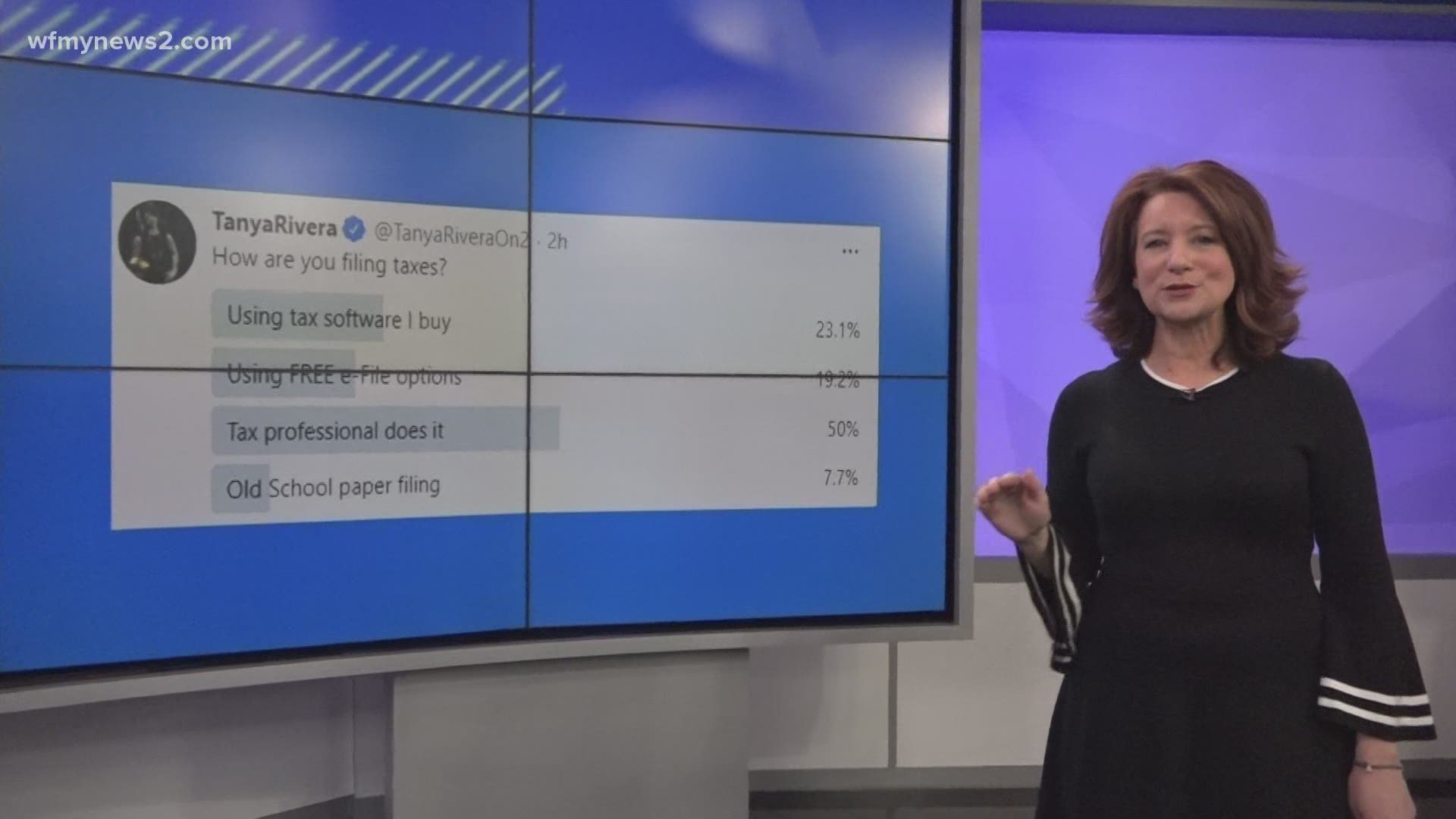

GREENSBORO, N.C. — How are you getting your taxes done? 2WTK asked on Facebook, Twitter, and Instagram:

1-Do it yourself and buy software

2-Use the free e-file options through the IRS

3-Have a Tax Professional do it

4-Do it yourself Old-School on paper

No matter how you do it, every person filing has one thing in common,

you're going to need documents and information. From W'2s to mortgage interest, to property taxes, student loans, and more. H&R Block has an entire checklist they put online to help folks gather the tax forms they will need.

his year due to COVID, there are very few options to get free help locally. In fact, all 600 spots at the two Greensboro Public Library with VITA volunteers are booked. So, what if you need help? Danielle Pritchett from the Greensboro Public Library says the IRS e-file is a great option.

”What I like about the e-file service is it is a guided step by step service and they use partners like Tax Pro and Turbo Tax and other tax preparing companies. All you have to do is go through the guidelines on the screen. Some have video tutorials, it's very simple.”

Check out the IRS free e-file options she was talking about. The IRS asks you a few questions first to help you figure out which software you best match up with. Then it allows you to scroll through and pick which one you want. Again this is free.

“Toward the end of your return they go through step by step to check everything lines up, if something seems a little off they'll let you know like hey, you might want to look at this number again,” said Pritchett.

If you need a computer to e-file your taxes, you can go to the Greensboro Public Library Central Branch. The computer time is limited to one hour but Pritchett says e-file allows you to stop and save your info so you can pick it up again the next day.

One more reminder, if you didn’t get all or any of the stimulus money, the only way to get that is by filing taxes. Even non-filers will need to file to get the Recovery Rebate Credit.