GREENSBORO, N.C. — Getting your $10,000 or $20,000 of student debt forgiven through President Biden’s plan only takes five minutes. Really, at least when you’re talking about the physical application.

QUICK AND EASY APPLICATION

“It is pretty easy. They just want your name and social security number and then to sign to say that you're not telling a story,” Ja’Net Adams of Debt Sucks University said.

Quick and easy. And get this, the deadline to apply for student loan forgiveness is December 31, 2023. Yes, that means you have more than a year to apply. A lot of people thought it should have just been automatic, no application needed. Here's why it happened the way it did.

WHY IS THERE AN APPLICATION?

“I mean, I wanted automatic cancellation, but because the administration went the route of having a means test limiting the income amounts of under $125,000 adjusted gross income (AGI) for single people or $250,000 AGI for married couples, because of that requirement, they needed an application,” said Melissa Byrne, founder of We, The 45 Million.

DO YOU QUALIFY FOR DEBT FORGIVENESS?

The application spells all the income levels out. But there is also a reminder, saying look at your AGI on your taxes, not just the salary you’re making.

“What you need to look out for is your AGI, your Adjusted Gross Income. That's line 11 on your 1040. A lot of people think they don't qualify due to the $125,000 or $250,000, you need to look at that line first,” said Adams.

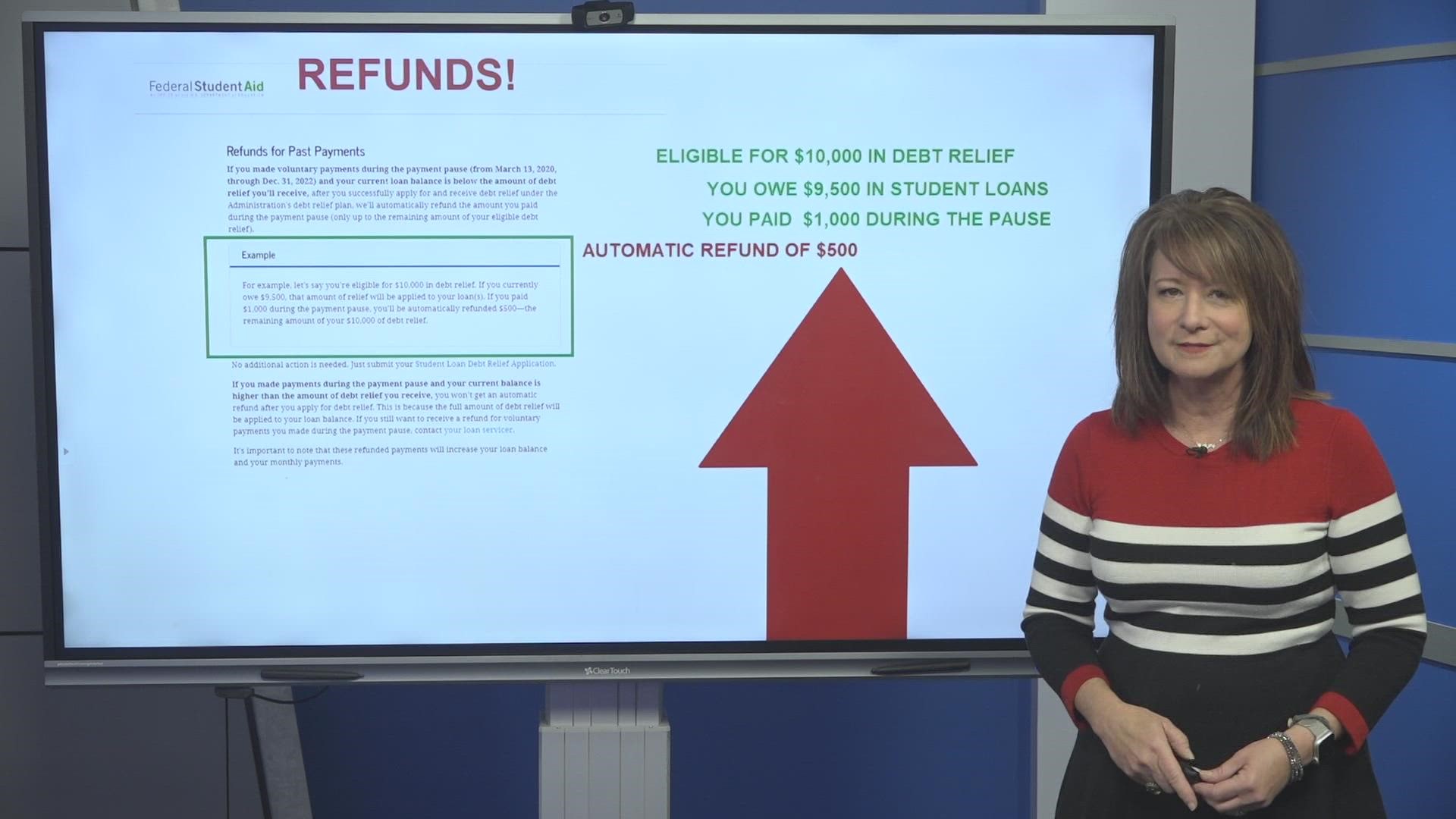

DID YOU PAY DURING THE PAUSE? HOW TO GET A REFUND.

There are refunds for those of you who made payments during the pause. The example on the StudentAid.gov page is:

If you're eligible for $10,000 in debt relief and you now owe $9,500 dollars in debt, but you paid $1,000 on your loan during the payment pause, you might think you’re out that $500 extra you paid. Nope.

The government is going to automatically refund you that money so you're getting the full benefit. How will you get that money back? We're waiting on details of how that will work.