GREENSBORO, N.C. — Time is ticking away. Tax Day is now just days away on May 17.

A viewer asked 2WTK for guidance saying:

I've had 4 jobs recently and none of them will give me my W-2’s to file my taxes.

That's a sticky place to be, but there are ways to get around it. The IRS has Form 4852 for you to fill out. It takes the place of your W-2. Right on the form, it says:

The amounts shown on line 7 or 8 are my best estimates for all wages or payments made to me and tax withheld by my employer.

Lines 7 and 8 are where you will plug in numbers. The best advice is to find your last pay stub. It will show you the amounts of each line and then you can multiply the amounts by how many paychecks you received to get the totals. You'll have to use one form per employer.

Now, what about if you're waiting for your tax refund?

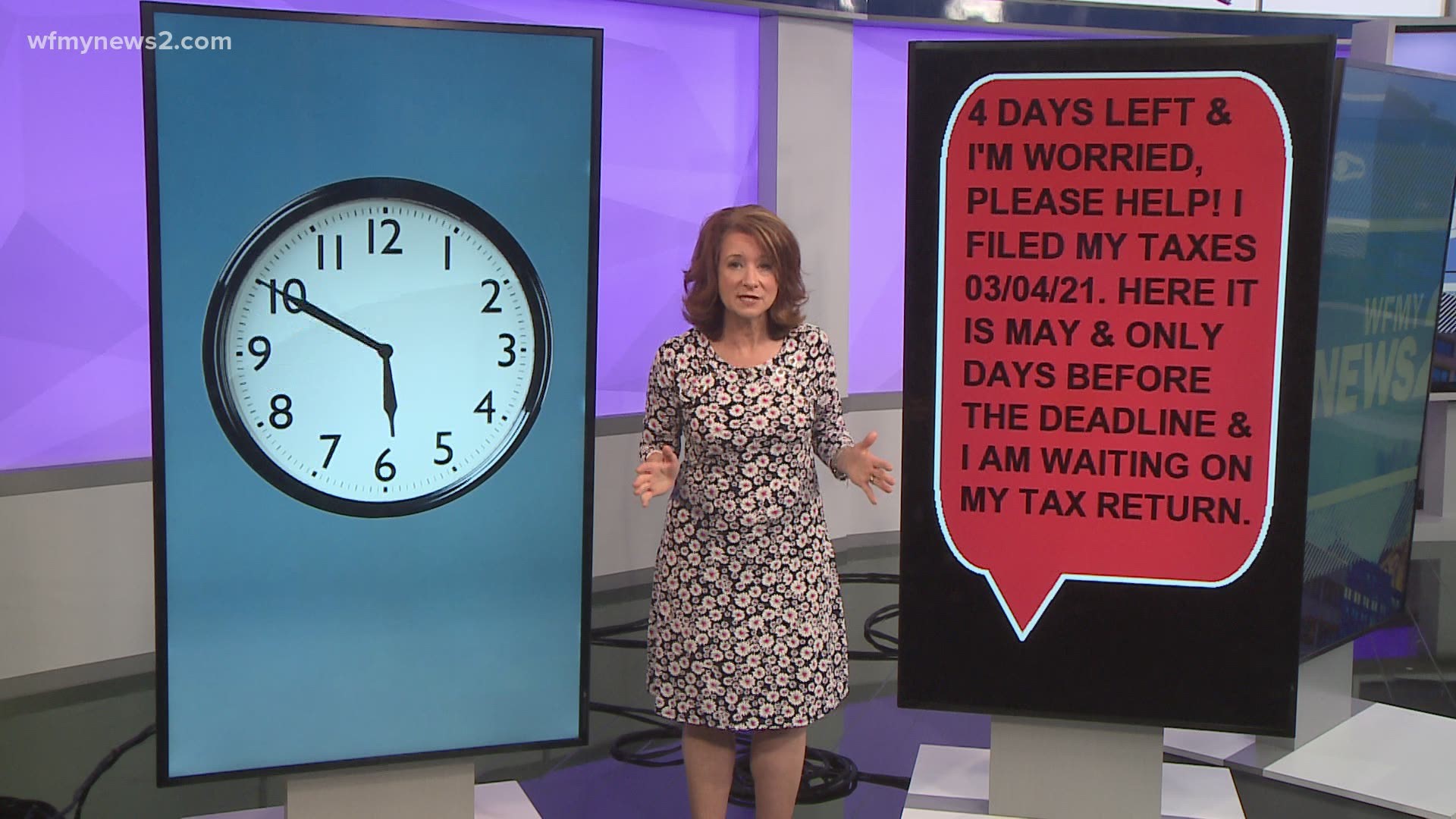

Just recently a viewer wrote in to say:

4 days left and I'm worried. Please help!!!!! I filled my taxes on 03/04/2021 here it is may and only days before the deadline and I am waiting on my tax return.

Here's the good news, you filed your taxes by the deadline. The IRS doesn't have to get your refund back to you by the deadline. But it has been a month, so what's going on with your refund?

The first place to start is with the IRS Where's My Refund page. You find it on the main page, look under the refunds tab. You'll put in your information and it takes you to the Refund Status Results. You can see by the color bars at the top where your return is either received, approved or sent. And there could be dates there as well.