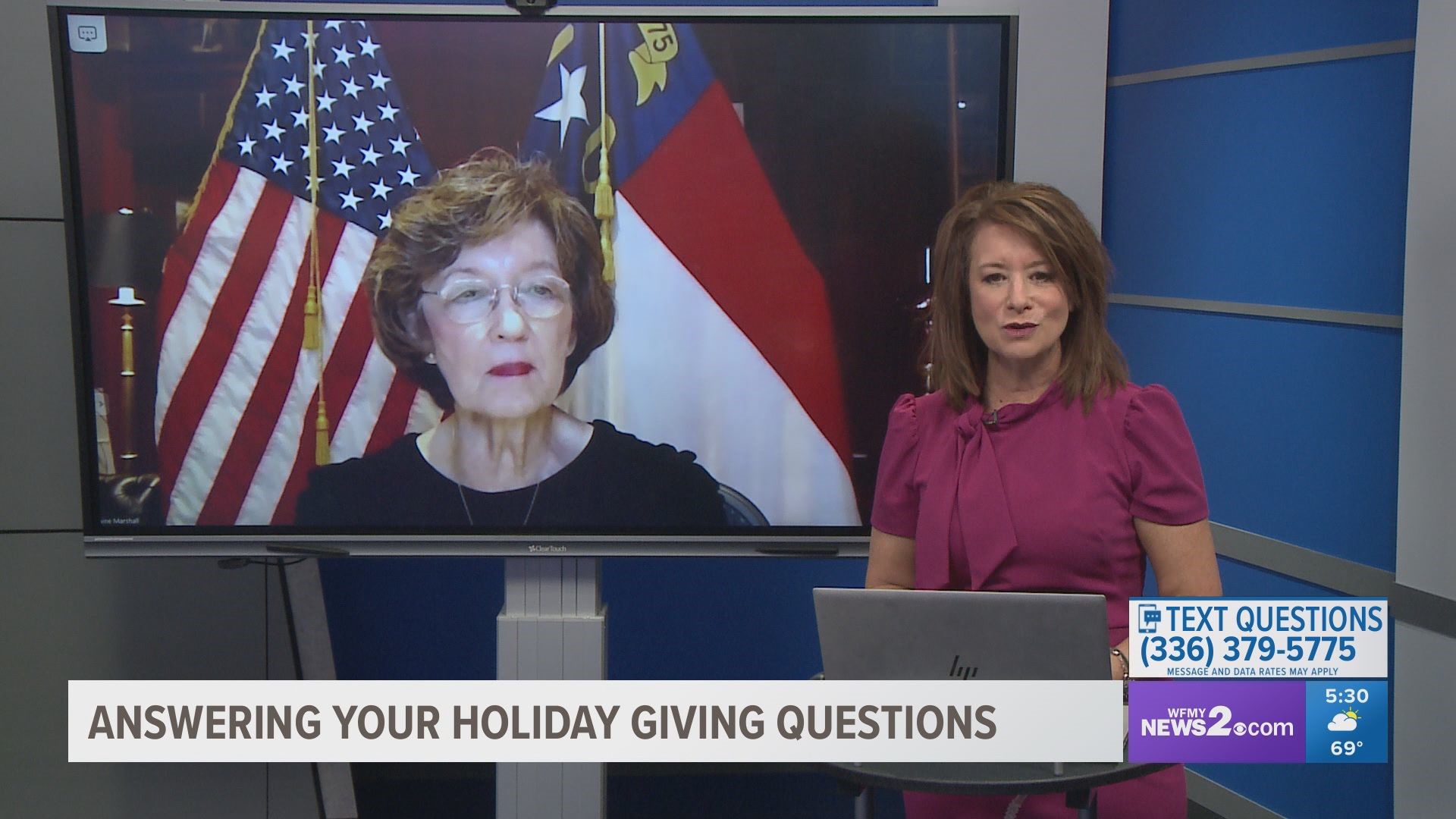

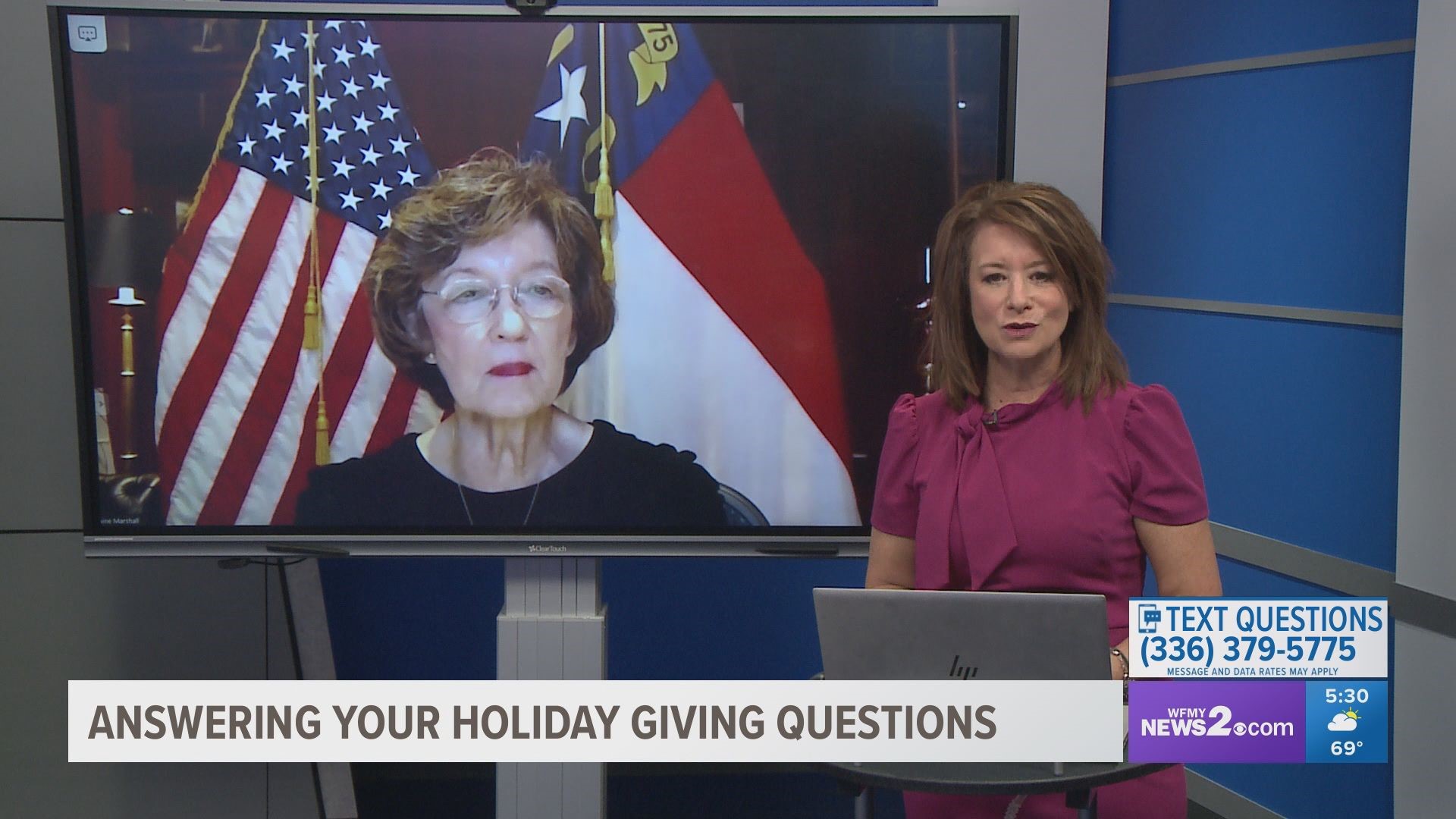

NORTH CAROLINA, USA — As we enter the holiday season, people are thinking about making annual donations to help those in need but beware of fake charities. Secretary of State Elaine Marshall regulates charitable solicitations in North Carolina for organizations that fall under the Solicitation of Contributions statute. She joined us to answer your questions.

What are some top tips for wise giving?

Look out for sound-alike names and “spoofing” on caller ID to make it look like calls are coming from a real charity. Instead of clicking on links in unsolicited emails, texts, and social media posts, do a quick Google search to make sure you’re going to the genuine charity’s official site and direct your donations there.

The Smart Donor Checklist is a handy list of suggested questions you might want to ask when someone’s seeking your donation. You can keep the PDF of this checklist on your smartphone or keep a hard copy by your landline to reference if you get a cold call for a donation.

The state releases an Annual Report during the holiday season with information on all licensed charities and fundraisers, as well as a listing of organizations with formal exemptions from licensure.

Can state regulators simply set a minimum percentage of each charitable dollar that has to go directly to charities?

The US Supreme Court ruled back in the 80s that government cannot regulate a specific percentage that goes to your chosen charities’ programs – that is settled law. That makes it all the more important for us to strive for transparency in the records we house regarding charitable solicitations.

From charities’ contracts with professional fundraising solicitors and final reports after those fundraising campaigns have concluded to their 990 tax returns or other forms of annual financial data – you can do a deep dive on any charity with a North Carolina charitable solicitation license as you’re deciding how to direct your donations.

What can we do if we encounter something that we suspect might be a fake charity?

The state's CSL Division has enforcement authority to investigate when we get word of a scam or any charitable organization that’s out of compliance with the Solicitation of Contributions statute. You can file a complaint here.