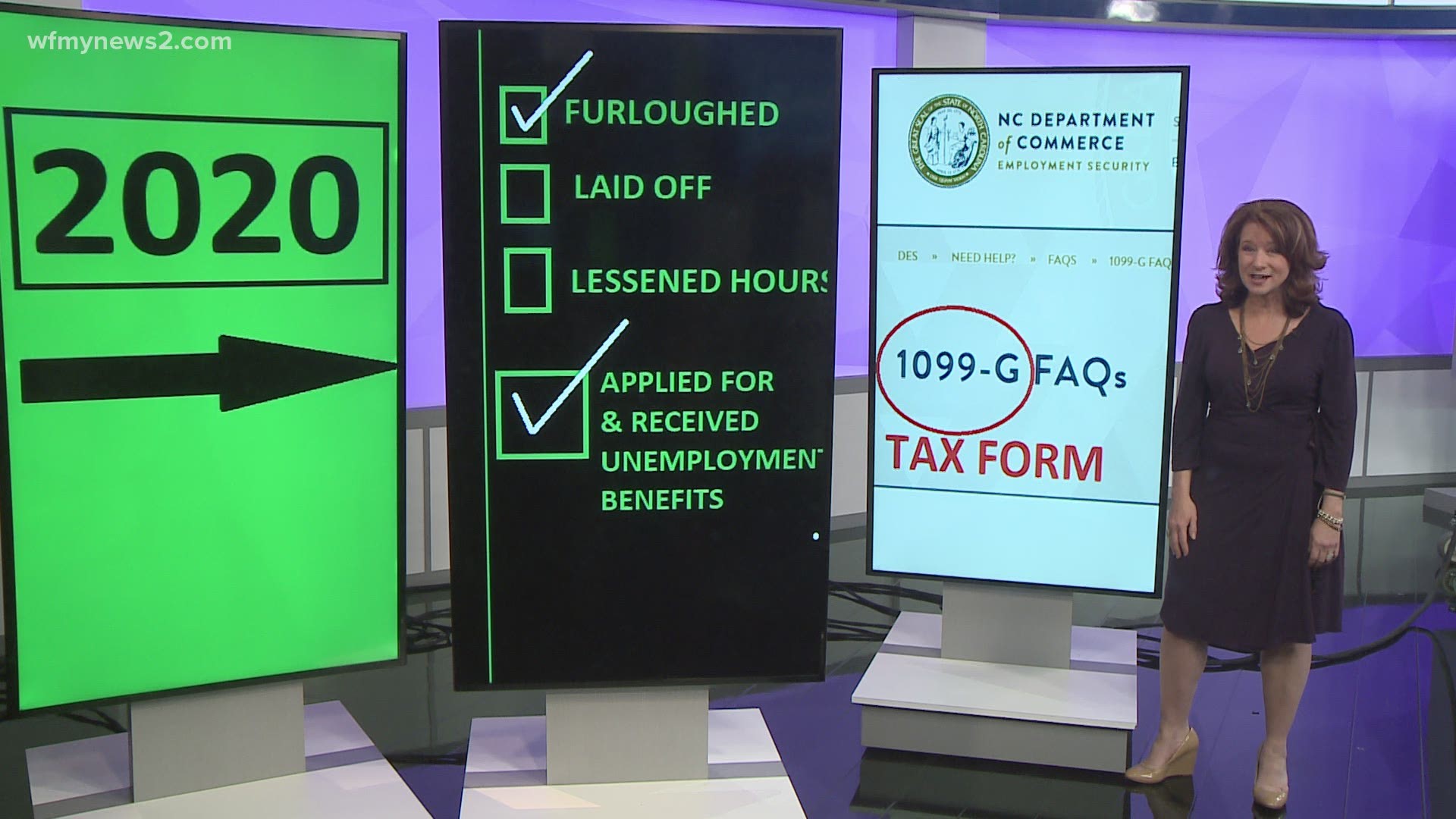

GREENSBORO, N.C. — 2020 had a lot of ups and downs. If you were: furloughed, laid off

had lessened hours and you applied for and received unemployment benefits then you're going to need to make sure you have a 1099-G form at tax time.

Unemployment benefits are taxable income and your 1099-G form shows you how much you were paid in benefits and how much you paid in federal and state taxes.

If you didn’t withhold any taxes and you’re looking at zeros in the withheld boxes, you could owe the government money.

How do you get your 1099-G?

Chances are you got an email from the NC Department of Commerce about it this weekend.

In the email, it tells you to log into your account. When you do, you’ll see an option to view my 1099-G.

The example we have shows the person paid federal taxes on their benefits, but not the state. This means they'll probably owe the state a few bucks. Don't be surprised if you're in that same boat.

You should get your 1099-G in the mail by January 31, but you can always access it online.

IF YOU'RE STILL GETTING UNEMPLOYMENT BENEFITS.....

If you're getting unemployment benefits now, be aware of withholding. For example, if you withhold “0” federal and state income taxes, you get more money in your benefit check but you'll owe it all in a lump sum at tax time.

If you withhold a percentage of taxes you get less in your weekly check-- but you don't add that to what you owe tax time.