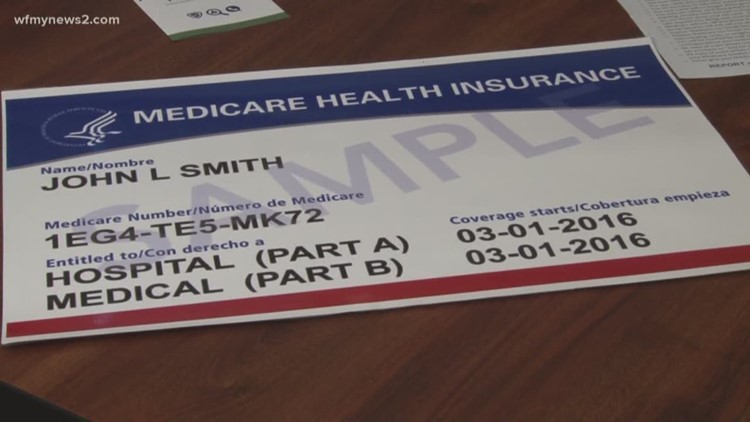

GREENSBORO, N.C. — You turn 65 years old, you get on Medicare, it's that simple.

If only it was.

From the very beginning, if you don’t get it right, it could cost you a lot of money.

“What's most important to understand is when the open period enrollment is. It's the month of your 65th birthday plus three months prior and three months after. If you miss that window you will suffer a 10% penalty every 12 months and that penalty doesn't go away once you start, and you pay that higher premium for the rest of your life,” said Scott Braddock of Scott Braddock Financial.

And while Medicare usually covers 80% of expenses and you pay about 20% out of pocket, you certainly don't want a hefty premium.

A few key points to note about Medicare:

Long term expenses are not covered

Eye, dental and hearing care are not covered

Medicare Part A: covers inpatient hospital stays. If you paid into the program when you worked, it's free.

Medicare Part B: is a premium plan which starts at about $148 and increases with your income. It covers doctor visits.

Medicare Part D: covers prescriptions

Medigap or Supplement: is extra insurance you buy to cover co-pays, deductibles, and travel.

“What we want to make sure we don't do is make choices based on commercials we see, info we receive in the mail, and don't make a decision on what your neighbor might be doing,” said Braddock.

The answer? Meet with an independent Medicare agent. They know the ins and outs and can help direct you. Scott Braddock Financial has several on staff, but you can also Google ‘independent Medicare agent near me’ to find one in your area.