GREENSBORO, N.C. — Seven victims of the Surfside building collapse in Miami became ID theft victims. It’s estimated at least $45,000 was stolen.

“The day of the wake is when they started an online account for my mom. They also requested credit cards and ATM cards,” said the son of two of the victims.

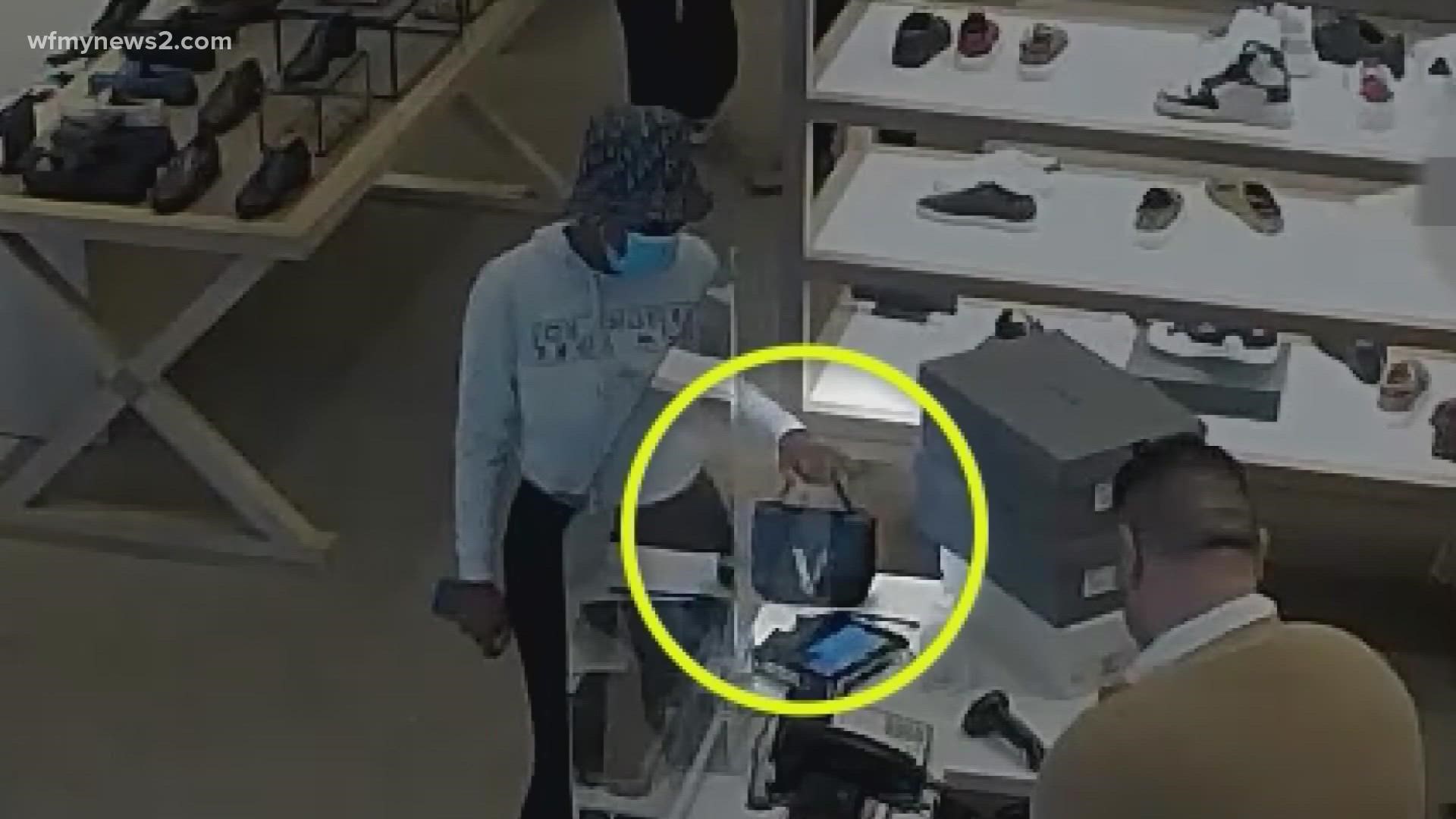

With those credit cards, the ID thieves went shopping. The Miami-Dade State Attorney has video surveillance of one of the credit cards being used in a Bloomingdale's store. One of the suspects is seen carrying a Versace purse she bought for more than $1,000.

This ID theft story should make you mad. Mad enough to take action to protect yourself because ID theft can happen to you today, when you're alive and well and have to live with the mess of trying to fix it.

FREEZE YOUR CREDIT

You can ward off a scammer even having access to your financial identity by freezing your credit. This is also free. You should do it with all three credit bureaus.

WHY? Freezing your credit keeps anyone from opening up a credit card or loan or line of credit in your name. (You would only need to check your credit report once a year if you did this)

WHAT ABOUT USING YOUR CREDIT CARDS? Freezing your credit DOES NOT impact you using your credit cards. The only impact would be if you wanted to open up a new credit card or get a loan for a car or house. In that case, you would unfreeze your credit while you apply.

Why get a credit freeze? This allows you to block identity thieves from opening up credit in your name and steal your money. You should freeze your credit with all three credit bureaus. Use the links or do it by mail:

Equifax Security Freeze

P.O. Box 105788 Atlanta, GA 30348//1-800-685-1111

Experian Security Freeze

P.O. Box 9554 Allen, TX 75013//1-888-397-3742

TU Protected Consumer Freeze

P.O. Box 380 Woodlyn, PA 19094//1-800-916-8800

And yes, you need to do it with all three. A freeze on one doesn’t mean an ID thief can’t try it on the other two.

FREE WEEKLY CREDIT REPORTS

AnnualCreditReport is a government-based site to check your credit report

and now, you can check your credit report for free every week if you want to instead of just once a year.

Checking your credit report shows you what credit cards or loans are in your name. If you don't check, scammers could be opening up cards in your name and racking up bills.

This three-step process includes: filling out a form, picking the reports you want (and you should do all three, Experian, Equifax, and Trans Union), and then requesting and reviewing, which will ask you specific financial questions. Be aware, you will be giving your social security number. You should print off your credit report and keep it in your files.