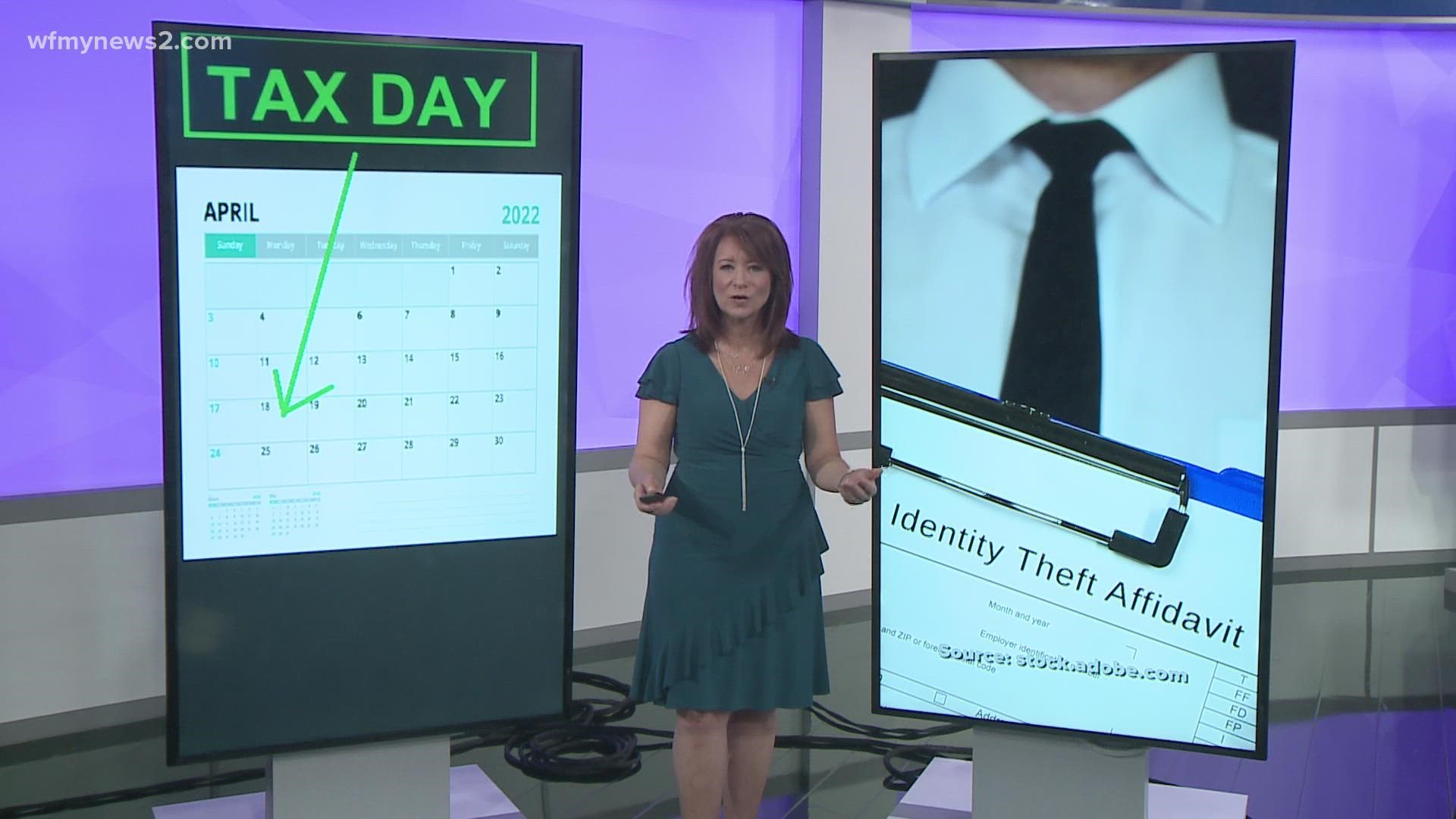

GREENSBORO, N.C. — Five days and counting. Tax Day is Monday, April 18, 2022.

What if you need more time?

You can file for an extension, but remember, filing an extension only gives you more time to get your paperwork in order. If you owe the IRS, you have to pay the IRS on April 18. There is no extension to pay.

Now, what happens if you get all your paperwork together, you fill in all the blanks and the IRS rejects your tax return because it's already been filed?

“Your tax return has already been filed, this usually happens from an identity thief or someone who has access. It's people who have access to your information to try to get a free refund,” said Mark Steber, Jackson Hewitt Tax Service.

When an identity thief gets your social security number and files a fake tax return under your name to collect your refund, you don't even realize it happened until you try to file a return and the IRS rejects it as a duplicate filing.

According to the Federal Trade Commission, in 2021, nearly 6 million Americans filed reports of fraud. Identity theft was ranked as the most common.

If you think someone is trying to steal your tax return, You need to do two things:

Contact the IRS to start the process to straighten things out.

Call your local police department to file an "identity theft affidavit form".

DON'T MISS THE REST OF THE CHILD TAX CREDIT

Last year in 2021, parents got Advanced Child Tax Credit Payments.

Every month from July to December, the IRS mailed out these advanced payments. Those checks made up half of the full credit. Half, which means most parents have more money out there.

“If you are one of the more than 30 million families who have already received the Child Tax Credit, you still need to file your taxes. So that is the only way to receive the second half of what you are owed. So, remember: you are owed more, but you still need to file your taxes,” said Vice-President Kamala Harris.

The total Child Tax Credit is $3,600 per child under the age of six and $3,000 per child ages six to 17-years-old. If you got some of the Advanced Child Payments, the IRS sent letters out to remind you of how much you got last year. You will need to put that amount into your tax form. Don’t have the letter anymore? Create an IRS online account, all your information is there.

The IRS reminds folks, even if don’t normally file taxes, you should file taxes to get the full Child Tax Credit. There are resources to file your taxes for free and for you to check out if you’re eligible for the Child Tax Credit.