GREENSBORO, N.C. — The IRS has a whole list of do's and don'ts, but most people don't pay attention to a long list of stuff. This is why the IRS is turning to this guy in the hopes of getting your attention.

This IRS tweet:

We can't send dragons to protect you. Look out for scams trying to steal your child tax credit payments.

Above the dragon it reads:

If you get an unexpected IRS email prompting you to give up personal or financial info to get your child tax credit payments, don't reply, it's a scam!

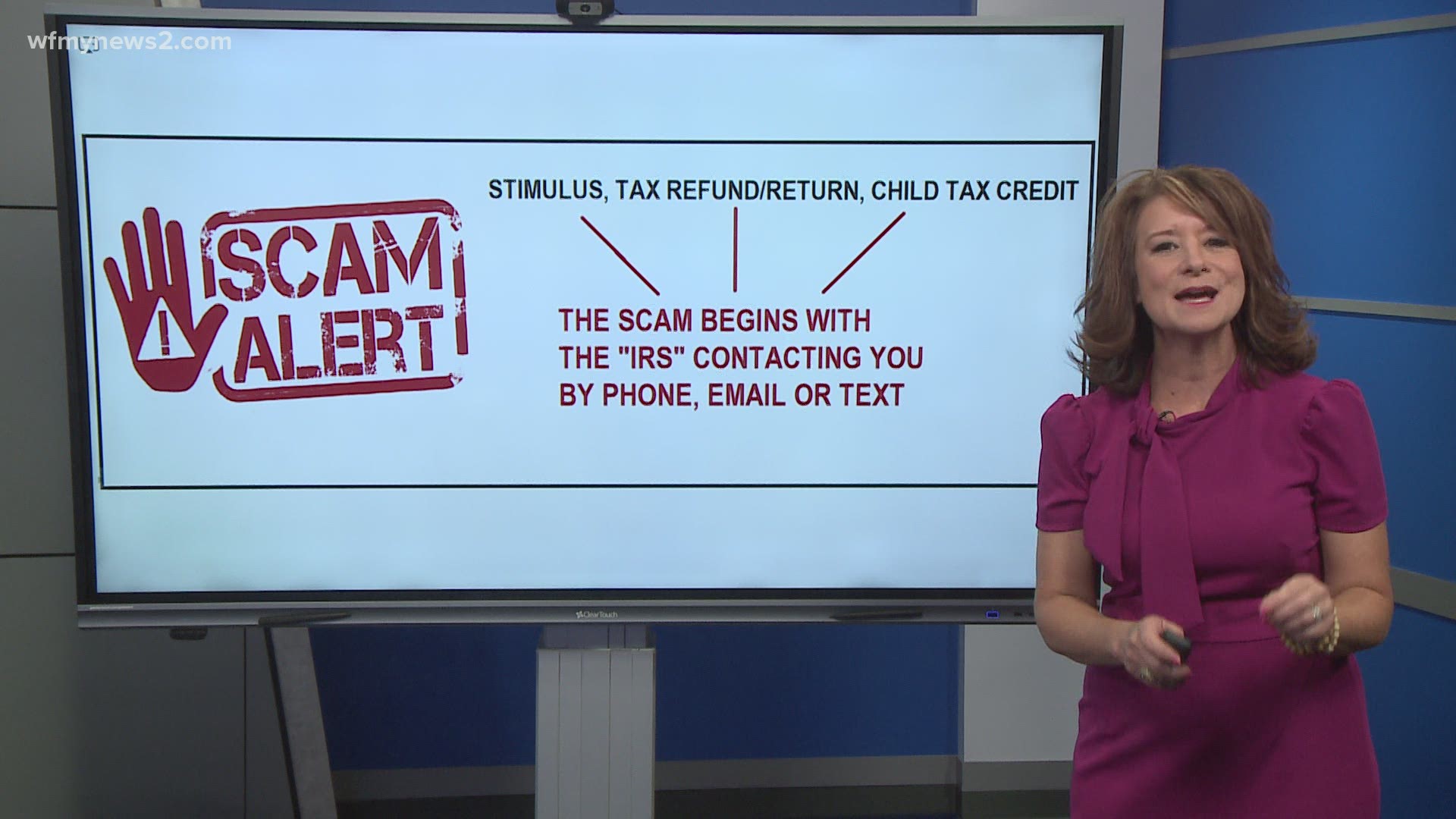

Whether it's a stimulus check, a tax refund, or in this case, the child tax credit, the scams always begin with the "IRS" contacting you by phone, email, or text.

Folks, that is not going to happen.

“We are seeing some scam artists that are contacting the consumers saying we know the IRS is going to send this out, if you send a processing fee, we will get it to you quicker,” said a Better Business Bureau spokesperson.

The IRS is not going to:

Initiate contact with you by email, text, or social media

Leave pre-recorded messages on your voicemail (and any call that claims you're facing a lawsuit or arrest is fake)

Now, what if the message sounds real, looks real and you're scared. I get it. Here's how you know it's not a real call and you're not in trouble.

The IRS will never:

Contact you and ask you to provide or verify any of your financial information so they can get your child tax credit payment for you

Ask for payment with a gift card, wire transfer, or cryptocurrency

As a reminder, the next Child Tax Credit payment goes out on August 13.

The IRS sends the payment automatically, either by direct deposit or by check. You can now change your banking information with the IRS.

The Child Tax Credit Update Portal allows you to:

- Check to see if you're eligible to receive payments

- Unenroll from the payments

- Provide updated information about your bank account information

To use the portal, you will need to sign in or create a new account with IDme. Be sure to have a photo ID ready.

NEED TO MAKE CHANGES TO YOUR ADDRESS INFORMATION?

The portal to do that is expected to be up by early August.

NEED TO UPDATE DEPENDENT, INCOME OR MARITAL STATUS?

The portal to do any of those things is expected by late summer.

When it's up and running and you put in your info, the IRS is expected to send you whatever payments you missed with the next upcoming payment.