GREENSBORO, N.C. — The IRS could be sending you another payment this summer. It's not a stimulus payment, let me explain.

If you filed your 2020 taxes already and you got unemployment income in 2020, chances are you're going to get money back from the IRS. Here's why: the American Rescue Plan allowed taxpayers to exclude up to $10,200 in unemployment benefits from their Adjusted Gross Income (AGI).

Because of that, taxpayers didn't have to pay taxes on that income, but the legislation took effect after many filed returns and paid that tax. So now, Uncle Sam owes you that money back. The refunds will come automatically, you don't have to do anything. The IRS estimates the refunds will start to go out in May and will continue through the summer.

Will the refunds be by check or direct deposit? The IRS didn't say.

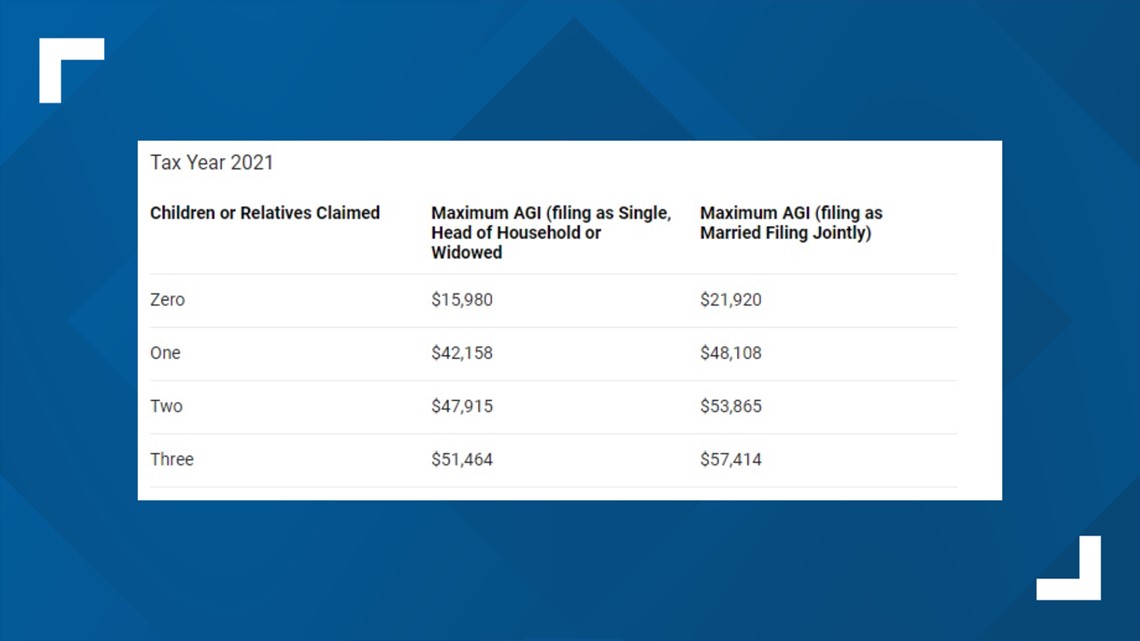

There's one more thing. If excluding your unemployment benefits drops your income enough to qualify you for another tax credit, like the EITC, the IRS isn’t going to calculate that for you and refund you automatically.

“They'll do the calculation to exclude the income and send you that part back, however, if you do qualify for another credit, they are not doing that calculation, you will have to file an amended tax return to get that part done,” said Ryan Dodson of Liberty Tax Service.

Will that affect you? It depends on your new AGI. Here are the maximum incomes allowed.

STIMULUS PAYMENTS FOR SS & SSI BENEFICIARIES

The Internal Revenue Service and Treasury Department announced Tuesday that stimulus checks for Social Security recipients and other federal beneficiaries will be issued this weekend.

While these payments will be distributed in the coming days, the agencies said the majority of the checks will be sent electronically and received on Wednesday, April 7.