GREENSBORO, N.C. — The debt ceiling sounds complicated and with all the yelling about it by politicians, you may tune it out.

But here is what you need to know and this comes straight from the U.S. Department of Treasury.

The debt limit is the total amount of money the US is authorized to borrow to meet its existing obligations, read into that the “bills” we pay on a consistent basis.

We're talking about Social Security, Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.

Chances are you or someone you know to get one or more of these. If the debt ceiling isn't raised, we can't pay for all these things.

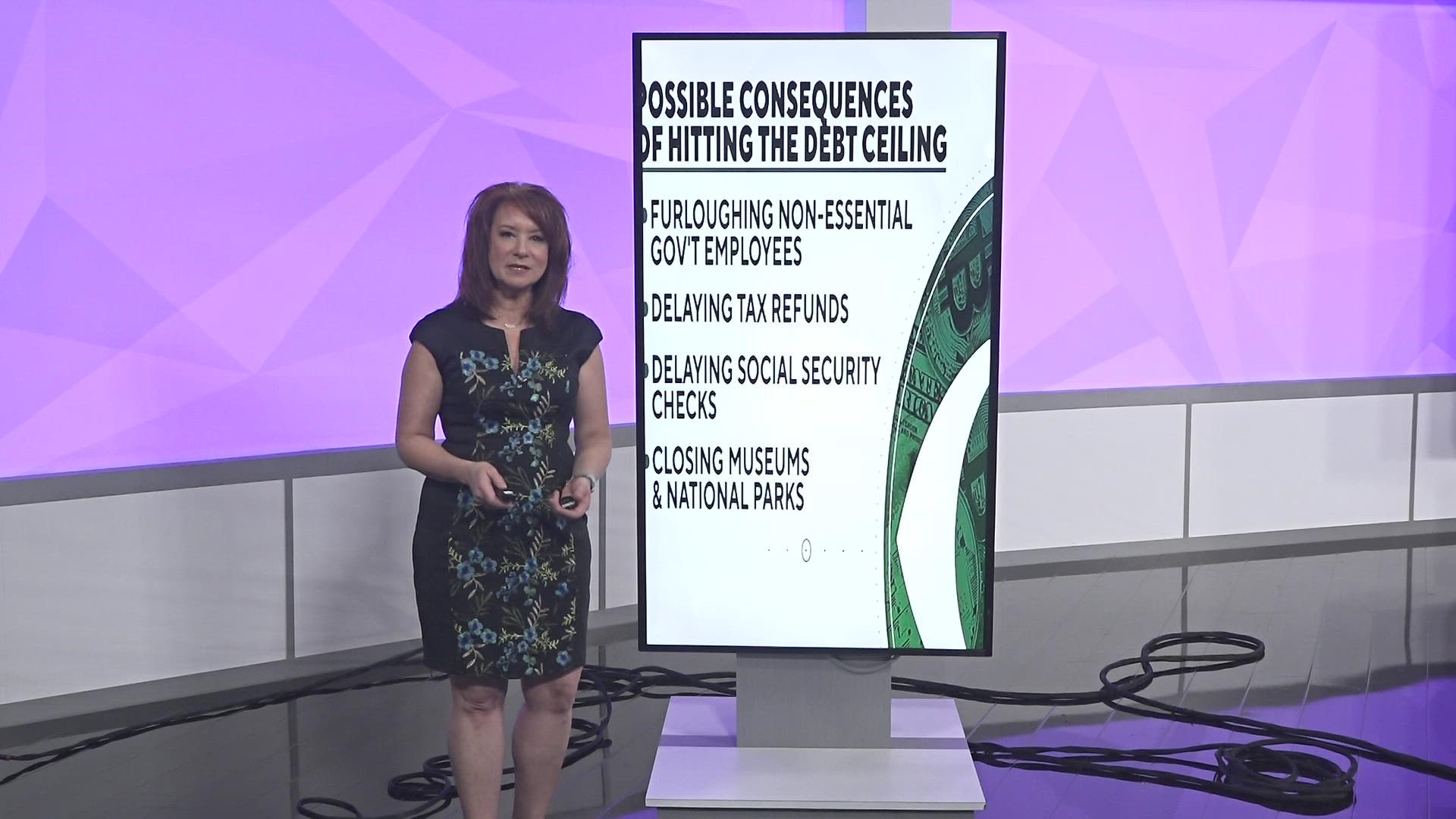

The possible consequences of hitting the debt ceiling include but are not limited to:

- furloughing non-essential government employees

- delaying tax refunds

- delaying Social Security checks

- closing museums and national parks

“When you don't have Social Security checks coming in, not only does it put individuals at risk, it is putting the economy at risk,” said Jill Schlesinger, a Business analyst for CBS News.

To be clear, your social security checks are just fine for now.

These are possibilities if these debt ceiling talks go into the summer and aren't resolved. Looking through information on other debt ceiling issues, even when debt ceiling talks broke down in 2011 and an agreement wasn’t made until late summer, the checks weren't delayed

Right now, the US debt ceiling is $31.4 trillion. It has been raised 78 times since 1960 according to the US Treasury. This back and forth is nothing new, raising the debt ceiling to pay bills is nothing new, and get this, the debt is nothing new.

“When you think about the debt ceiling this is not running of new debt for something we haven't voted on. Congress and previous congresses, Republicans, and Democrats have voted on certain spending measures. Raising the debt ceiling pays for the measures that have already been voted on,” said Schlesinger.