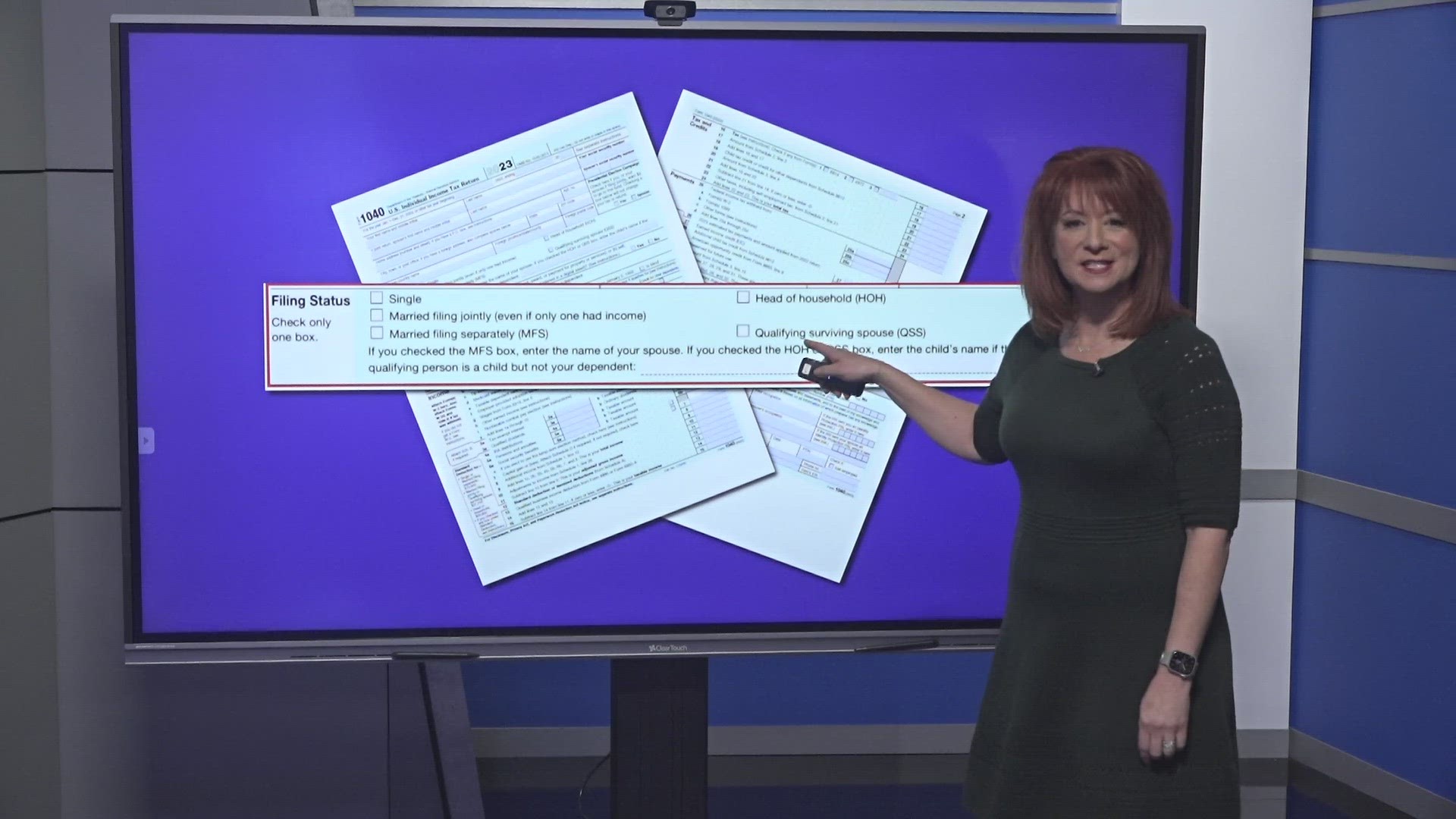

GREENSBORO, N.C. — It is officially tax season. The IRS begins accepting tax returns today, January 29, 2024. While filling out all the money lines may make you nervous, 2 Wants To Know gets more questions about the boxes of Filing Status. Should you file Married jointly or separately? Are you Head of Household or Single? Let's start there.

"With Head of Household, you have to have qualifying dependents versus being single. If you have dependents then you have more tax credits than if you were single," said Kevin Robinson of Robinson Taxes & Accounting Service.

Usually, Married filing jointly is the best option for couples. It usually gives the lowest taxes owed or the biggest refund and all of the tax credits. But if both earn about the same amount of money, filing separately may put each one in a lower tax bracket and therefore be better overall.

It's worth running the numbers both ways just to see how the money comes out. After Filing Status, the next most common question is about dependents.

"You can claim your parent. That will qualify you for Head of Household and a higher standard deduction and lower tax rate and I see that a lot with elderly parents, the child is taking care of that parent," said Ryan Dodson of Stanaland, Dodson & Associates, Certified Public Accountants.

The IRS has an entire page dedicated to questions about caregivers claiming their parents as dependents. Chances are your specific question is answered there.

Tax Day is Monday, April 15, 2024.