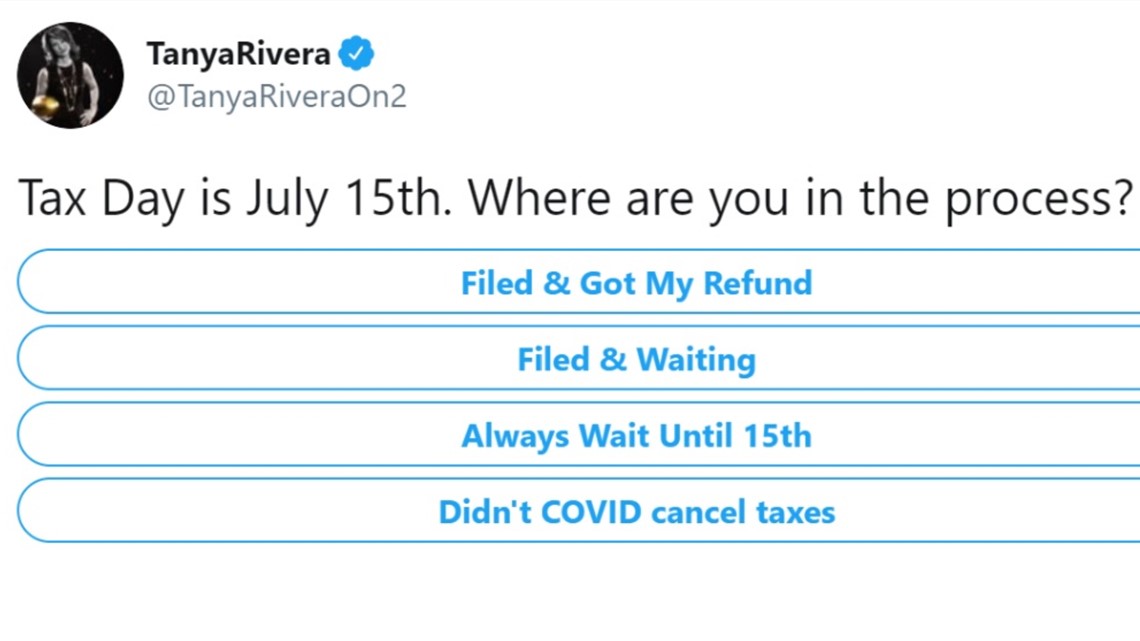

GREENSBORO, N.C. — Tax Day is July 15. Where are you in the process?

I asked folks on Twitter in a poll:

At one time, at least 17% said they thought COVID-19 canceled taxes. While that may have been kind of a joking response, “A lot of folks think you don't have to do much of anything since COVID is out there. Unfortunately, that is not the case,” adds Ryan Dodson of Liberty Tax Services.

RELATED: Is your Covid-19 relationship real?

You can file for an extension, but the extension only covers the paperwork of taxes, if you owe money, you'll still need to pay it by the July 15 deadline.

Now, the extension form will reveal you have six months, but the IRS is clear, you have a six-month extension from the April 15 deadline, not the July deadline. That means that everything is due October 15. You'll need Form 4868.

A lot of the free one-on-one tax helps are not happening this year.

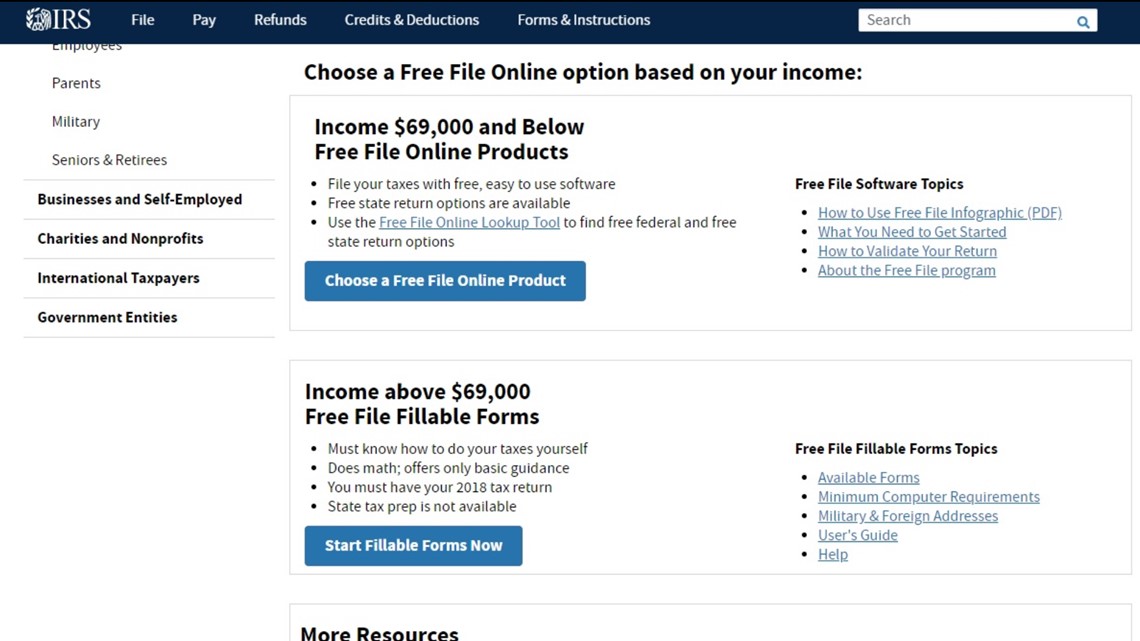

But the IRS offers free on-line tax forms and products you can use -- depending on your income.

Now, if you're looking to have a tax preparer do it but you're squeamish about meeting them face to face -- there are virtual appointments.

“If anyone is not comfortable coming in, we offer a virtual tax prep where we set up a portal, only you know the password and exchange your tax documents and go through the return to signing to the IRS,” explains Dodson.

Liberty Tax is one of several tax preparers that are offering this type of virtual service. The key here -- a portal with a password to keep your information safe.