GREENSBORO, N.C. — Tax Day is Tuesday, April 18, 2023. 2 Wants To Know answers the questions:

What happens if you don't file on time?

How does the IRS payment plan work?

“If you don't file your taxes, and you owe, you'll pay interest on any money you owe. There are two separate types of penalties for failure to file, a failure to file penalty which goes up to 25% of the unpaid tax as well as late payment of the tax. So, you basically have a lot of money that you'll be paying on top of the tax,” said David Ragland, Certified Financial Planner, and CEO of IRC Wealth.

That all just sounds like a whole bunch of money and a big headache. So, let's go the route of filing a return and knowing you owe money, but can’t pay it.

IRS PAYMENT PLANS

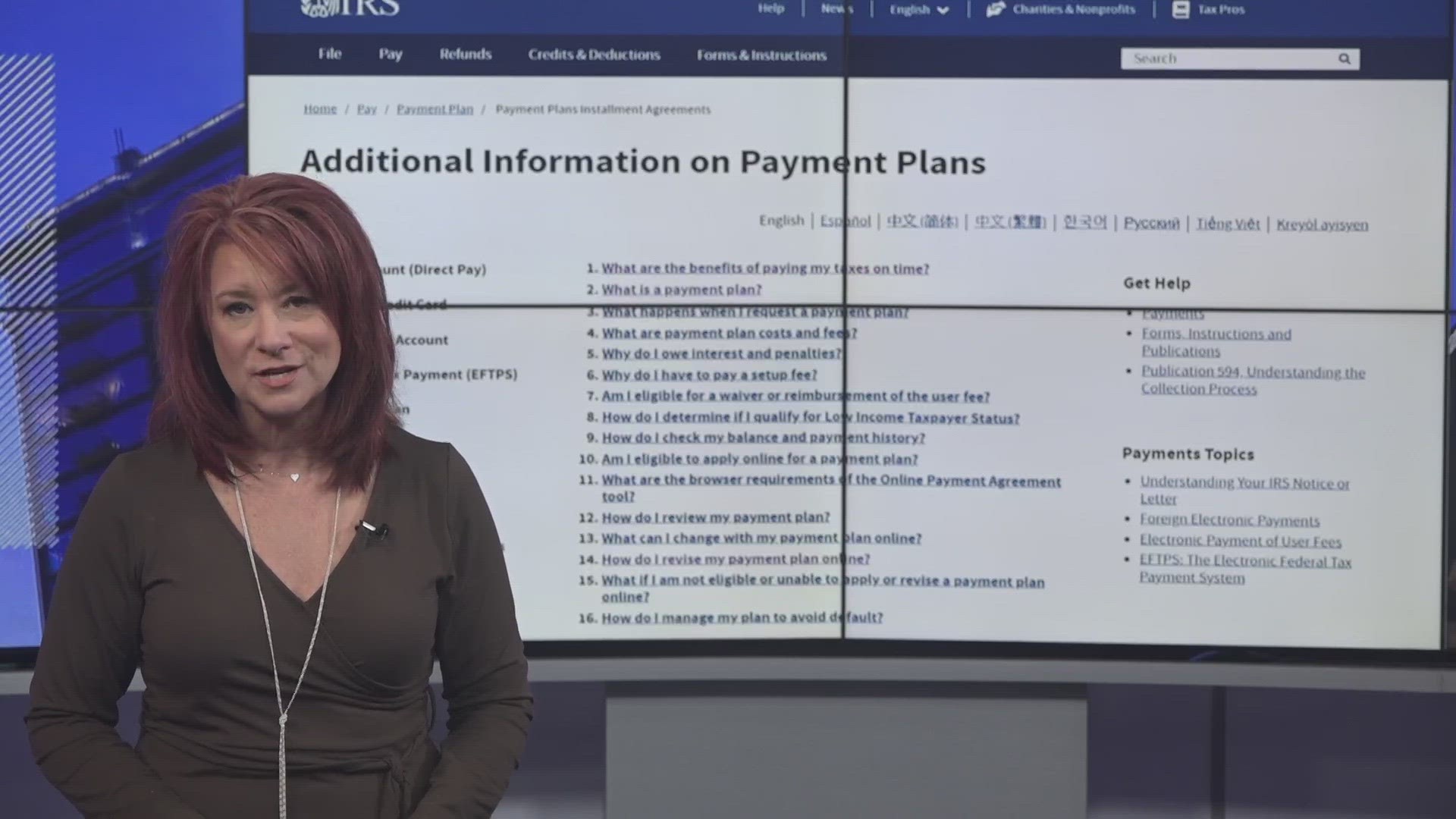

The IRS has Short-Term (180 days or less) and Long-Term payment plans. The Short-Term plan has no set-up fees, but the Long-Term plan has several fees attached to it.

The IRS webpage answers 16 frequently asked questions. One thing not in these questions is how the IRS determines how much you pay each month.

“They go through your income and assets and determine what a reasonable payment is. They're not going to take every single dollar coming in,” said Ragland.

Before Midnight, Tuesday, April 18. That's the deadline for all electronic filing. If you insist on a paper return, the Post Office does not stay open late on Tax Day.