GREENSBORO, N.C. — The Biden-Harris Administration is offering student loan relief for 804,000 borrowers, totaling $39 billion in loan forgiveness. The measure is a result of fixes to income-driven repayment plans for borrowers who've submitted payments over the years.

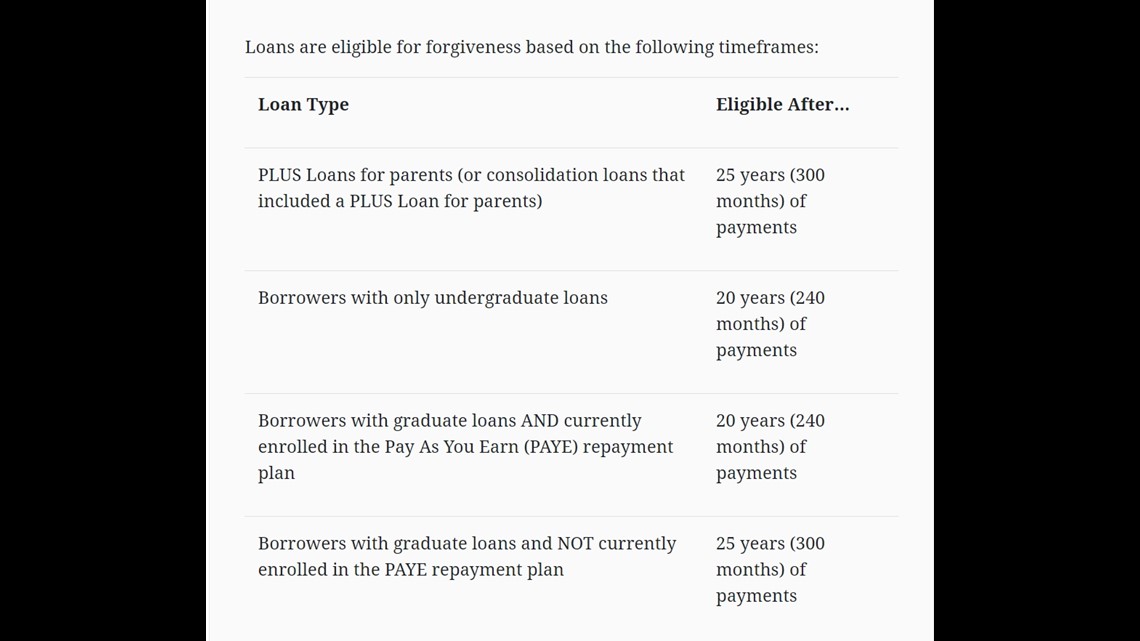

The first group of eligible borrowers was informed by the Education Department on July 14, 2023, that they have loans that qualified for forgiveness. No further action is required from these borrowers to get this forgiveness. ED will continue to identify and notify borrowers who reach the necessary forgiveness threshold of 240 or 300 months’ worth of qualifying payments, depending on the repayment plan and type of loan. Student loan servicer(s) will notify people directly after the forgiveness is processed. Make sure to keep contact information up-to-date with the servicer and on StudentAid.gov.

Who This Is For:

on an income-driven repayment (IDR) plan or were on one in the past;

in the Public Service Loan Forgiveness (PSLF) program; or

not on an IDR plan but are interested and have Direct or Federal Family Education Loan (FFEL) Program loans held by the U.S. Department of Education (ED).

Federal Student Loan Repayment

For a more comprehensive understanding of the federal loan repayment options available under this initiative, it's beneficial to explore the Federal Student Aid website. The website offers a detailed breakdown of the various repayment plans, including income-driven plans like Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans cater to different income levels, family sizes, and financial situations, ensuring that borrowers can select the one that aligns with their circumstances.

In addition, the website emphasizes that borrowers should explore all available repayment options before making a decision. It provides clarity on the pros and cons of each plan, enabling borrowers to make informed choices that suit their financial realities. This is crucial, as selecting the right repayment plan can make a significant difference in managing student loan debt effectively.