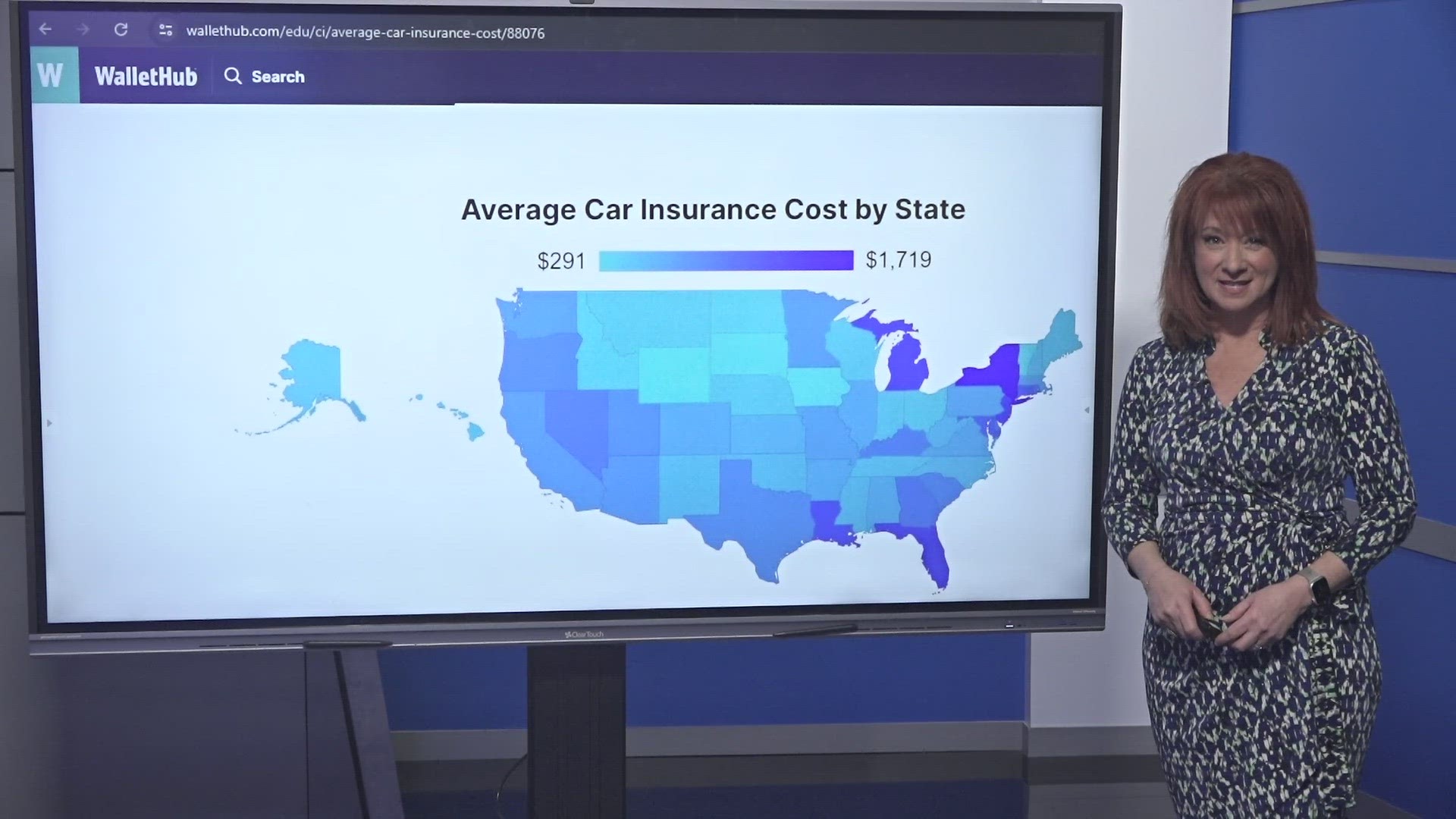

GREENSBORO, N.C. — It's not your imagination, the cost of car insurance is going up. Most folks are seeing an increase of several hundred dollars from the year before.

According to this WalletHub map showing the comparisons of auto insurance rates nationwide, we're in lighter blue, which means less expensive than many other parts of the country. But try telling that you your wallet, right?

Before you start shopping around it's helpful to know how insurance works so you'll have a better idea of what you need. The easiest way to shop around is online, just so you can get an idea of what the price point should be.

“It’s always important to obtain quotes from 3 insurers to make sure you have the best rates for your circumstances, so take that extra time to compare,” said Cassandra Happe, WalletHub Analyst and Communications Manager.

Once you have a baseline, contact a local agent as well. Talking to a human can help answer coverage questions.

The monthly cost or the yearly cost can sometimes bring sticker shock. A common question from drivers is, can I get a lower premium if I raise my deductible? Before you do that, here's what you need to think about.

“There are pros and cons to changing your deductible. It's a good way to save money on your monthly premiums, and money in the long run if you don't have a lot of claims, but keep in mind, if you have that higher deductible you need to be prepared to comfortably afford that out of pocket expense that you're still liable for,” said Happe.

It's all a trade-off. Price versus the value of what you're getting, how you're covered, or not covered. And while the bottom line may seem like the most important thing when you're looking at the bills you have, here's a quick warning.

“It's great to save a few dollars but you don't want to save those dollars and then not have the support you need when you need to cash in on that. Look beyond the rates customer service is important, so keep that in mind,” said Happe.