GREENSBORO, N.C. — Back to school usually means spending money, from pencils to markers, loose-leaf paper, binders, and hand sanitizer, it all adds up.

Did you know these school supplies can be a tax deduction--- whether you're an educator or a parent?

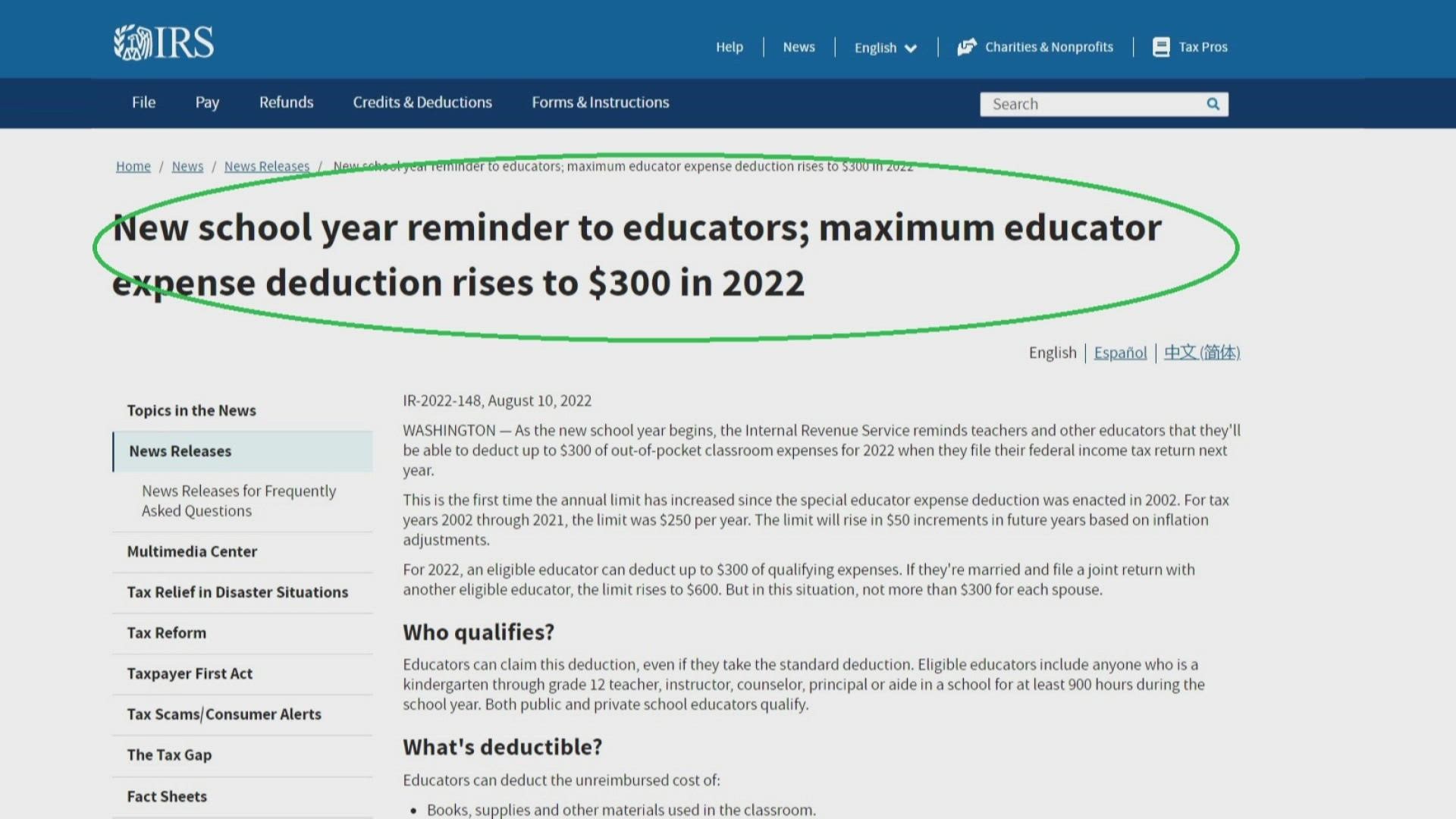

This 2022 tax year, educators can deduct up to $300 of their out-of-pocket classroom expenses. Last year it was $250.

Educators are described by the IRS as K-through-12 teachers, instructors, counselors, principals, or school aides. This is for both public and private schools.

“The IRS gives them this deduction regardless of whether or not they itemize or not. Keep any receipts for any supplies that you're not getting reimbursed from and when you go to file your tax return, make sure you claim it on your tax return,” said Ryan Dodson, Liberty Tax Services.

Deductible school supplies include everything from books, computer equipment, software, and COVID-19 items like gloves, sanitizer, and even the tape, paint and chalk you use to mark off social distancing spots.

Parents, I know you have a list of school supplies to buy. Some of them are tax deductible too!

“This is one of my favorite tax deductions, if you're a parent and you itemize your taxes and you do donate school supplies to your teacher's class, then yes, you can take that as a deduction on your tax return,” said Dodson.

Here's the catch, the school supplies can't be for just your child, the supplies have to be for the entire room to use. This deduction only works if you, the parent, itemize deductions on your tax return.