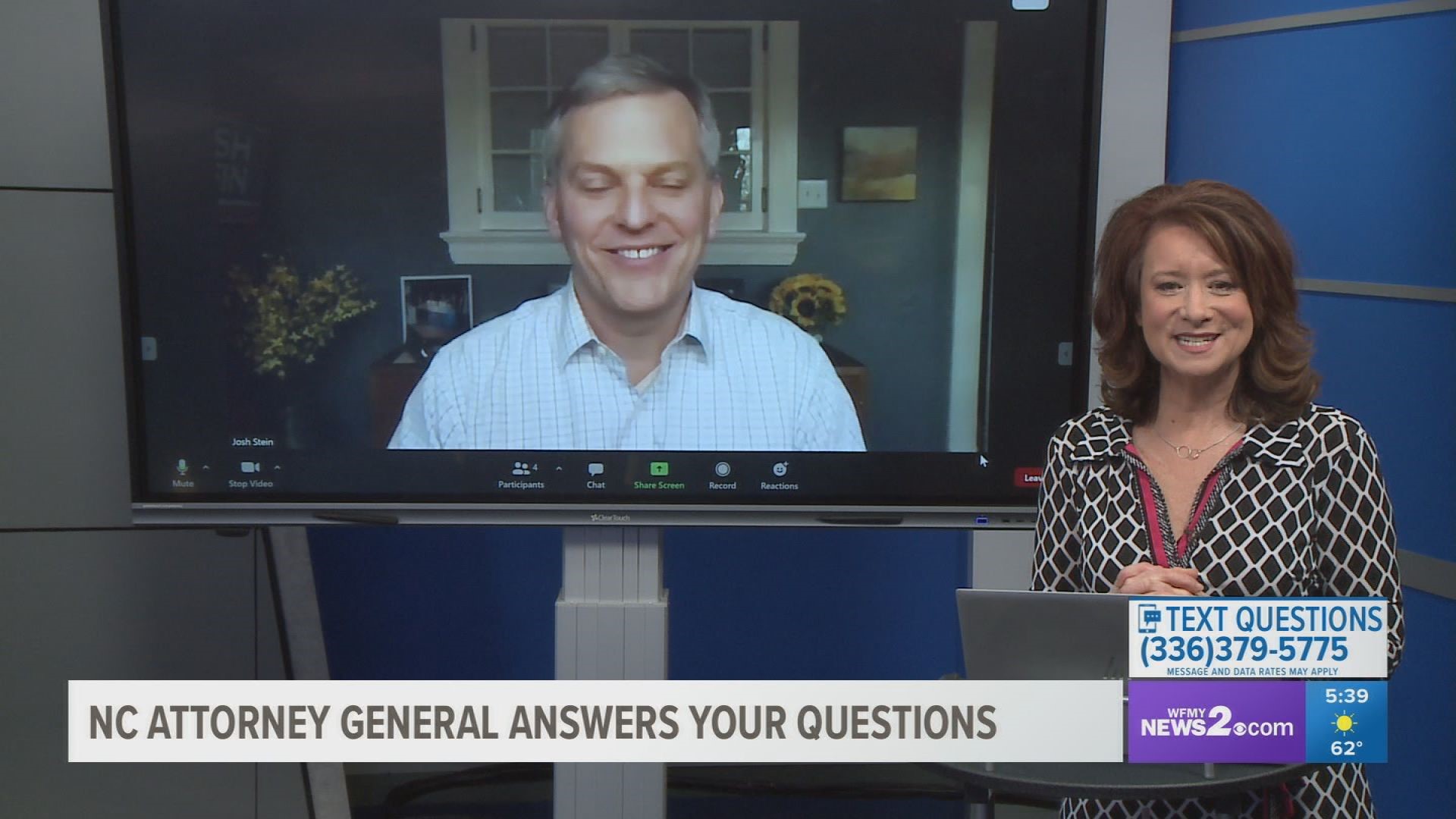

GREENSBORO, N.C. — In 2020, the Consumer Protection Division of the North Carolina Department of Justice received 31,019 consumer complaints. More than 10,000 of them were robocall and do not call complaints. Since so many scams originate through robocalls, Attorney General Josh Stein created the Robocall Report Task Force and asked North Carolinians to report robocallers through a detailed web form (www.ncdoj.gov/norobo) and dedicated robo-report hotline (1-844-8-NO-ROBO). While robocalls and illegal telemarketing calls can be hard to track down and stop, these robocall reports help them identify patterns in scams that they can use to warn consumers about and help them work with state and federal partners to identify technological solutions to stop people from getting these calls.

DON'T FALL FOR FAKE COVID-19 VACCINE SCAMS

Here’s what you should know about these fake vaccine offers and scams:

- Beware of counterfeit vaccines or miracle cures. There are currently only two COVID-19 vaccines authorized for use in the United States – the Pfizer-BioNTech and Moderna vaccines. If other vaccines are approved by the FDA, they will be listed here. Scammers may try to sell you a trafficked or counterfeit vaccine – avoid them by ensuring that you schedule your vaccine appointment through a legitimate provider. Find local vaccine providers through the North Carolina Department of Health and Human Services website.

- Vaccines are free, even if you don’t have insurance. If you’re being offered a vaccine for a fee or at a “very low” price, it’s a scam. Vaccines cannot be purchased. Some scammers may reserve several appointment slots at once, and then try to sell them to the highest bidder. You should not pay for any appointment – don’t give these scammers your money or your personal data.

- Don’t believe claims of “miracle cures” or new treatments that will protect you from COVID-19. If it sounds too good to be true, it probably is.

- You cannot get the vaccine before it’s your turn and do not pay anyone to move up in the line. North Carolina is currently vaccinating through a phased group approach based on public health guidance to protect those most at risk. You can find your vaccine group here.

- If you are a health care provider or work for a health care facility, be skeptical of out-of-the-blue offers to vaccinate residents, staff, and patients from people or organizations you’re not familiar with. Vaccinations should be coordinated through public health and government bodies.

- Safeguard your vaccine card data. These cards are to help you track your vaccination, and they contain personal information. If you post pictures of them online, it’s easier for scammers to steal your information and commit ID theft, or to create their own fake vaccination ID cards. Instead of sharing your vaccine card, consider sharing your vaccine stickers/buttons or other social media features instead.

- If you’re registering to get a vaccine, make sure the website or link you are using is legitimate. You can verify by calling the health department or provider or by searching for the link independently online. Look for the lock icon and a URL beginning with https in the address bar. If a link is asking for your bank account, Social Security, or credit card numbers, don’t share them – it’s a scam.

DON'T FALL FOR TAX SCAMS

Be very careful about how you share your tax-related information, and follow these tips to avoid scams:

- Verify that the message is authentic. If the sender is someone you know, call them and confirm that they actually sent the message. If you’re not familiar with the sender, don’t respond and report the email to your company’s IT department and to the FBI’s Internet Crime Complaint Center.

- Beware of scammers posing as the IRS and demanding tax payments over the phone. If you get a call from someone claiming to work with a government agency, chances are he or she is a crook. Unless you have received written communication from the IRS that outlines your tax debt, the IRS is unlikely to call you to collect. Ask them for the caller’s name and identification number. Then, hang up, look up the agency’s telephone number and call the agency directly to confirm the information. Also, if anyone demands you make immediate payments using gift cards, money orders, or wire transfers, hang up the phone – it’s a scam.

- Guard your personal information. Identity thieves can use your Social Security number to take out loans, open credit cards or even collect your tax refund. Remember, email is vulnerable to hackers, so avoid emailing your Social Security number or other confidential information to a tax preparer or accountant. If you’re using a website to file your taxes, make sure your information is secure by looking for the lock icon on the address bar.

- Watch out for tax refund thieves who file returns in your name and collect your money. If you receive a notice or letter from the IRS indicating that more than one tax return was filed in your name, respond immediately to the IRS employee whose contact information was provided.

STEIN URGES BIDEN TO ACT ON STUDENT LOAN RELIEF

Attorney General Josh Stein is urging President Joe Biden to take action to reduce the burden of student debt, which has become even greater for student borrowers and their families during the COVID-19 crisis. Attorney General Stein encouraged President Biden to reduce student debt, including canceling some debt where it's lawful and appropriate.

“The federal student loan program is fundamentally broken and has failed many students in a number of ways,” said Attorney General Josh Stein. “The issues facing student borrowers have been exacerbated by the current pandemic and economic downturn, which makes the job market bleak. They are in dire need of relief. I know this is a priority for President Biden, and I urge him to act on their behalf as soon as possible.”

In his letter, Attorney General Stein points out several ways students have been harmed by the federal student loan process:

- Students promised loan forgiveness in exchange for working in public service have found it nearly impossible to see that release – less than 2 percent of applicants’ loans have been forgiven.

- Loan servicers hired by the federal government have inappropriately steered many students into programs that have made things worse for them and increased the amount of their debt.

- Students who were defrauded by for-profit colleges find it difficult, if not impossible to have their student loans discharged through the federal process that is supposed to provide relief.

It is estimated that 40 percent of recent student borrowers who have debt have no degree to show for it, which significantly hinders their ability to pay.