GREENSBORO, N.C. — You save for retirement so that when you need the money, you have it to spend the way you want to.

Did you know the government requires you to take a certain amount of money out of your 401K or IRA when you reach a certain age?

The IRS page on Required Minimum Distributions, or what's called RMDs says:

You cannot keep retirement funds in your account indefinitely. You generally have to start taking withdrawals from your retirement accounts when you reach 72 years of age (or 73 depending on your birthday).

“The IRS allowed you to withhold paying taxes on those accounts, they grew tax-deferred, part of the deal was when you hit that age, you have to take the money out and start paying taxes,” said Scott Braddock of Scott Braddock Financial.

There is a list of retirement plans this rule impacts. It impacts everything from traditional IRAs to 401Ks, designated Roth IRAs have different rules.

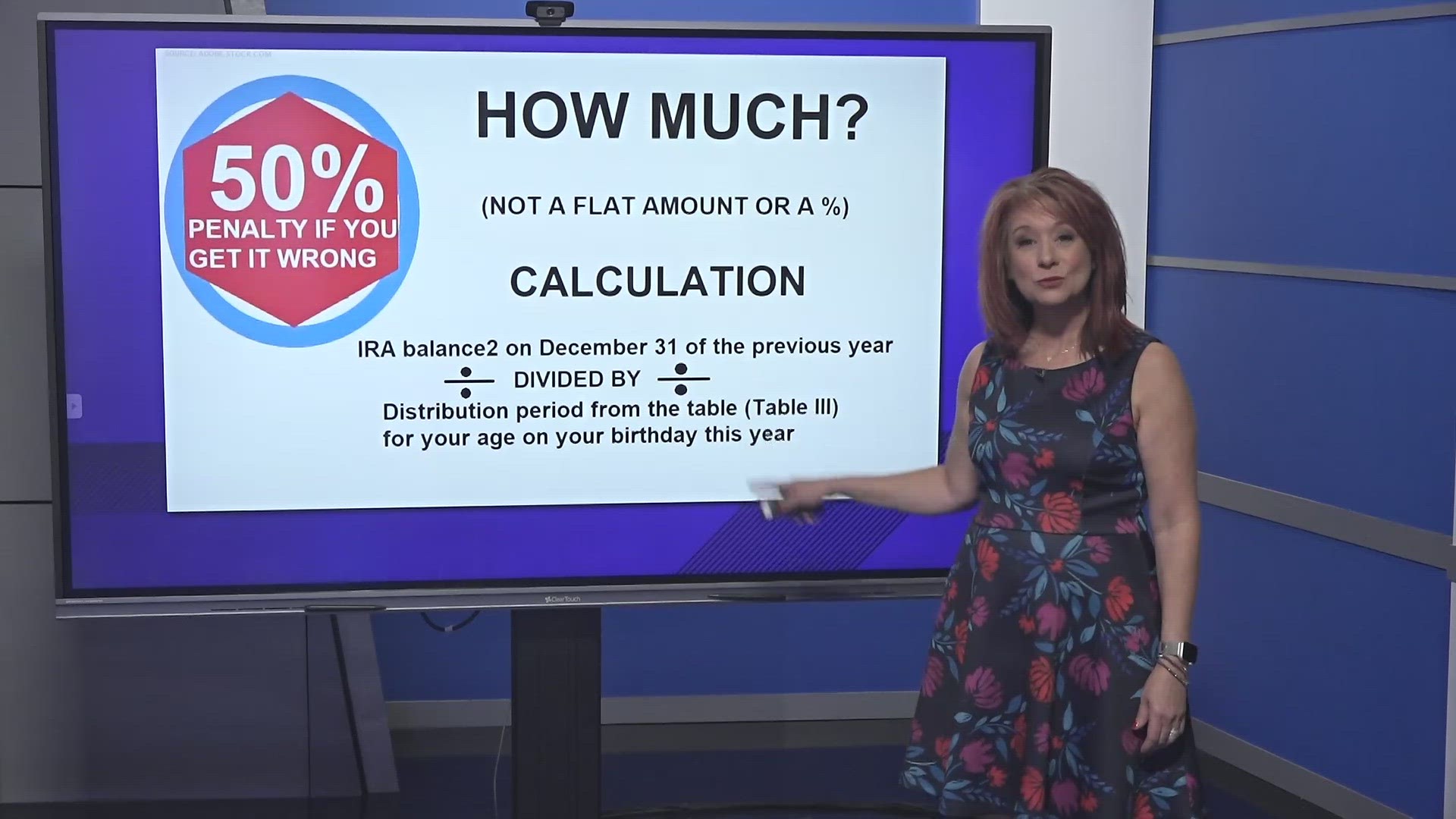

Now the question you're asking is, how much do you have to take out? It's not a flat amount, it's not a percentage. It's a calculation that you have to look up an IRS table to figure out. If you get it wrong, there's a 50% penalty.

“The good news is the companies that house your qualifying accounts or are by law required to tell you exactly how much you need to take out,” said Braddock.

Thank goodness, right? Braddock has a few strategies for how to make these required minimum distributions work for you.

Braddock’s strategy for IRAs:

If you have multiple IRA accounts and let's just say you have three for example and each one says you have to take out $10,000, there's a strategy where you can take out $30,000 from one account and leave the other two alone.

The only nuance there is if it is a 401K, you have to take the distribution from the 401K, there's no way around it.

PAYING TAXES ON YOUR RMD

“You're going to pay taxes on that RMD. If you don't spend it, chances are you'll put it somewhere where you'll have to pay taxes on it once again,” said Braddock.

One way to lessen that is to put the RMD into an account and make all your charitable contributions from that account so you can then write it off, and take it as a deduction on your taxes.