GREENSBORO, N.C. — You could soon have a couple of hundred extra dollars in your bank account thanks to the Advance Child Tax Credit.

The IRS will make the first payment to parents on July 15. Most families will get the money through direct deposit. A mailed check is the second form of payment.

You can expect $300 for each child under the age of 6 and $250 for each child ages 6 to 17 years old. The payments will come every month on the 15th, except for August, that payment will be August 13.

Parents are getting these payments due to a move by Congress. The Child Tax Credit is on the 2021 tax forms. Parents can claim $3,600 for each child under the age of 6 years old and $3,000 for children 6 years to 17 years old. Lawmakers are allowing for half of the credits to be given in advance to help with COVID hardships.

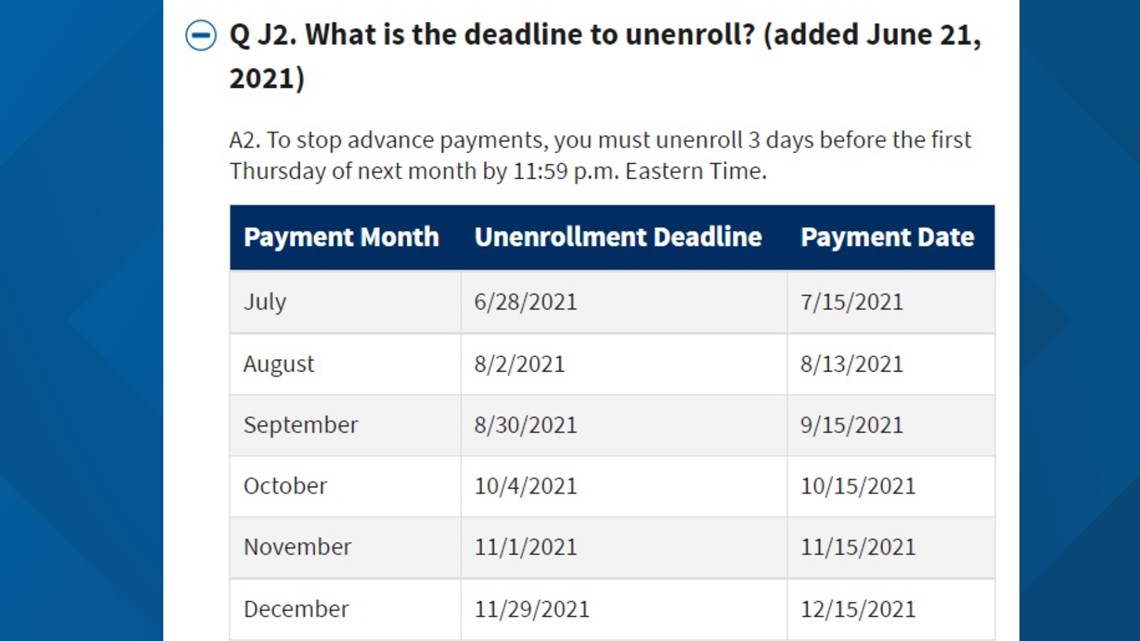

You can unenroll or opt-out of the payments at any time. At this point, you only have to unenroll once, but if you unenroll it could take several months for you to be able to re-enroll and begin payments again.

If you opt-out or unenroll, you will claim the full credit during tax time.

To unenroll or opt-out, you use the Child Tax Credit Update Portal.

This portal also allows you to give the IRS your banking information or new banking information to make sure the direct deposit goes to the right account.

If you need to make changes to your address, make changes to the number of dependents, marital status, or income, the IRS has a timeline out for those portals, which is later this summer.

Do you have to do anything to get this? No.

It's automatic, but if you are a non-tax filer, the IRS just created a tool for you to put your info in so your direct deposit or check is not delayed.

Who Should Use This Tool

Use this tool to report your qualifying children born before 2021 if you:

- Are not required to file a 2020 tax return, didn’t file one and don’t plan to; and

- Have a main home in the United States for more than half of the year.

Also, if you did not get the full amounts of the first and second Economic Impact Payment, you may use this tool if you:

- Are not required to file a 2020 tax return, didn’t file and don’t plan to, and

- Want to claim the 2020 Recovery Rebate Credit and get your third Economic Impact Payment.

Do not use this tool if you:

- Filed or plan to file a 2020 tax return; or

- Claimed all your dependents on a 2019 tax return, including by reporting their information in 2020 using the Non-Filers: Enter Payment Info Here tool; or

- Were married at the end of 2020 unless you use the tool with your spouse and include your spouse’s information; or

- Are a resident of a U.S. territory; or

- Do not have a main home in the United States for more than half the year and, if you are married, your spouse does not have a main home in the United States for more than half the year; or

- Do not have a qualifying child who was born before 2021 and had a Social Security number issued before May 17, 2021.