GREENSBORO, N.C. — Expect to see rate increases for both your auto and homeowners' policies. Supply chain issues and inflation have caused companies to raise their rates.

To help you understand why this is happening, we spoke with Christopher Cook from Alliance Insurance Services.

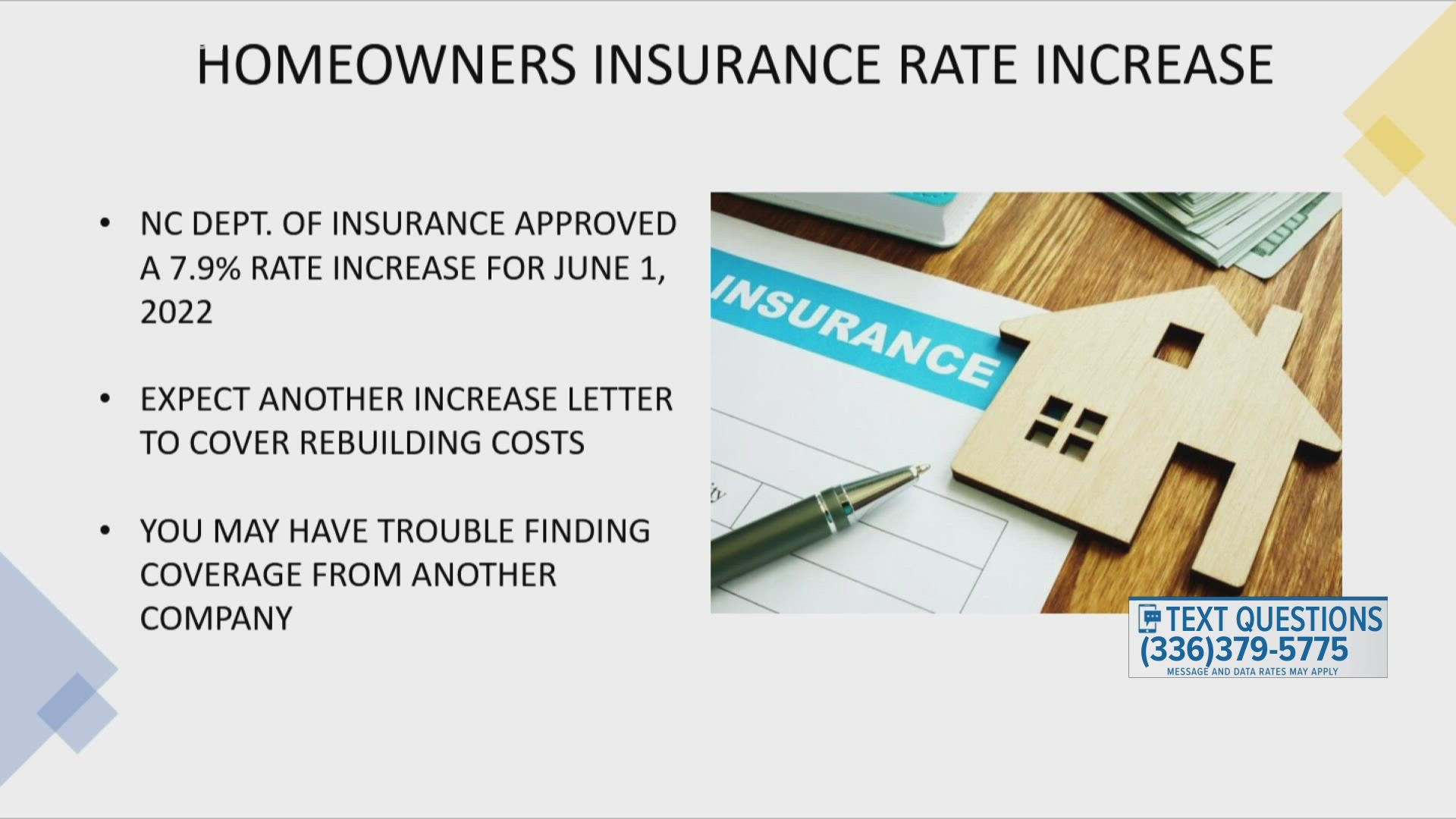

The NC Insurance Commissioner approved an average of 7.9% increase instead. The new rates kick in on June 1, 2022.

You're about to get an increase, twice. You have this increase coming in June of this year and right now, the cost to rebuild your house if something were to happen, has increased due to supply chain issues and inflation, which means you need more insurance on your house.

Be prepared for two increase letters. You'll get one now about upping your insurance to meet rebuilding costs and another in the summer.

There's no good time to get into a car accident, but now with a chip shortage and a global supply chain issue, your auto insurance could be affected in ways you never thought about.

The cost of repairs is up. The fix rate speed is down. That trickles down to more days your insurance pays for a rental car for you. In the end, premiums go up to cover all the extra costs.

An insurance adjuster normally deems a car a total loss if the cost to repair the car exceeds 70% of the value of the car. With the increase in repair costs and parts, the chip and shortage situation sets up for more cars to be totaled.

If you bought a car within the last 2 years, you can consider adding Purchase Price Guarantee Coverage. According to Auto-Owners Insurance, this policy ensures you'll be compensated for the higher price if you have to purchase another car.