GREENSBORO, N.C. — Millions of Americans are still without jobs nearly a year into the pandemic. Since March 15, 2020, the North Carolina Department of Employment Security has paid out $9,168,251,850 in unemployment benefits.

Last month, President Donald Trump signed a second $900 billion coronavirus relief bill to get money into the pockets of struggling Americans. Renewed unemployment benefits were a part of that package, including an additional $300 a week.

North Carolina DES has begun releasing those benefits to some eligible claimants. Eligible claimants will begin to receive an additional $300 a week in Federal Pandemic Unemployment Compensation (FPUC) for the week that ended Jan. 2, 2021. It's important to note, the $300 goes to everyone who is collecting unemployment for any reason, not just because of the pandemic.

DES is still waiting on the U.S. Department of Labor to give guidance before fully implementing additional federal unemployment benefits. The remaining guidance includes information for those who previously exhausted their benefits.

How long will the benefits last?

Under state law, the number of weeks an individual may receive state unemployment insurance benefits depends on the seasonal adjusted statewide unemployment rate that applies to the time period when the claim was filed. Therefore, people whose claims are effective on or after Jan. 3, 2021, may receive up to 16 weeks of state unemployment insurance benefits. People whose claims were effective prior to Jan. 3, 2021, may receive up to 12 weeks of state unemployment insurance benefits.

Claimants to Receive 1099-G Forms By Jan. 31

All individuals who received unemployment benefits during 2020 should receive an IRS Form 1099-G from the Division of Employment Security. This statement reports the total amount of benefits paid to the claimant in the previous calendar year for tax purposes.

All claimants are notified by DES when filing a claim that unemployment benefits are taxable income and must be reported on federal and state tax returns. Claimants may elect to have state and/or federal taxes withheld from their benefit payments. 1099-G forms will be delivered by Jan. 31 to claimants by mail or email, as preferred by the claimant, and will also be available to download through their DES online account.

Wake Forest Law Pro Bono Project

Not only can you get help, but you help students increase their legal skills as they work with you. That's what the Wake Forest Law Pro Bono Project is all about.

Wake Forest University School of Law students, working under the supervision of faculty members, will offer guidance and consultation to North Carolina residents who have questions about unemployment insurance and federal supplements. There is no charge for the service.

Not only can you get help, but you help students increase their legal skills as they help you.

Preparing for a new job

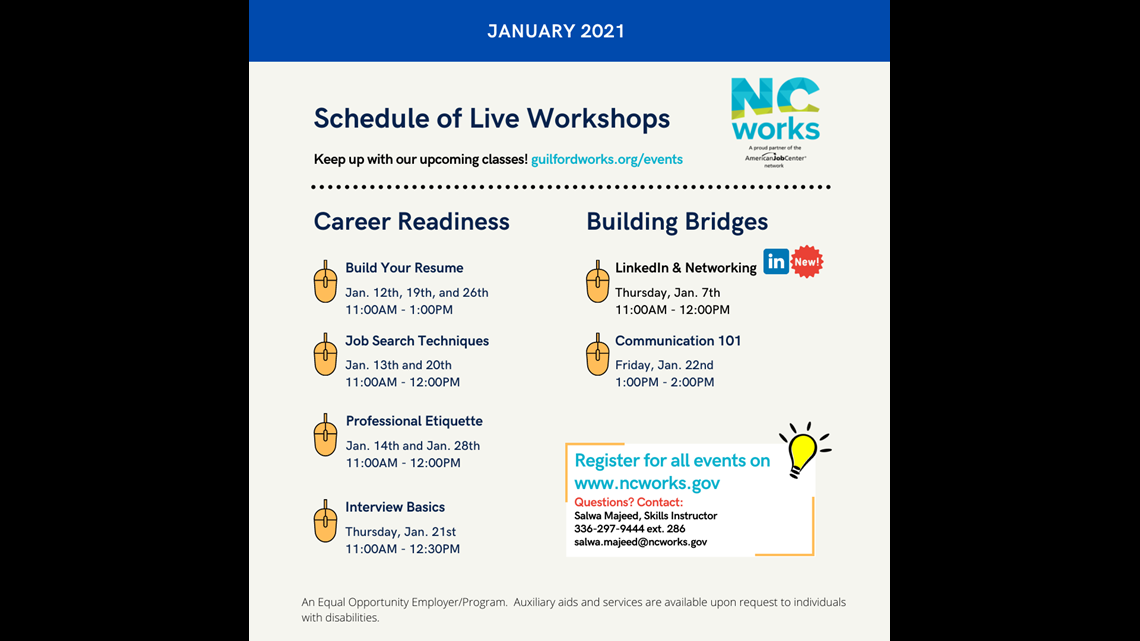

As more people try to get back on their feet, NC Works wants to help.

There are several live workshops coming up to help you building your resume, learn the basics of interviewing and professional etiquette, as well as job search techniques. All classes are free, but you must register at www.ncworks.gov.