GREENSBORO, N.C. — As if 2020 wasn’t enough, now the taxes for 2020 are just as frustrating.

UNEMPLOYMENT INCOME

The Federal Government is allowing you to waive the first $10,200 of unemployment income on your Adjusted Gross Income (AGI).

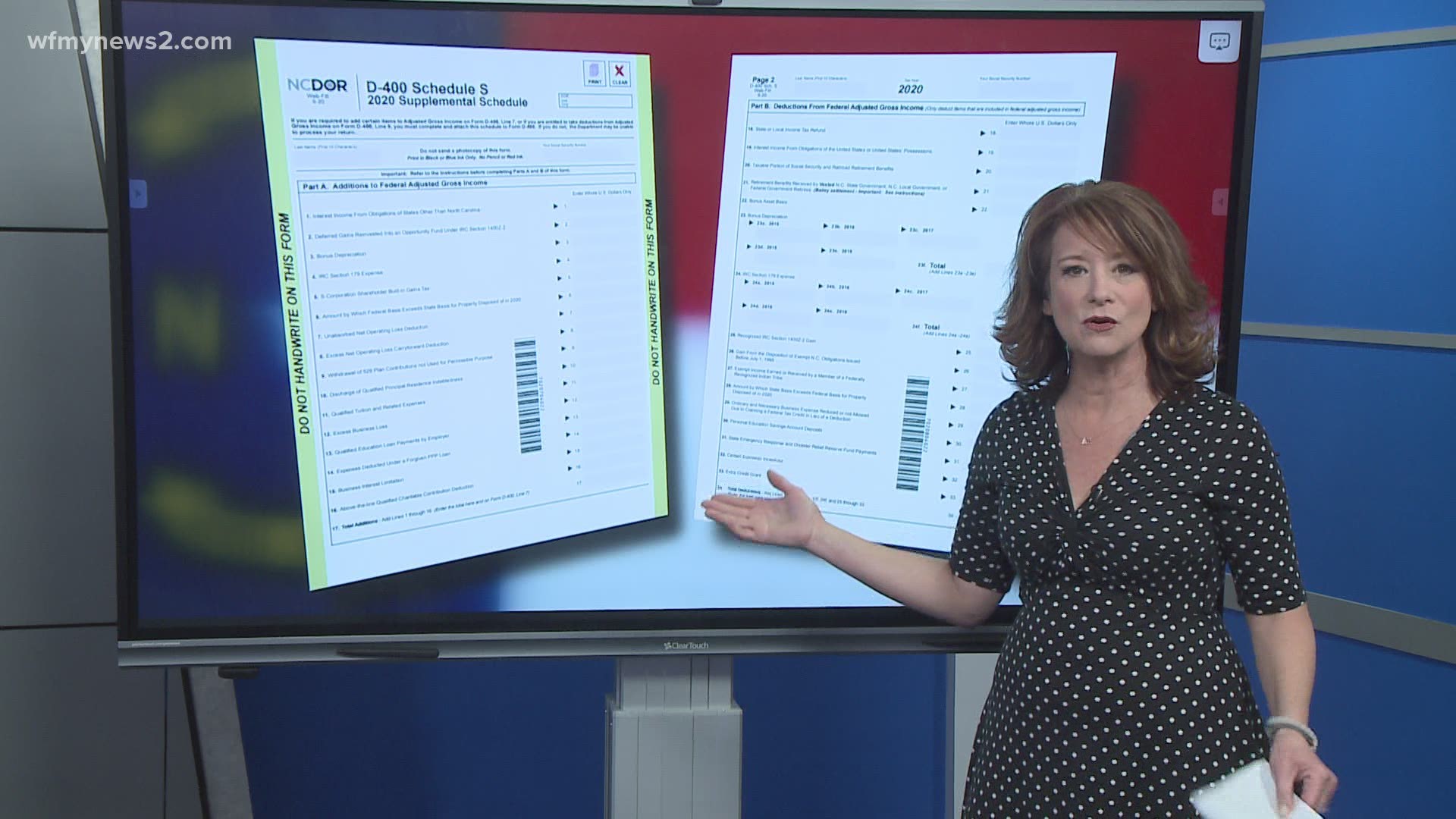

The state of North Carolina is not. You'll have to add that income back in on your state return. To make it all right in the state's eyes, you'll need a D-400 Schedule S and a worksheet. The two will help you add in the unemployment income the feds are waiving so you pay taxes on all the income. Without these forms, the state could deny your return.

The good news is most tax companies, like TaxSlayer, have updated their software.

TAKE BACK THAT CHARITABLE CONTRIBUTION!

Line 16 in the D-400 Schedule S form calls for you to list Above-The-Line Qualified Charitable Contribution.

This year, the Federal Government is allowing you to write off up to $300 in charitable contributions, without you having to itemize. Again, North Carolina isn't following the feds and you have to add that contribution back into your AGI as if you didn't give it.

HOW TO E-FILE FOR FREE

If you earn less than $69,000 a year, you can use the "Free File" software. TurboTax, H&R Block, and TaxSlayer are a few of the "Free File" partners. In 2021, there are 10 products to choose from.

To ensure you won't be charged, it's important to access the software through the IRS' website. Using the tools through other means, including searching online or using an account you set up for free in a previous year, could shift you into a paid product.

Using the IRS' free file page also makes it easier to find the specific product you're eligible for. While anyone earning less than $69,000 should be able to use at least one free-filing product, each tool has slightly different requirements. For instance, FreeTaxUSA requires your income to be less than $36,000, while Free 1040 Tax Return isn't available to people living in Florida, Tennessee, Texas, or Washington.